Key Takeaways

- Manual, inconsistent screening processes increase workload, slow approvals, and create avoidable risk for Florida HOAs and condominium associations.

- Florida-specific regulations require clear authority in governing documents, consistent criteria, and careful handling of Fair Housing and data privacy requirements.

- Standardized digital workflows help boards apply criteria fairly, document decisions, and maintain transparent records for every application.

- Automation reduces processing time, cuts administrative costs, and can turn screening from a pure expense into a predictable revenue stream.

- TenantEvaluation offers a Florida-focused platform that standardizes screening criteria, supports compliance, and simplifies board decisions. Schedule a demo to see how TenantEvaluation can support your HOA or condo association.

The Problem: Why Inconsistent Standardized Screening Criteria Management Harms Florida HOAs

Manual Screening Creates Heavy Administrative Work

Manual tenant screening forces staff to manage paperwork, chase missing documents, and respond to constant status requests from applicants, realtors, and unit owners. Time that could support residents and strategic projects turns into time spent checking IDs, leases, and income documents by hand.

Larger portfolios can see teams lose dozens of staff hours each week to repetitive tasks that a digital workflow could handle. These delays slow move-ins, frustrate owners and applicants, and increase the chance of errors or incomplete files.

Complex Florida Regulations Increase Compliance Risk

Florida HOAs operate within a detailed legal framework, so inconsistent screening criteria can quickly create risk. Florida associations may screen tenants when their governing documents authorize it, but must avoid Fair Housing violations. New rules add more complexity. Florida HB 43 (2025) introduced reusable tenant screening reports that remain valid for up to 30 days, which raises questions about how boards verify accuracy and timing.

Fair, consistent criteria matter as much as legal knowledge. Florida HOAs cannot ask about children, disabilities, or national origin while screening, and screening, fees, and guest rules must appear in governing documents. Manual workflows make it easy for different people to apply rules in slightly different ways, which can create exposure for the board.

Inefficient Screening Hurts Association Finances

Slow and inconsistent screenings lengthen vacancy periods, which can reduce rental income for owners and indirectly affect assessment collections. Errors or missing documentation can lead to disputes, legal bills, or the need to re-run checks.

Hidden labor costs add up when staff spend large portions of each day on phone calls, emails, and manual data entry. These delays can also push qualified applicants toward communities that offer faster, clearer approval timelines.

Lack of Transparency Frustrates Boards and Residents

Boards that rely on email threads, paper files, or scattered spreadsheets struggle to see the full picture. Members often review incomplete information or receive it too late, which slows votes and leads to inconsistent decisions.

Without standardized reports and audit trails, it becomes difficult to prove that criteria were applied fairly across applicants. That lack of visibility can strain relationships between the board, management, and residents.

The Solution: Embracing a Specialized Platform for Standardized Screening Criteria Management

Digital Workflows Simplify Tenant Evaluation

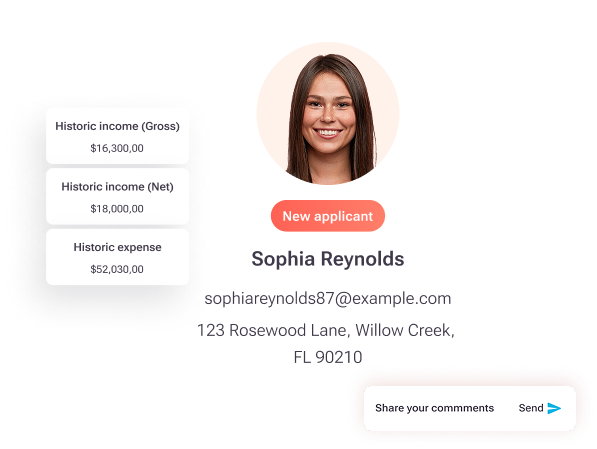

A specialized platform replaces manual back-and-forth with clear online workflows. Applicants submit forms, upload documents, and pay fees in one place, while managers track each file from submission to decision.

Built-in checks help ensure applications are complete before submission, which reduces delays and repeated outreach. Automated notifications keep applicants, realtors, and owners updated so staff spend less time answering status questions.

Built-In Rules Support Florida Compliance

Platforms designed for Florida communities embed state and federal rules into the screening flow. HOAs configure their governing documents, policies, and criteria so the system applies them consistently on every file.

Security features such as PCI Level 1 compliance, encryption, and automatic redaction help protect sensitive applicant data and reduce liability. Florida condo and HOA acts permit application and background fees only when governing documents clearly authorize them, and a rules-based platform can enforce those limits on every application.

Automation Reduces Costs and Supports New Revenue

Online payment collection removes the need to track checks or manual credit card forms, which reduces errors and staff time. Associations can charge approved screening fees at submission, so no file moves forward without payment.

Some Florida management companies report six-figure annual savings after moving from manual processing to automated screening and fee collection. Those savings can support reserves, capital projects, or additional services for residents.

Board Dashboards Improve Transparency and Decisions

Board-facing dashboards give members a single source of truth. They can review summaries, supporting documents, and screening results without sorting through crowded email chains.

Clear audit trails record who reviewed each file, how they voted, and when decisions occurred. Those records support Fair Housing compliance, help resolve disputes, and make it easier to onboard new board members.

TenantEvaluation: Your Partner in Standardized Screening Criteria Management

TenantEvaluation is a resident screening and onboarding platform built with Florida HOAs and condominium associations in mind. The company has operated since 2007, combining property management, board, and software experience, and now processes more than 100,000 applications per year while helping communities generate substantial screening-related revenue.

Key Benefits of TenantEvaluation’s Standardized Screening Criteria Management

- Custom setup for Florida rules and your governing documents, so criteria are applied the same way every time.

- Intelligent forms and automatic redaction that adapt to applicant type while protecting personal information.

- QuickApprove board dashboards that centralize voting, comments, and audit history in one place.

- Automated fee collection and optional revenue-sharing models that reduce manual work and support association income.

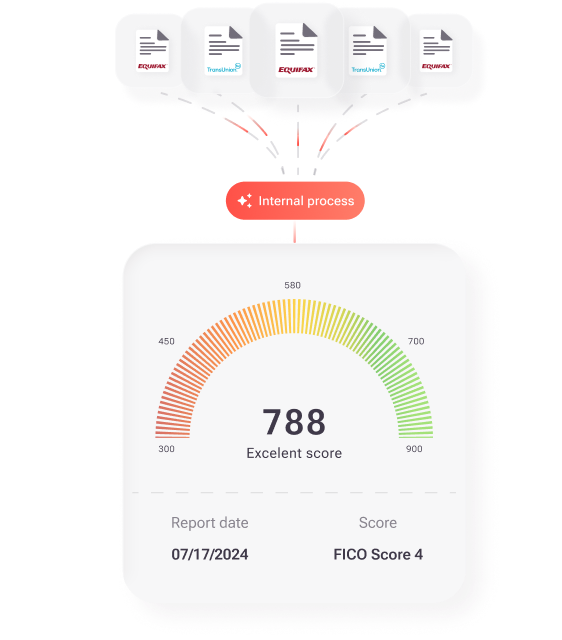

- Integrated tools such as IDverify, IncomeEV, and SafeCheck+ for a unified view of identity, income, and background results.

|

Feature/Benefit |

Manual Processes |

TenantEvaluation |

|

Administrative workload |

High paperwork and repeated follow-ups |

Streamlined workflows that can cut processing time by up to 70 percent |

|

Compliance with Florida rules |

High risk of inconsistent criteria and missing documentation |

Built-in Florida requirements, with support for FCRA and Fair Housing standards |

|

Data security |

Paper files and unsecured email attachments |

PCI Level 1 controls, encryption, and automatic redaction of sensitive data |

|

Revenue impact |

Screening seen as a cost center |

Automated, trackable fee collection and potential revenue-sharing model |

Frequently Asked Questions (FAQ) about Standardized Screening Criteria Management in Florida HOAs

What Florida regulations matter most for tenant screening?

Florida HOAs must confirm that tenant screening is clearly authorized in their governing documents and that criteria follow the federal Fair Housing Act. That means avoiding questions or rules tied to protected classes such as children, disabilities, or national origin, and documenting how decisions are made. New requirements such as HB 43 (2025) reusable reports also affect how boards review and verify third-party screening information.

Can a Florida HOA charge screening fees?

Florida HOAs may charge tenant screening fees when their governing documents authorize those fees. Amounts must be reasonable, applied consistently, and tied to the actual cost of screening activities such as credit and background checks, rather than used as a penalty or profit tool. Clear, standardized processes help show that every applicant is treated the same way.

How does a platform keep criteria consistent?

A dedicated platform allows an HOA to configure its rules once, then apply them across all applications. The system uses those rules to control required fields, document uploads, screening checks, and approval paths. This approach reduces human error, helps avoid ad hoc exceptions, and maintains audit trails that show how criteria were applied.

What risks arise without standardized screening?

Associations that rely on informal or inconsistent screening face higher legal risk, slower approvals, and more disputes. Files are harder to track, data is less secure, and decisions are more vulnerable to Fair Housing challenges. Owners and applicants may also lose confidence in the process when communication is slow or criteria appear unclear.

How does automation help boards make better decisions?

Automated screening brings all relevant information together in one dashboard, so board members can review clear summaries instead of fragmented emails. Standardized reports, side-by-side comparisons, and recorded votes make decisions faster and easier to explain if questions arise.

Conclusion: Strengthen Your Community with Standardized Screening Criteria Management

Florida HOAs and condominium associations that rely on manual screening carry higher administrative costs, greater compliance risk, and more frustration for everyone involved. Standardized, digital criteria management helps reduce those pressures while supporting fair, documented decisions.

A specialized platform like TenantEvaluation allows associations to move approvals online, embed Florida-specific rules, and give boards clear dashboards and audit trails. Communities that adopt these tools in 2026 can protect themselves legally, improve the experience for applicants and owners, and manage screening as a controlled, predictable process.