Key Takeaways

- Florida HOAs and condominium associations face new 2025 rules, including HB 43 and updated board certification, that raise the stakes for clear, compliant resident screening.

- Documented screening criteria and FCRA-compliant background checks reduce legal exposure and support consistent, fair decisions.

- Digital screening platforms with secure workflows and board dashboards improve approval speed, accuracy, and transparency.

- Transparent application fees and structured document retention support financial integrity and long term compliance with Florida law.

- Tenant Evaluation provides Florida focused tools for screening, HB 43 readiness, and compliance, helping associations streamline work and reduce risk, Get started with Tenant Evaluation.

Why Optimized Resident Screening is Critical for Florida HOAs

Florida community association rules are changing quickly. HB 43 on reusable tenant screening reports and enhanced board certification rules take effect in 2025. At the same time, associations must protect residents, property values, and operating budgets.

Ineffective screening creates security issues, unpaid assessments, and legal disputes. Florida Statutes 718 and 720 require associations to define screening rules in their governing documents, including who screens, what is checked, and how decisions are made. Clear processes and modern tools limit administrative strain, support compliance, and protect revenue.

1. Define Clear Screening Criteria in Governing Documents Using Best Resident Screening Services for HOAs

Written criteria in bylaws and declarations give boards a solid legal and operational foundation. These rules should specify:

- Who conducts screening and approves applicants

- Which checks are required, such as criminal, credit, and eviction history

- Objective thresholds for approval or denial

- The appeal or reconsideration process

Objective standards reduce accusations of discrimination and support fair housing compliance. Associations should review these criteria regularly so they stay aligned with current law and risk tolerance.

2. Implement Thorough and FCRA Compliant Background Checks with Best Resident Screening Services for HOAs

Comprehensive background checks support both safety and financial stability. A sound program typically includes:

- National and state criminal checks

- Credit reports and debt indicators

- Eviction and rental history

All checks must follow the Fair Credit Reporting Act. That includes written applicant consent, use of a certified consumer reporting agency, and proper adverse action notices when an application is denied.

Florida law specifies that certain background screening must be performed by a consumer reporting agency, which reinforces the need for compliant vendors and documented procedures.

3. Prepare for Florida HB 43: Reusable Tenant Screening Reports Using Best Resident Screening Services for HOAs

Florida HB 43, effective July 1, 2025, gives applicants the option to use reusable tenant screening reports. These reports can contain credit, criminal, rental, and employment history in a single package. The law is designed to reduce costs for renters and make applications more efficient.

Associations that choose to accept these reports:

- Cannot charge an additional application fee to process them

- May still verify information and request backup documents

- Must obtain a written statement from applicants that information remains accurate

Policies and forms should state clearly whether reusable reports are accepted, how they are verified, and what happens if information is incomplete or appears altered.

Schedule a demo today to see how Tenant Evaluation can help your association apply HB 43 while keeping strong controls around accuracy and fraud prevention.

4. Use Technology for Streamlined and Secure Screening Processes with Best Resident Screening Services for HOAs

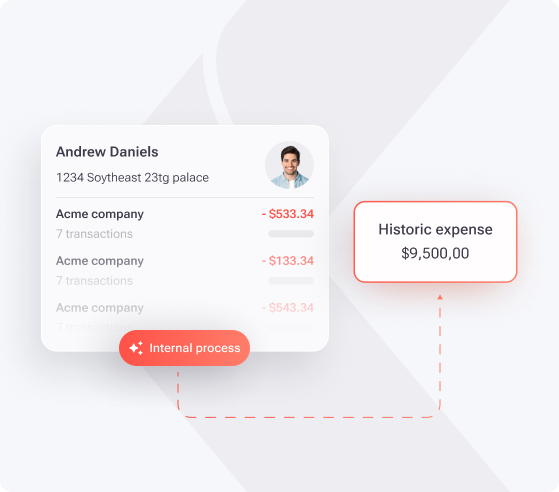

Digital screening platforms replace paper files and email chains with structured, trackable workflows. For many associations, this means faster approvals and fewer errors.

A modern system should offer:

- Online applications tailored to association and Florida requirements

- Integrated FCRA compliant background checks and document collection

- Automatic redaction of sensitive personal information

- High level payment and data security standards

Tenant Evaluation delivers FCRA compliant checks, document and income verification, and automated routing for board approval in a single system, which can free staff time for higher value work.

5. Give Board Members Clear Digital Approval Workflows through Best Resident Screening Services for HOAs

Board members make critical decisions about who enters the community. Clear digital workflows help them do this consistently and efficiently.

Effective tools for boards typically include:

- Dashboards that show application status at a glance

- Concise applicant summaries with attached reports

- Digital voting with recorded timestamps and comments

- Automatic logs for compliance and dispute resolution

Tenant Evaluation’s QuickApprove dashboard provides these capabilities in one place, so boards can move away from scattered emails and paper packets.

6. Handle Application Fees and Financial Transparency Properly with Best Resident Screening Services for HOAs

Clear, reasonable fees build trust with applicants and protect the association from disputes. Florida guidance indicates that screening fees should be set out in governing documents and tied to actual costs.

Strong financial practices for screening include:

- Listing all application and screening fees in governing documents and policies

- Aligning charges with actual screening and processing costs

- Providing itemized receipts and records for each transaction

Digital systems that collect fees online reduce errors and speed reconciliation. Tenant Evaluation can also share revenue above screening costs back to the association within a documented structure.

7. Maintain Strong Document Preservation and Compliance with Florida Laws for Best Resident Screening Services for HOAs

Record keeping is a legal requirement and a practical safeguard. Chapter 720 requires HOA boards to address document preservation as a mandatory annual agenda item, covering records such as screening files and approval decisions.

Updated 2025 board certification rules also require new condo directors to certify within 90 days and existing directors to comply by June 30, 2025. Noncompliance leads to suspension, and related records must be kept for seven years or the director’s tenure.

Digital platforms that archive applications, reports, board votes, and communication logs in a secure, searchable format make these obligations easier to manage.

Schedule a demo today to see how Tenant Evaluation’s audit trails and record retention features support Florida compliance.

Frequently Asked Questions

Impact of Florida HB 43 on HOA Resident Screening Processes

HB 43 allows applicants to submit reusable screening reports that package credit, criminal, rental, and employment data. Associations that accept these reports cannot add extra application fees for processing, but they can still verify the information and request more documents. Applicants must also confirm in writing that the report is current and accurate. HOAs should adjust procedures so reviews remain thorough while benefiting from potential time and cost savings.

Key Components of an FCRA Compliant Background Check for Florida HOAs

An FCRA compliant check for an HOA uses a certified consumer reporting agency and includes criminal history, credit evaluation, and eviction records. Applicants must give written consent. If the association denies an application based on the report, it must send an adverse action notice, share the report, and provide the agency’s contact details. All data must remain confidential in line with federal rules and Florida privacy requirements.

How Technology Improves Transparency and Efficiency in Board Approvals

Digital platforms give board members a single place to review applications, supporting documents, and votes. Real time status updates, automatic notifications, and timestamped logs create a clear audit trail. This structure reduces delays from email chains or missed messages and helps boards show that decisions follow consistent standards tied to community safety and association policy.

Document Preservation Requirements for Florida HOA Screening Records

Florida HOAs must treat document preservation as an annual agenda item and maintain organized records of screening activity. Typical retention periods run seven years or the length of a director’s service, whichever is longer. Key records include applications, background reports, approval or denial notes, board votes, and related communications. Digital record systems help the association prove compliance and respond efficiently to record requests.

Effect of 2025 Board Certification Rules on Screening in Florida Condominiums

The 2025 certification rules require new condominium board members to complete certification within 90 days and give current members until June 30, 2025. Directors who do not comply face suspension, which can slow or disrupt application approvals. Properly certified directors are more likely to understand fair housing, FCRA obligations, and association screening policies, which supports consistent, defensible decisions. Associations should track certifications alongside other screening related records.

Conclusion: The Future of Resident Screening for Florida HOAs with Best Resident Screening Services

Florida HOAs and condominium associations face higher expectations for safety, fairness, and legal compliance in resident screening. Clear criteria, FCRA compliant checks, HB 43 readiness, secure technology, transparent fees, and careful record keeping all work together to protect communities.

Associations that modernize screening now can lower risk, shorten approval timelines, and improve the experience for applicants, boards, and managers. Schedule a demo today to see how Tenant Evaluation supports these goals for Florida HOAs and condominiums.