Key Takeaways

- Condo-focused screening platforms combine credit, criminal, eviction, employment, and rental history checks with AI to improve accuracy and reduce risk.

- Florida associations benefit from platforms that embed state-specific rules, Fair Housing requirements, and customizable criteria into every application.

- Digital applications, secure document uploads, and automated redaction reduce staff workload while protecting sensitive data and speeding approvals.

- Board-ready dashboards, built-in fees, and analytics help associations shorten decision timelines, create new revenue, and plan for the community’s future.

- Tenant Evaluation provides condo associations with an AI-enabled, Florida-aware screening platform; get started with Tenant Evaluation to modernize your resident screening in 2026.

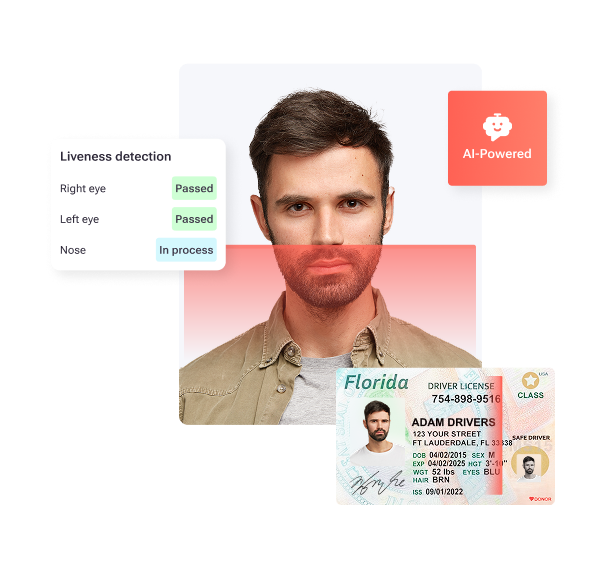

1. Comprehensive Background Checks and AI-Powered Verification

Effective condo screening platforms use multiple checks instead of relying on a single credit report. Strong systems combine credit, criminal history, eviction records, employment verification, and rental history into one clear view of each applicant. AI-powered tenant screening analyzes credit, income, and rental patterns to support faster and more consistent approval decisions.

AI-based tools also improve fraud prevention and risk prediction. RealPage’s AI screening reduced evictions by up to 30% for property managers, which illustrates how algorithmic models can flag risk patterns that humans may overlook. For condos, this means safer communities, more reliable assessment of applicant stability, and fewer surprises for association budgets.

Advanced ID checks, including liveness verification and document validation, help confirm that the person applying is the person on the ID. When combined with income verification through employers or bank data, boards gain more confidence that new residents meet both behavioral and financial expectations.

2. Florida-Specific Compliance and Customizable Screening Criteria

Florida condo associations must align with state statutes, community bylaws, Fair Housing standards, and FCRA rules. Generic rental software often misses these nuances. Florida-aware screening platforms embed local requirements into the workflow so every application follows the same compliant path.

Digital screening supports fair housing compliance by applying consistent, configurable criteria that match local rules and risk tolerance. Intelligent form logic adapts based on the applicant type, whether the person is an owner, a renter, or an additional adult resident, which reduces errors and back-and-forth with management.

Community boards can define standards such as minimum credit scores, income-to-assessment ratios, documentation rules for international applicants, or limits on past delinquencies. The system then applies these rules automatically, rejects incomplete files, and keeps a clear record of how and why each decision was made.

3. All-in-One Online Application and Document Collection

Fully digital applications are now a baseline expectation for condo buyers, renters, and realtors in 2026. Strong tenant screening platforms provide a single online portal where applicants submit information, pay fees, and track status from any device, at any time.

These platforms also centralize document collection. Applicants upload IDs, proof of income, association forms, and any required addenda directly into the system. The platform checks for completeness, flags missing items, and routes everything to management and the board in a standardized format. E-signatures complete the approval process without printing or in-person visits.

This approach reduces manual data entry, eliminates scattered email attachments, and shortens approval timelines. Community Association Managers gain back hours each week that would otherwise be spent chasing documents and reconciling information.

4. Automated Data Redaction and Advanced Security Measures

PII security is a core requirement for any association that handles Social Security numbers, bank data, and government IDs. Manual processes, shared email inboxes, and unencrypted storage introduce unnecessary risk.

Modern screening platforms address this risk with automatic redaction of sensitive data as documents enter the system. Social Security numbers, account numbers, and other high-risk fields are masked from most users while remaining available in limited form for required checks. PCI Level 1 controls and end-to-end encryption protect data during transmission and storage.

Detailed audit logs record who accessed what, when, and why. These records give boards and managers clear documentation for compliance reviews and vendor oversight. Applicants also gain peace of mind that their information is not stored in unlocked file cabinets or forwarded through unprotected email.

Schedule a demo today to see how automated security and redaction can reduce your association’s exposure to data breaches while keeping screening efficient.

5. Streamlined Board Member Review and Voting Dashboard

Board review is often the slowest part of condo approvals. Email threads, printed packets, and unclear checklists can stretch decisions across weeks. Specialized screening platforms simplify this work with board-focused dashboards.

QuickApprove-style views show each application, AI-generated summaries, supporting documents, and risk indicators in one screen. Board members log in, review key details, ask questions, and cast votes inside the system. Automated reminders and clear status indicators keep everyone on track and reduce confusion.

This transparency benefits boards, managers, and applicants. Boards see consistent information for each case. Managers can identify bottlenecks early. Applicants and realtors receive more predictable timelines and fewer status calls.

6. Integrated Revenue Generation Opportunities

Screening does not need to function only as a cost center. Well-designed platforms can create or enhance revenue streams for associations while keeping processes fair and transparent.

Application fees are collected online as part of submission, which eliminates manual payment handling and unpaid applications. The system prevents files from moving forward until payment is complete, and records each transaction for accounting and audit purposes.

Some platforms support revenue-sharing structures, where a portion of screening fees flows back to the association or management company after vendor costs. These funds can offset platform expenses, support reserves, or contribute to capital projects, which helps boards align screening policies with long-term financial planning.

7. Comprehensive Support and Community Analytics

Condo teams need both day-to-day help and long-term insight. Leading screening platforms provide live or AI-assisted support for managers, applicants, and realtors, often in multiple languages. Entrata’s AI “Layered Intelligence” shows how property platforms can automate fraud detection, messaging, and lead handling, and similar approaches now support applicant guidance and status updates in screening tools.

Analytics add another layer of value. Platforms can surface trends in applicant demographics, income ranges, vehicle ownership, approval rates, and processing times. Boards can use this data to refine policies, plan amenities, or evaluate how competitive their community is within the local market. For example, an uptick in electric vehicle ownership may support discussion of charging infrastructure in the next budget cycle.

Frequently Asked Questions

Specialized tenant screening platforms for condos differ from generic property management software

Condo-focused platforms are built around association governance rather than landlord-tenant management. They incorporate Florida-specific rules, community bylaws, owner-occupied structures, and board approval workflows. Generic property management tools focus more on rent collection, maintenance, and lease management, which leaves gaps for associations that must document every admission decision.

Modern platforms reduce the administrative burden for Community Association Managers

Current systems automate background checks, document intake, fee collection, reminders, and status updates. Many routine emails and phone calls disappear because applicants can see requirements and progress online. The resulting time savings allow managers to shift from paperwork to resident service, project oversight, and board support.

Tenant screening platforms support fair housing compliance and reduce bias

Consistent criteria, standardized workflows, and automated evaluations help remove subjective judgment from initial decisions. Platforms apply predefined thresholds for credit, income, and background findings, and they log every step of the review. Detailed records make it easier to show that similar applicants receive similar treatment, which supports Fair Housing and FCRA compliance.

Condominium associations can expect measurable return on investment

ROI often comes from several areas at once. Automation cuts staff and board time spent on manual processing. Stronger compliance and documentation reduce legal and regulatory risk. Fee collection and revenue-sharing can offset or exceed platform costs. Faster approvals also limit vacancy periods when units are rented and improve the experience for incoming residents.

Modern screening platforms are suitable for smaller condominium associations

Smaller communities gain particular value from automation because they may rely on part-time staff or volunteer boards. Cloud-based tools deliver enterprise-grade security, workflows, and reporting without requiring a large internal team. In many cases, added revenue from screening fees can cover the cost of the platform, which keeps adoption feasible for associations with modest budgets.

Conclusion: Strengthen Condo Screening and Governance in 2026

Choosing the right tenant screening platform in 2026 directly affects community safety, regulatory compliance, and board efficiency. The most effective systems combine AI-enhanced verification, Florida-aware compliance, secure digital applications, board-centered decision tools, revenue integrations, and actionable analytics.

Associations that move away from paper files and generic rental tools gain clearer insight into applicants, faster approvals, and better protection for resident data. Boards, managers, and applicants all benefit from predictable, well-documented processes that reflect current legal and security expectations.

Schedule a demo today to see how Tenant Evaluation can support your condo community’s screening, compliance, and revenue goals in 2026.