Key Takeaways

- Integrated HOA software with background checks helps Florida communities manage compliance, safety, and approvals in a single system.

- Florida Statutes Chapters 718 and 720 create specific screening and documentation requirements that software must support through configurable workflows.

- Automated applications, secure data handling, and board-focused tools reduce staff workload, shorten approval times, and improve applicant communication.

- A side-by-side comparison shows that Florida-focused platforms provide more targeted support than broad property management tools for local HOAs and condominiums.

- TenantEvaluation offers Florida-focused HOA software with online applications, advanced screening, and board review tools, and communities can schedule a demo to see the platform in action.

Why Integrated HOA Software with Background Checks is Essential for Florida Communities

Florida statutes create specific expectations for homeowner associations and condominium communities. Florida Statutes Chapter 720 for HOAs and Chapter 718 for Condominiums define compliance standards that require structured background screening and clear documentation.

Manual screening processes often introduce security and compliance risks. Spreadsheets, paper files, and email chains can lead to inconsistent approvals, data exposure, lost records, and heavy workloads that consume many hours of staff time each day.

Integrated HOA software with background checks centralizes these tasks. Automated workflows, Florida-aware settings, and secure storage reduce approval times, create clear audit trails, and help communities manage risk while maintaining a predictable experience for applicants and board members.

Schedule a TenantEvaluation demo to see how Florida-focused workflows can support your association.

Key Criteria for Evaluating HOA Software with Background Check Capabilities

Clear evaluation criteria help Community Association Managers and Board Members select software that fits Florida-specific needs.

Comprehensive background check features should include:

- Nationwide criminal records and eviction history

- Credit assessments aligned with association standards

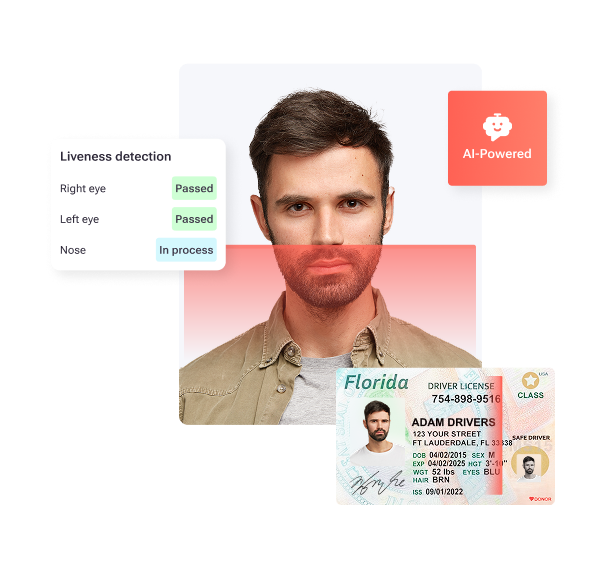

- Identity verification and fraud checks

- Income and employment validation

- FCRA-compliant reporting and disclosures

Florida-specific compliance and customization matter for legal accuracy. Effective platforms allow configuration by community for:

- Screening rules that match governing documents

- Credit score thresholds and deposit structures

- Required forms, affidavits, and supporting documents

- Different workflows for owners, tenants, and purchasers

Automation and workflow efficiency reduce manual tasks. Helpful features include online applications, guided document collection, automated reminders, and real-time status updates for applicants, managers, and boards.

Ease of use and user experience affect adoption. CAMs and boards benefit from clear dashboards and simple approval paths. Applicants need mobile-friendly forms and straightforward payment options.

Data security and privacy protection are essential for sensitive information. Baseline safeguards include PCI-compliant payment processing, encryption, role-based access, and automatic redaction of Social Security numbers and banking details.

Reporting and analytics support better decisions. Useful tools provide insight into approval timelines, application volumes, rental trends, and resident profiles so boards can refine policies and plan for future needs.

TenantEvaluation: A Florida-Focused All-in-One Solution for HOAs

TenantEvaluation focuses on Florida condominium and homeowner associations and centers its platform on local regulations and workflows.

All-in-one online applications bring the full process into a single platform. Applicants submit forms, upload documents, sign electronically, and pay fees through web and mobile interfaces, which removes paper handling and scattered email threads.

Custom setup for rules and compliance aligns each community with its governing documents. Screening criteria, credit standards, deposits, and document requirements are configured per association so every application follows the same structure.

Auto-redaction of personal information reduces exposure of sensitive data. The system encrypts information and automatically removes Social Security numbers, account numbers, and similar details from documents that board members review.

Document collection, board voting, and audit features appear in the QuickApprove dashboard. Board members see AI-generated application summaries, review supporting documents in one place, and cast votes inside the platform, which creates a clear audit trail for each decision.

Comprehensive resident screening through SafeCheck+, IDverify, and IncomeEV covers background history, identity, and income. Boards receive a clear view of risk that supports consistent, documented decisions.

Request a TenantEvaluation demo to review these tools with your board.

Side-by-Side Comparison: TenantEvaluation vs. Leading HOA Software with Background Checks

A side-by-side comparison helps clarify how TenantEvaluation differs from broader property management platforms such as Buildium and Vantaca.

|

Feature/Criterion |

TenantEvaluation |

Buildium |

Vantaca |

|

Target Market Focus |

Florida condominiums and HOAs |

General property management, including HOAs |

HOA and community management |

|

Florida Compliance |

Configuration for Florida statutes and local rules |

General tools with manual Florida setup |

General tools with manual Florida setup |

|

Background Checks |

SafeCheck+, IDverify, IncomeEV integrated |

Tenant screening and background checks |

Limited, not a primary focus |

|

Board Review and Approval |

Dedicated QuickApprove board dashboard |

Some approval features, less board-specific |

Basic workflows, no specialized board dashboard |

This focus on Florida associations allows TenantEvaluation to align more closely with local screening expectations and board processes.

How TenantEvaluation Addresses Florida HOA Requirements

TenantEvaluation differentiates itself through a narrow focus on Florida and an emphasis on board decision support.

Florida-centered design reflects the needs of condominiums and HOAs operating under Chapters 718 and 720. Workflows and documents can mirror community rules so boards spend less time adjusting generic software.

Board enablement through QuickApprove gives directors structured summaries, side-by-side document views, and recorded votes. This structure supports transparency and helps boards keep consistent records for future reference.

End-to-end automation covers steps from application intake to final approval. Consistent workflows lower administrative effort, reduce errors, and give applicants a clear understanding of status at each stage.

Risk management and revenue options appear in the screening fee model. Associations can receive a share of application fees once service charges are deducted, which can offset administrative costs or support community projects.

Explore how TenantEvaluation can align with your existing policies in a brief demo.

Frequently Asked Questions (FAQ) About HOA Software with Background Checks

What makes HOA software with background checks important for Florida communities?

Florida communities operate under specific legal frameworks for HOAs and condominiums, so they benefit from software that organizes screening, documentation, and approvals in one place. Integrated tools support community safety, document compliance steps, and reduce the time CAMs and boards spend on manual review.

How does TenantEvaluation support compliance with Florida HOA regulations?

TenantEvaluation configures each community to match its bylaws, screening criteria, and document requirements. Workflows reflect Florida statutes along with association rules, while FCRA-compliant screening, audit logs, and PCI Level 1 security standards help protect both applicants and associations.

Can HOA software with background checks help associations generate revenue?

TenantEvaluation uses an application fee structure where a portion of the collected fees can be returned to the association or management company after service fees. This setup can offset screening costs and provide additional funds for operations or community improvements.

What level of security does TenantEvaluation provide for applicant data?

TenantEvaluation applies PCI Level 1 controls for payments, encrypts data in transit and at rest, and automatically redacts sensitive personal information from documents that boards view. These steps limit unnecessary exposure of Social Security numbers and financial details.

How do automated workflows improve HOA operations?

Automated workflows replace manual data entry and repeated follow-ups with structured steps. Online forms, document prompts, and notifications help ensure complete applications, faster review, and clearer communication with applicants and board members.

Improve Florida HOA Operations with Smart Background Checks

Florida associations manage complex regulations, high application volumes, and rising expectations from residents and real estate partners. Manual processes increase the chance of inconsistent decisions, missing records, and security issues.

TenantEvaluation offers a Florida-focused platform that combines background checks, identity verification, income analysis, and board workflows in one environment. This approach supports compliance, shortens approval times, and gives boards clearer insight into each application.

Associations that adopt specialized HOA software with integrated background checks in 2026 can strengthen community safety, streamline operations, and add structure to board decisions. Communities that want to modernize their workflows can schedule a TenantEvaluation demo to review options with their management team and board.