Key Takeaways

- HOAs in 2026 face higher expectations around compliance, data security, and timeliness, so manual, paper-based screening processes now create real risk and delay.

- Advanced tenant evaluation focuses on verified identity, proven financial stability, and compliant background checks that apply consistent standards to every applicant.

- Digital workflows, automated document review, and structured board dashboards reduce administrative work, shorten approval times, and create clear audit trails.

- Florida communities must account for rules such as HB 43 on reusable tenant screening reports while still protecting community standards with additional checks.

- TenantEvaluation offers an integrated screening, onboarding, and approval platform for HOAs, and you can explore it through a quick demo at TenantEvaluation Get Started.

The Evolving Landscape of HOA Tenant Evaluation in 2026

Community Association Managers and HOA boards now manage more applications, stricter regulations, and higher resident expectations than in prior years. Paper applications and basic background checks no longer support consistent, auditable decisions.

Heavy manual work around data entry, document collection, and follow-ups slows approvals and increases the chance of mistakes. Delays frustrate applicants, realtors, and board members while creating exposure if files are incomplete or misplaced.

Florida’s HB 43 allows landlords to accept reusable tenant screening reports that cover credit, criminal background, rental history, and employment verification. HOAs can still request proof of income that meets their standards and can run community-specific checks that align with governing documents.

Higher expectations around data privacy and Fair Credit Reporting Act and Fair Housing compliance now push HOAs toward secure, fully documented digital platforms. These tools automate workflows, centralize information, and maintain consistent, trackable criteria for every applicant.

Why Advanced Tenant Screening Protects Your HOA

Risk Mitigation Through Compliance and Data Security

HOAs must apply clear, uniform standards to avoid discrimination claims. Fair Housing laws prohibit discrimination based on protected characteristics and require consistent criteria for all applicants. Paper files and ad hoc processes make it hard to prove that decisions followed the same rules.

Unsecured handling of Social Security numbers, bank statements, and credit reports increases the risk of data exposure. Modern screening platforms use encryption, controlled access, and structured workflows that reduce this liability.

FCRA requirements around disclosure, consent, and adverse action letters are easier to manage when the platform embeds these steps into the workflow instead of relying on manual checklists.

Community Stability and Property Value Protection

Consistent screening contributes to a safer, more stable community. Red flags such as prior evictions, non-discharged bankruptcies, relevant criminal history, and broken leases can signal higher risk for nonpayment or community disruption.

Clear, predictable screening standards build confidence among owners and residents. Strong processes show that the board takes community rules seriously, which supports property values and encourages applicants who intend to comply.

Digital onboarding can include required acknowledgments of HOA rules, parking policies, pet policies, and other standards so expectations are clear from day one.

Operational Efficiency and Potential Revenue

Staff time is often consumed by collecting documents, chasing signatures, and answering status questions. Digital workflows streamline intake, reminders, and communication so managers can focus on higher-value tasks.

Faster approvals help realtors close transactions and reduce vacancy or delay between buyers, tenants, and move-ins. Some platforms also support revenue-sharing models in which application fees generate income for the association while keeping processing compliant with local rules.

7 Advanced Tenant Evaluation Criteria and Tools for HOAs in 2026

1. Holistic Digital Identity Verification and Fraud Detection

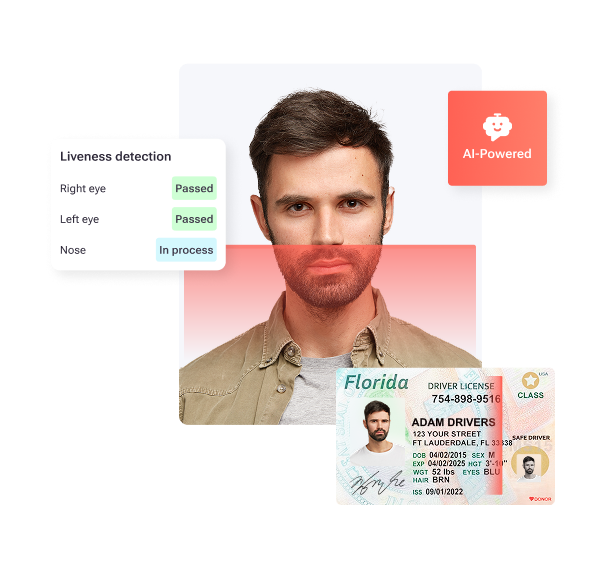

Identity fraud has increased in rental applications, so HOAs benefit from tools that go beyond visual ID checks. Advanced systems verify identity documents against trusted data sources and use biometric checks to confirm that the applicant matches the ID.

TenantEvaluation’s IDVerify solution authenticates government IDs, checks for common signs of tampering, and uses liveness detection to confirm that a real person is present. This approach reduces the chance of approving an applicant who is using stolen or falsified credentials.

2. In-Depth Financial Stability Assessment Beyond Credit Scores

Credit scores alone do not fully reflect an applicant’s ability to keep up with HOA payments and rent. Effective financial screening checks for income that is at least 2.5 to 3 times rent, consistent employment, and supporting documents such as pay stubs or tax returns.

TenantEvaluation’s IncomeEV report verifies employment directly with employers when possible and analyzes bank statements for authenticity and cash flow patterns. This method can uncover fake pay stubs, inflated income claims, or unstable earnings that increase the risk of delinquency.

3. Compliant Comprehensive Background Checks With Ongoing Monitoring

Background checks that cover only a single county or limited time frame can miss important information. HOAs benefit from searches that include federal, state, and local criminal records, sex offender registries, eviction data, and relevant watchlists.

Florida tenant screening rules require written consent and disclosure before pulling consumer reports under the FCRA. Platforms like TenantEvaluation’s SafeCheck+ automate these steps and produce a clear, consistent report that boards can review quickly.

State and local rules, including some ban-the-box regulations, can restrict how criminal history is used. A structured platform helps boards apply lawful, objective criteria and document how decisions were made.

4. Smart Application Logic and Automated Document Review

Dynamic application forms collect only the information that is needed for each applicant type, such as tenant, purchaser, or co-occupant. This structure reduces confusion and missing data.

TenantEvaluation’s application system checks uploaded documents for completeness and links them to the correct person, then flags missing items before the file moves to review. Applicants receive clear prompts to correct issues, which reduces back-and-forth emails for staff.

Schedule a demo to see how automated document review can cut manual processing time for your team.

5. Digital Resident Onboarding and Automated Compliance Workflows

Approval is only one step in the resident journey. HOAs also need signed documents, rule acknowledgments, and coordinated move-in details.

TenantEvaluation supports electronic signatures, automated welcome packets, and task lists for items like gate access, parking decals, or elevator reservations. Florida communities can configure state-specific disclosures and documents so that every new resident completes the same required steps.

6. Board-Focused Dashboards and Audit-Ready Reporting

Board members gain efficiency when they can review concise, organized information instead of large email threads and scattered attachments. A dedicated dashboard centralizes application files, summaries, and decisions.

TenantEvaluation’s QuickApprove tools present key details in a clear summary and allow board members to vote within the platform. Each action is timestamped and recorded, which produces an audit trail that supports the board if a decision is later questioned.

7. Ethical Behavioral and Social Indicators Where Permitted

Objective behavioral indicators can help boards understand community fit, as long as they stay within Fair Housing and FCRA boundaries. Standard steps include contacting previous landlords, current employers, and personal references.

Structured reference forms allow boards to ask consistent, allowable questions about payment history, property care, and rule compliance. The key is to avoid subjective judgments and focus on behavior that directly affects community safety and property conditions.

Digital platforms document reference outreach and responses so the association can show that it treated applicants fairly and applied the same standards to everyone.

Frequently Asked Questions (FAQ)

Q1: How does Florida’s HB 43 affect HOA tenant screening in 2026?

Florida’s HB 43 permits landlords to accept reusable screening reports that cover credit, criminal background, rental history, and employment verification. HOAs that accept such reports generally cannot charge a second fee for those same report components, but they can still verify income, employment history, and landlord references and run additional community-specific checks. Written statements from applicants about the accuracy of the reusable report and procedures to confirm report validity help HOAs meet both legal and community standards.

Q2: What are the key red flags HOAs should watch for during tenant evaluation?

Important red flags include prior evictions, non-discharged bankruptcies, a pattern of late payments, and criminal records that relate to community safety. Inconsistent application details, unverifiable income, negative landlord references, frequent address changes, and income that does not meet community guidelines also warrant attention. HOAs should apply the same objective criteria to every file and consider both the nature and timing of any negative items.

Q3: How do advanced screening tools like TenantEvaluation support Fair Housing compliance?

TenantEvaluation standardizes screening steps so that every applicant is evaluated using the same criteria. The platform tracks disclosures, consent, report ordering, and decisions, then stores this information in an auditable format. Role-based access and redaction of unnecessary personal details help reduce bias, while configurable, rule-based criteria support compliance with federal, state, and local requirements.

Q4: Can HOAs charge application fees when using an advanced screening platform?

Most HOAs can charge application fees as long as they follow state and local rules and clearly disclose what the fee covers. Florida’s HB 43 limits fees when an HOA accepts an eligible reusable screening report, so communities in Florida may need to separate charges for additional screening, community-specific checks, or administrative work. Automated fee collection in platforms like TenantEvaluation helps boards apply consistent policies and maintain clear records.

Conclusion: Modern Screening Strengthens HOA Operations in 2026

HOAs that rely on basic background checks and paper workflows face growing compliance, security, and efficiency challenges. Advanced tenant evaluation tools that verify identity, assess true financial stability, and manage compliant background checks now form a core part of responsible community governance.

Structured screening processes with consistent, documented criteria that align with Fair Housing laws reduce risk while giving boards the information they need to make fair decisions.