Key Takeaways

- Florida HOAs face unique regulatory, security, and workload challenges that generic HOA software often cannot address without heavy manual work.

- Modern, automated platforms reduce application processing time, improve transparency for boards, and lower risk around data handling and compliance.

- Broad HOA platforms excel at accounting, communication, and operations, but often need add-ons or workarounds for deep resident screening and Florida-specific workflows.

- Specialized screening tools with board dashboards, automated document review, and strong security controls provide clearer governance and more predictable timelines.

- Florida associations that want Florida-specific screening, faster approvals, and potential revenue sharing can schedule a demo with Tenant Evaluation.

Why a Specialized HOA Management Platform Comparison Matters for Florida HOAs

Manual, paper-based resident screening and onboarding slow down Florida associations and increase costs. Larger management companies can lose dozens of staff hours each day to repetitive data entry, status updates, and document handling. Delayed application decisions affect move-in dates, fee collection, and overall cash flow, while manual handling of sensitive data raises the risk of breaches and compliance issues.

Florida’s regulatory environment adds another layer of complexity. Generic HOA platforms often need extensive configuration and manual workarounds to align with state and local rules. Community Association Managers spend more time troubleshooting than managing, and Boards often work with incomplete or outdated information when reviewing applications.

The Benefits of Adopting a Modern HOA Management Platform

Modern HOA platforms that support Florida communities focus on automation, clear workflows, and secure data management. One Florida management company reduced administrative workload by about 70 percent and saved roughly $240,000 per year after replacing manual processes with an automated system.

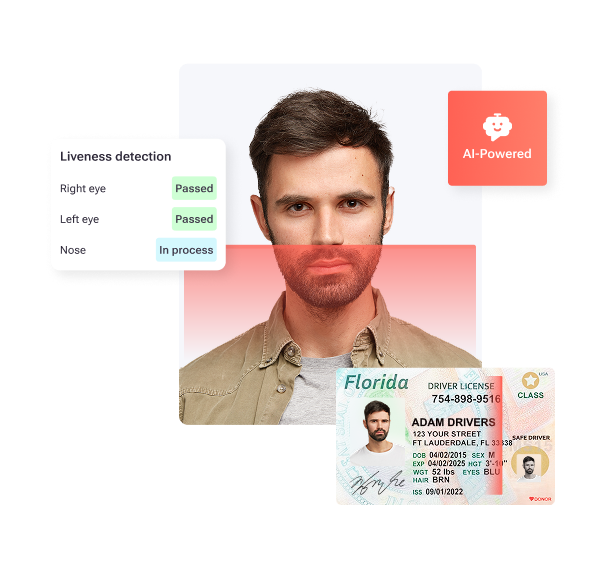

These platforms improve compliance through configurable workflows, structured approval steps, and consistent documentation. They also strengthen data security with tools such as automatic redaction of sensitive data and PCI Level 1 compliant payment processing, while giving Board members live dashboards that support faster, more informed votes.

7 Leading HOA Management Platforms: Features and Comparison

1. CINC Systems: Enterprise-Level Financial Management

CINC Systems is widely used by large associations and professional management companies that need strong accounting and banking integrations. The platform supports rules enforcement, architectural reviews, and detailed reporting across multi-community portfolios. The CINC Connect portal offers residents self-service tools for payments, communications, and amenities.

CINC works best for larger, complex portfolios that prioritize financial reporting. Smaller or self-managed communities may find the breadth of features more than they need and may still require separate tools for Florida-specific screening workflows.

2. AppFolio: Broad All-in-One HOA and Property Management

AppFolio provides an all-in-one property management platform with architectural reviews, dues collection, and violation tracking across Core, Plus, and Max tiers with per-unit pricing. Both web and mobile access support day-to-day operations for larger communities and mixed property portfolios.

AppFolio covers most general HOA tasks. Some Florida communities still add dedicated tools or custom workflows for in-depth applicant screening and state-specific compliance checks.

3. PayHOA: Budget-Friendly Option for Small to Mid-Sized HOAs

PayHOA targets small to medium HOAs and self-managed boards with a cloud-based, all-in-one system. Plans start at $49 per month with a 30-day trial and include member databases, committee management, calendars, work orders, and payment processing, with a 4.7 out of 5 rating and positive customer support feedback.

PayHOA offers good value and an approachable interface for boards with modest needs. It does not include a dedicated mobile app and may not provide the depth of Florida-focused screening, income verification, and compliance automation required by higher-volume or more regulated communities.

4. Condo Control: Communication and Operations Emphasis

Condo Control focuses on communication and operations for condominiums and HOAs. Associations can manage maintenance requests, amenity bookings, package tracking, and resident messages in one system. The platform positions itself as a complete digital hub, intended to improve productivity and lower operating costs.

Condo Control fits communities that prioritize service requests and engagement. Many Florida associations that use it still rely on other tools or manual steps for comprehensive screening and regulatory documentation.

5. Smartwebs: Violation and Accounting Specialist

Smartwebs is well regarded for HOA accounting, automation, and reporting in an all-in-one system. The platform also emphasizes violation tracking, architectural request management, work orders, and mobile functionality.

Smartwebs serves associations that need strong violation management combined with accounting. Communities that must meet strict Florida screening rules may still need supplemental tools for background checks, identity verification, and structured board approvals.

6. Buildium: Established Property Management Software

Buildium is a familiar name in property management, with accounting, resident communication, and maintenance tracking features that extend to HOAs. It offers standard HOA tools for payments, notices, and financial reporting.

For Florida HOAs, Buildium’s limited focus on screening and compliance is a constraint. Features for digital document review, automatic redaction, and dedicated board approval dashboards are less developed than in platforms that specialize in application processing and regulatory alignment.

7. Tenant Evaluation: Florida-Specific Resident Screening and Onboarding

Tenant Evaluation is an all-in-one resident screening and onboarding platform built exclusively for Florida condominium and homeowner associations. Since 2007, the team has combined more than 50 years of industry experience to automate application intake, document collection, background checks, and approval workflows tailored to Florida statutes and association documents.

The QuickApprove dashboard gives Board members real-time visibility into every application, along with structured voting tools and clear audit trails. Security controls include PCI Level 1 compliance, end-to-end encryption, and automatic redaction of sensitive data. Tenant Evaluation uses a revenue-sharing model in which application fees fund the service, which can make the platform cost-neutral or revenue positive for many communities. The system processes more than 100,000 applications per year, has generated over $150 million for associations, and holds a 4.8 out of 5 rating on Google.

|

Platform Category |

Typical Broad HOA Platform |

Specialized Screening Platform |

Key Differentiator |

|

Florida Compliance |

Flexible configuration, manual adjustments for state rules |

Custom setup based on Florida laws and governing documents |

Built-in regulatory knowledge |

|

Screening Depth |

Basic checks with manual review steps |

ID, income, criminal, and credit verification in one workflow |

Automated document and data review |

|

Board Transparency |

General reports and email-based approvals |

Board dashboard with voting tools and audit history |

Real-time decision support |

|

Revenue Impact |

Fees collected to cover software costs |

Revenue-sharing model tied to application volume |

Shifts screening from cost center toward revenue opportunity |

Pricing for HOA platforms varies by unit count, feature set, and level of support. Schedule a demo to learn how Tenant Evaluation can streamline applications, support compliance, and help your Florida community manage risk and revenue.

Frequently Asked Questions

How critical is Florida-specific compliance for an HOA management platform?

Florida maintains complex and frequently updated HOA and condo laws. Platforms that do not account for these rules often rely on manual workarounds, which increases the chance of errors and legal exposure. A platform that supports Florida-specific bylaws, timelines, and document requirements helps protect association assets and reduces risk for boards and managers.

Can a comprehensive HOA platform reduce administrative workload for Community Association Managers?

Modern platforms that automate document collection, background checks, and status updates can significantly reduce manual work. Some Florida associations report savings of up to 50 staff hours per day and annual cost reductions near $240,000, with application processing times cut by about 70 percent once digital workflows are fully adopted.

What makes a Board Member Dashboard an important feature?

A dedicated Board dashboard centralizes applications, supporting documents, and voting tools in one place. This setup reduces reliance on long email threads, lowers the chance of missed information, and creates clear audit trails. The result is faster, more consistent decisions and better alignment with Florida governance requirements.

How do revenue-sharing models work with HOA management platforms?

In a revenue-sharing model, residents pay application fees and the platform provider collects its service fee from those payments. The remaining funds go back to the association. This structure can offset or eliminate direct software costs and may provide additional income that can be used for reserves or community improvements.

What security features should Florida HOAs prioritize?

Florida HOAs should look for PCI Level 1 compliant payment processing, end-to-end encryption, and automatic redaction of Social Security numbers, bank data, and other sensitive details. Strong access controls, logging, and audit trails also matter, since they support both privacy protection and regulatory compliance.

Conclusion: Align Your Platform Choice With Florida’s Real Needs

The right HOA management platform helps Florida communities handle applications faster, maintain compliance, and manage risk in a structured way. Broad HOA systems cover accounting, communication, and daily operations, while specialized screening tools close gaps around Florida-specific rules, identity checks, and board approvals.

Florida HOAs and Community Association Managers benefit most when they select platforms that combine local compliance expertise, thorough screening, strong security, and clear board involvement. Focusing on these areas supports efficient operations, predictable timelines, and a better experience for residents and volunteers.