Key Takeaways

- HOAs and condo associations in Florida face heavy administrative workloads, compliance risk, and data security concerns when they rely on manual onboarding and access control processes.

- Digital screening and onboarding tools reduce errors, shorten approval times, and provide clearer visibility for boards, managers, and residents.

- Secure handling of sensitive applicant data, including payment information and background checks, helps communities reduce legal exposure and protect resident trust.

- Specialized platforms that focus on HOAs support better board decisions, transparent voting, and more consistent enforcement of community rules.

- TenantEvaluation offers an HOA-focused, digital onboarding and screening platform that streamlines applications, supports compliance, and helps communities work more efficiently; schedule a demo to see it in action.

The Problem: Administrative Burdens and Compliance Risks in HOA Management

Many HOAs depend on outdated, manual processes for resident applications, access control, and document collection. These workflows create delays, confusion, and long email chains that frustrate owners, tenants, and managers.

Manual application handling often produces incomplete or inaccurate submissions. Staff then spend hours requesting missing documents, clarifying information, and coordinating with applicants, realtors, and owners. Time that could support maintenance, communication, or planning instead goes into chasing paperwork.

Paper-based or email-based systems also increase exposure to data loss and security incidents. Handling Social Security numbers, payment data, and background reports without strong controls raises the risk of non-compliance with regulations such as the Fair Credit Reporting Act and payment security standards. These gaps can damage trust and carry financial consequences.

Slow, opaque approval processes create further challenges. Applicants may not understand where they stand, boards may lack a clear view of pending files, and managers may struggle to keep everyone aligned. Communities can miss move-in dates and delay fee collection, which hurts both resident satisfaction and revenue.

HOA teams that want a structured way to manage onboarding and approvals can benefit from a dedicated platform that reduces manual work and centralizes information. Explore how TenantEvaluation supports that approach.

The Solution: TenantEvaluation’s All-in-One Platform for HOA Management

TenantEvaluation provides a digital resident screening and onboarding platform built for condominium and homeowner associations in Florida. The system replaces fragmented email and paper processes with a single online workflow for applications, approvals, and access-related documentation.

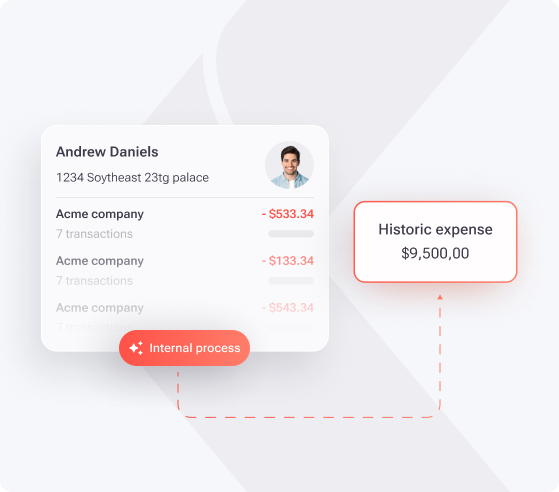

The platform digitizes applications, document uploads, payments, background checks, and approvals in one place. Smart rules check for required information and flag missing documents before an application reaches the association. This approach can cut manual processing time by dozens of hours per week for larger communities.

Security and compliance functions run in the background. TenantEvaluation uses PCI Level 1 compliant payment processing, end-to-end encryption, and automatic redaction of sensitive data. FCRA-compliant background checks and detailed audit trails help boards and managers document decisions and reduce legal risk.

The QuickApprove dashboard gives Boards of Directors a clear view of every application. Board members can review summarized reports, see supporting documents, and record votes in a structured, trackable way. This setup supports faster, more consistent decisions and reduces dependence on long email threads.

Key Benefits of TenantEvaluation for HOA Management

Streamlined Application Processes

TenantEvaluation lets applicants complete forms, upload documents, and submit payments online from any device. The platform checks for core requirements before submission, which reduces incomplete files and back-and-forth communication.

Community managers see every application in a central dashboard. Status indicators, alerts, and task lists make it easier to track what needs attention, who must respond next, and which applications are ready for board review.

Enhanced Data Security and Compliance

Secure data handling sits at the center of the platform. PCI Level 1 compliant payment processing, encryption in transit and at rest, and automatic redaction of sensitive fields help protect both applicants and communities.

Comprehensive audit trails record who viewed or changed information, when they did so, and how decisions were reached. These records support FCRA-compliant practices and make it easier to respond to questions from residents, board members, or legal counsel.

Improved Decision-Making for Boards

Boards gain consistent access to the same information through the QuickApprove dashboard. Members can review background summaries, financial indicators, and application notes without searching through email threads or shared drives.

The built-in voting panel structures the approval process. Each vote is recorded, timestamped, and linked to the relevant application, which supports transparency, reduces disputes, and aligns decisions with community standards.

Operational Efficiency and Revenue Opportunities

Automation of routine steps shortens approval times and reduces bottlenecks. Many communities see faster move-in approvals, fewer manual follow-ups, and clearer tracking of where each file stands.

TenantEvaluation also centralizes fee collection related to applications. The platform can support revenue-sharing arrangements that help communities offset screening and onboarding costs, often creating a cost-neutral or positive financial impact.

HOA leaders who want to see these workflows in practice can review a live walkthrough. Book a demo with TenantEvaluation to explore options for your community.

Critical Considerations for HOA Onboarding and Security Integration

Choosing a Platform That Fits Community Rules

Each HOA has its own bylaws, approval criteria, and access policies. TenantEvaluation configures workflows to match Florida-specific regulations and community documents, so screening questions, document requirements, and approval paths align with local rules.

Maintaining Regulatory Compliance and Data Privacy

FCRA obligations and privacy expectations apply to many aspects of resident screening. TenantEvaluation embeds compliance into its processes, from secure document handling to structured background checks and detailed logs of each action taken on a file.

Vendor Expertise and Support

Technology alone does not solve onboarding challenges. Communities benefit from working with a provider that understands HOA governance, board dynamics, and Florida regulations. TenantEvaluation supports that need and serves management firms such as RealManage and FirstService Residential with 24/7 AI-supported assistance in 11 languages.

Training and Adoption for Optimal Use

Clear training for managers, staff, and board members improves adoption of any new system. TenantEvaluation focuses on intuitive interfaces and ongoing support so teams can integrate digital onboarding into daily operations without disrupting residents.

Comparison Table: Manual vs. TenantEvaluation’s Digital Platform for HOA Onboarding

|

Feature or Approach |

Manual Processes |

TenantEvaluation Platform |

|

Application process |

Paper or email based, heavy follow-ups, frequent errors |

Online forms, automated checks, real-time status updates |

|

Data security |

Higher risk from manual handling of sensitive data |

PCI Level 1 payments, encryption, automatic redaction |

|

Board involvement |

Limited visibility and scattered email-based approvals |

QuickApprove dashboard with structured review and voting |

|

Compliance |

Manual audits and inconsistent documentation |

FCRA-aligned background checks and audit-ready trails |

Frequently Asked Questions (FAQ) About TenantEvaluation for HOAs

How does TenantEvaluation improve operational efficiency for HOAs?

TenantEvaluation automates resident onboarding from application to decision. The platform reduces manual data entry, flags missing items before review, and routes applications to the right people. Communities often see approval times drop significantly, which frees staff to focus on communication, maintenance, and resident services.

How does TenantEvaluation protect sensitive resident data?

TenantEvaluation protects information through encrypted storage and transmission, PCI Level 1 compliant payment processing, and automatic redaction of fields such as Social Security numbers. Detailed audit logs show how data was used, which supports both security and regulatory compliance.

What makes TenantEvaluation different from other property management software?

Broad property management systems handle many tasks but may not go deep on HOA governance needs. TenantEvaluation focuses on Florida HOAs and condominium associations, with workflows, board dashboards, and compliance tools designed specifically for screening and approvals in that environment.

What kind of support does TenantEvaluation offer to HOA managers and applicants?

TenantEvaluation offers 24/7 AI-assisted chat and phone support in 11 languages. Applicants can get help completing forms or uploading documents, and managers can get guidance on workflow settings, reports, or board tools.

Communities that want to understand how this support looks in real situations can review a tailored demonstration. Request a demo for your association.

Conclusion: Strengthen HOA Management with TenantEvaluation

Administrative backlogs, unclear approvals, and data security concerns place real pressure on HOA teams. A digital onboarding and screening platform designed for Florida communities helps reduce that pressure and supports a more consistent, transparent process for residents and boards.

TenantEvaluation combines online applications, secure data handling, FCRA-aligned background checks, and the QuickApprove board dashboard in one system. Associations that adopted the platform have reported significant time savings and measurable financial benefits, including a Florida-based management company that saved $240,000 per year after implementation.

One community user summarized the experience as fast and easy, explaining that it makes every transaction simple and improves both staff work and the application process for residents.

HOA leaders who want to modernize onboarding and reinforce data security can review how TenantEvaluation fits their community structure. Schedule a demo today to see how the platform can support your board, staff, and residents in 2026 and beyond.