Key Takeaways

- Tenant application fraud in 2026 has grown more sophisticated, with realistic fake documents and identity misuse that directly affect HOAs and condominiums.

- Stronger income, employment, identity, and document verification reduces payment risk, legal exposure, and community safety issues.

- Integrated screening platforms, clear audit trails, and behavioral red flag training help Community Association Managers and HOA Boards close common fraud gaps.

- Florida associations that align screening practices with FCRA and state rules improve compliance while protecting board members and residents.

- Tenant Evaluation offers an HOA-focused screening platform with built-in fraud detection; get started with Tenant Evaluation here.

Why Fraud Detection Now Defines Effective Tenant Screening

Tenant fraud has become easier to commit because online tools and AI forgeries are widely available. 93.3% of property managers encountered fraud last year, with income and employment schemes rising along with economic pressure.

HOAs and condominiums face three main risk areas when fraud slips through:

- Financial risk, including unpaid assessments, legal fees, and damage recovery costs

- Legal risk, including non-compliance with screening laws and difficulty collecting from fake or stolen identities

- Community risk, including safety concerns and stress on relationships between residents and the board

Stronger fraud detection helps boards admit only qualified, verifiable residents, which supports stable cash flow and a safer, more predictable community environment.

1. Verify Income and Employment To Reduce Payment Risk

Income and employment fraud now represents one of the most common threats to HOA stability. Fake pay stubs are easy to purchase online and can be enhanced with AI, which makes a simple visual review unreliable.

Weak income verification often leads to higher default rates, stalled collections, and budget pressure for the association. Strong verification focuses on independent confirmation instead of trusting documents at face value.

For more reliable income and employment checks:

- Contact employers through phone numbers or email addresses you locate, not those the applicant provides

- Use real-time bank verification that connects directly to applicant accounts to confirm regular deposits

- Flag pay stubs with perfectly round numbers, missing tax or benefit deductions, or unusual fonts and layouts

- Compare bank deposits to claimed pay frequency and employer name

2. Use Advanced Document Analysis To Catch Forgeries

Manual document reviews no longer keep up with fraudsters who alter PDFs, metadata, and images with advanced tools. Polished forgeries can appear authentic while hiding critical tampering details.

Low-quality document checks expose associations to unqualified residents and may create regulatory issues if boards cannot show reasonable diligence. A more technical review finds manipulation that the eye misses.

AI-powered document analysis tools now scan for hundreds of fraud indicators, including edited metadata, inconsistent fonts, cloned signatures, and altered dates. Visual warning signs still matter and include:

- Blurry or cropped images that conceal headers or security elements

- Formatting that changes from page to page within one document set

- Missing security features that similar documents from the same institution normally include

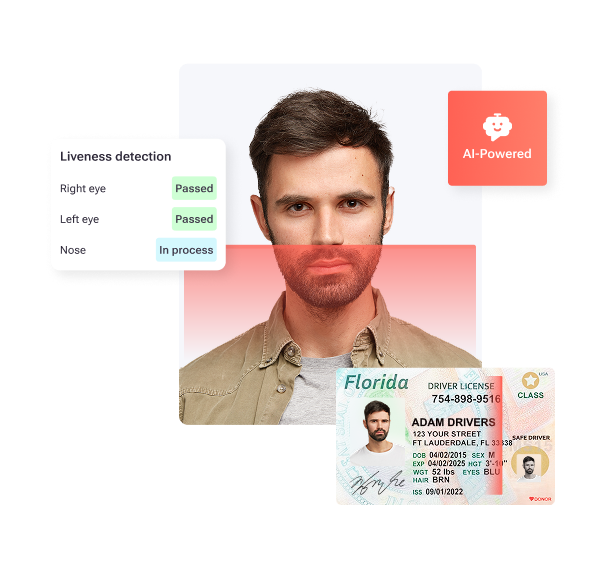

3. Strengthen Identity Verification and Impersonation Checks

Identity misuse now often involves fabricated or stolen Social Security Numbers. Fraud can involve SSNs tied to children, deceased individuals, or manufactured numbers, which helps applicants hide poor credit or eviction records.

Weak identity checks lead to serious problems when collections, legal action, or safety incidents arise. If the resident is not the real identity behind the application, boards may struggle to enforce rules or recover losses.

Effective identity verification typically includes:

- Matching government IDs to application data, including name, date of birth, and address history

- Verifying Social Security Numbers against trusted databases that flag fabricated, deceased, or stolen numbers

- Using selfie and liveness checks to confirm that the applicant matches the ID photo

4. Watch For Red Flags and Behavioral Cues

Fraudulent applicants often show patterns in how they communicate, respond to requests, and attempt to move the process along. Common red flags include mismatched identity details, document quality issues, and resistance to normal checks.

Staff who know what to look for can pause a risky application early and request more verification instead of approving under pressure.

Useful behavioral red flags include:

- Refusal to provide direct employer contact information or permission to verify details

- Strong pushback on application fees, background checks, or association screening steps

- Attempts to rush approval, including pressure to sign quickly or move in before completion of screening

- Offers to pay large amounts in cash to avoid normal review

- Details that do not match across IDs, applications, and supporting documents

5. Expand Background and Eviction Checks For Deeper Insight

Basic credit reports give only a partial picture of risk. Fraudsters target communities that stop at credit because identity theft and synthetic identities can hide negative histories.

Broader checks help boards understand whether an applicant has a pattern of non-payment, criminal behavior, or prior conflicts in housing communities.

Stronger background and eviction screening usually includes:

- Nationwide and, when appropriate, global criminal checks

- Searches across sex offender registries and FBI Most Wanted lists

- Dedicated eviction databases that do not rely on self-reported history

- Comparison of address history across credit, ID, and application documents

6. Replace Tool Frankenstacks With Integrated Screening

Many property managers use separate tools for credit, background, income, and ID checks. Disjointed systems can miss cross-references between stolen IDs, credit files, and forged documents, which leaves space for organized fraud.

Integrated platforms link all data points in one place so inconsistencies become easier to spot. This approach also reduces duplicate data entry and speeds up board review.

An integrated screening system should:

- Connect identity, income, document, and background checks in a single workflow

- Flag conflicts between sources, such as income that does not match employment records

- Provide consistent decision reports for managers, boards, and compliance records

7. Track Applications and Keep Audit Trails For Compliance

Organized fraud can involve multiple attempts with slightly changed details. Fraud rings now use networks of fake identities and manufactured income, which makes pattern recognition important.

Clear tracking and audit trails help teams see how an application moves through screening and who approved each step. This detail also supports compliance with FCRA and Florida rules for HOAs and condominiums.

Effective tracking tools usually provide:

- Real-time status updates for each application

- Digital timestamps for every change, review, and decision

- Downloadable records that support board minutes, disputes, or legal needs

Explore how Tenant Evaluation supports audit-ready, compliant screening for HOAs.

FAQs: Tenant Screening With Fraud Detection

What is the most common type of tenant application fraud today?

Falsified income and employment documents remain the most common type of tenant fraud. Fraudsters often rely on fake pay stubs and altered bank statements created with advanced editing tools, which look realistic enough to pass a basic visual review.

How has AI impacted tenant screening fraud?

AI has made it easier to generate convincing forged documents, including pay stubs, letters, and statements. These files often contain consistent layouts and realistic metadata, which means traditional manual checks and simple detection tools may no longer be sufficient.

What are the key financial risks for HOAs and condominiums from tenant fraud?

Tenant fraud can lead to unpaid assessments, costly eviction actions, higher legal expenses, and damage that is difficult to recover from residents using stolen identities. Communities can also face reputational harm and greater tension among rule-following residents when fraud is not controlled.

Why are integrated screening platforms better than using multiple separate tools for fraud detection?

Integrated platforms connect credit, identity, income, and background data in one system. This connection allows the software to flag conflicts between data sources and reduces blind spots that appear when separate tools do not share information.

How can HOA boards maintain proper oversight of the tenant screening process?

Boards maintain oversight by using dashboards that summarize each application, show status in real time, and provide clear approval or denial records. Systems that log every action with timestamps and user details help boards document decisions and stay aligned with bylaws and state rules.

Conclusion: Protect Your Community With Proactive Fraud Controls

Tenant screening for HOAs in 2026 now requires fraud detection that goes beyond simple credit checks. Stronger income, identity, document, and background verification helps boards limit bad debt, reduce disputes, and support a safer living environment.

Integrated platforms with audit trails and fraud-aware workflows give Community Association Managers and boards a clearer view of each applicant and a stronger position if issues arise later. These improvements support both community well-being and regulatory compliance.

Get started with Tenant Evaluation to modernize HOA tenant screening and fraud detection.