Key Takeaways

- Florida HOAs and condos now operate under stricter 2026 compliance expectations driven by laws like HB 913 and HB 1203 and expanded DBPR oversight, so manual screening processes carry higher risk.

- Manual resident screening creates administrative overload, inconsistent decisions, and exposure to fraud, data breaches, and FCRA-related liability.

- Compliance-focused tenant verification systems embed Florida-specific requirements into automated workflows, improving accuracy, consistency, and record-keeping.

- Boards and community association managers gain faster approvals, clearer dashboards, better fraud detection, and stronger data security while reducing operating costs.

- Tenant Evaluation provides a Florida-focused tenant verification platform that supports 2026 compliance and operational efficiency; get started with Tenant Evaluation to modernize your screening process.

The Problem: Why Florida HOAs & Condos Need Compliance-Focused Tenant Verification Now

Staying Current With Florida’s 2026 Condo and HOA Regulations

Florida’s regulatory environment became more complex in 2025, with House Bill 913 introducing wide-ranging changes to condominium governance. Expanded DBPR oversight now reaches milestone inspections, insurance compliance, board education, and reserve reporting. Associations must maintain online DBPR accounts while local enforcement agencies report inspection data on defined timelines.

Community association managers face added scrutiny as CAMs must hold active Florida licenses as a condition of contracts, and boards must verify licensure status. Managers who lose licenses for misconduct cannot reapply for 10 years, so associations now depend on precise documentation and reliable tracking to show compliance.

Reducing Administrative Overload in Resident Screening

Most associations still rely on paper forms, email chains, and spreadsheets. Staff members spend hours chasing incomplete applications, manually reviewing documents, and coordinating with applicants, realtors, and board members. These steps slow approvals, frustrate residents, and inflate administrative expenses.

Each application often follows a different path, which increases the chance of missed documents, inconsistent screening criteria, and delayed board decisions. As volume grows, manual processes struggle to keep up and expose the association to regulatory and operational risk.

Responding to Growing Fraud Risks in Applications

Fraudsters now use high-quality fake IDs, altered pay stubs, fabricated bank statements, and false employment records. Basic visual checks and manual reviews rarely keep pace with these methods. Once admitted, fraudulent residents may default on assessments, cause property damage, or create safety and legal issues for the community.

Costs can extend beyond unpaid fees to legal expenses, eviction procedures, repairs, and reputational harm. Manual verification rarely includes the layered checks needed to spot modern document manipulation and identity theft.

Protecting Resident Data and Reducing Liability

Many associations still handle Social Security numbers, bank statements, and other sensitive data through email, hard copies, and unsecured shared drives. This practice increases exposure to data breaches, lost documents, and unauthorized access.

FCRA requirements also demand careful handling and disposal of background check information and clear audit trails for decisions. Manual systems often lack consistent retention rules, access controls, or documentation, which raises both regulatory and legal risk.

Helping Boards Make Faster, More Transparent Decisions

Board members often receive scattered information through long email threads and attachments. This format slows reviews, creates version control issues, and makes voting difficult to track. Applicants then wait longer for decisions, and boards have limited visibility into current application status.

Associations also miss the opportunity to use application data for planning. Insights about rental ratios, demographic shifts, or resident profiles rarely reach the board in a structured, usable format.

The complexities of modern resident screening are increasing. Associations that adopt structured, technology-supported verification processes gain a clear advantage in compliance, security, and efficiency.

The Solution: How Compliance-Focused Tenant Verification Systems Future-Proof Florida Associations

Aligning Screening Workflows With Florida-Specific Compliance

Modern tenant verification platforms embed Florida requirements directly into their workflows. Mandatory record retention periods, such as 7 years for financial records and 15 years for structural reports, can be supported through automated archiving and organized digital storage.

Each association can define screening rules that reflect its bylaws and covenants while staying aligned with HB 913, HB 1203, and DBPR expectations. Consistent processes and audit-ready records make it easier to demonstrate compliance during disputes, elections, or regulatory reviews.

Improving CAM Productivity With Streamlined Online Workflows

Fully online applications reduce manual data entry and paper handling. Applicants complete forms via web or mobile, and system logic tailors questions based on whether the person is a tenant, purchaser, or additional occupant. Staff members no longer retype information or assemble packets by hand.

Automated reminders, status updates, and document checklists keep applicants on track without constant phone calls or emails. Staff can then redirect time toward resident relations, vendor coordination, and community projects rather than chasing paperwork.

Strengthening Fraud Detection and Risk Assessment

Advanced verification systems combine ID authentication, income validation, and multi-database background checks. Automated tools flag mismatches, detect altered documents, and confirm employment details directly, which reduces reliance on self-reported information.

Layered screening can include criminal background checks, credit data, eviction history, and references, assembled into a standardized risk profile. Boards then see a clear, comparable view of applicants rather than fragmented reports.

Securing Data and Supporting FCRA Compliance

Enterprise-grade platforms apply PCI Level 1 controls, end-to-end encryption, and automatic redaction of sensitive information. Access permissions define who can view what data, and every interaction is logged.

Detailed audit trails show when reports were generated, who reviewed them, and how decisions were made. This structure supports FCRA obligations, improves consistency, and reduces exposure from misplaced or mishandled documents.

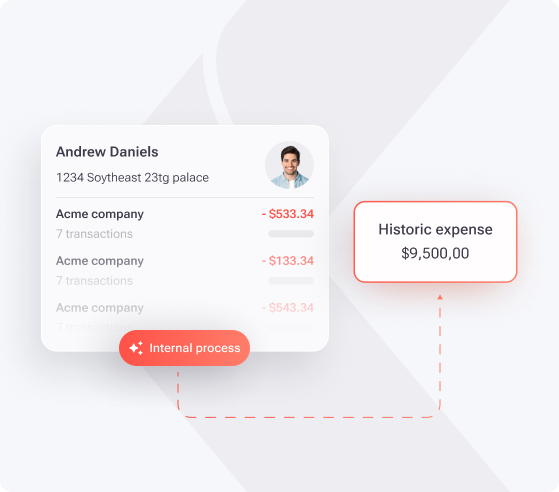

Accelerating Board Reviews and Increasing Transparency

Board portals give directors one place to review application summaries, supporting documents, and standardized risk indicators. Voting tools simplify approvals and denials, and comments remain stored with the application record.

Analytics dashboards can highlight trends in rentals, resident demographics, and processing times. Boards use this information to adjust policies, refine screening criteria, or plan capital projects with clearer context.

Creating New Revenue and Cost Savings for Associations

Automated processing reduces labor hours and error rates, which lowers the true cost of each application. Online fee collection also improves capture of application fees and reduces reconciliation work for accounting teams.

Some platforms support revenue-sharing arrangements that return a portion of application revenue to the association. Combined with fewer errors and faster decisions, these savings strengthen the community’s financial position.

Associations that use systems built for Florida regulations gain a stable framework for 2026 and beyond, rather than repeatedly adjusting manual processes.

Case Study: Florida Management Company Cuts $240K in Annual Costs

A large Florida management company previously handled applications with paper forms, phone calls, and email threads. Staff spent many hours each day assembling files, tracking down missing documents, and coordinating with multiple boards.

After adopting Tenant Evaluation’s compliance-focused platform, the company freed roughly 50 staff hours per day and cut processing times by about 50 percent. The change produced savings of about $10 per hour per property, adding up to $240,000 per year in reduced labor and fewer process errors. Centralized digital records and encryption also reduced the liability that came from storing sensitive data in paper files and inboxes.

Associations that use similar tools often see faster approvals, lower administrative stress, and clearer documentation for residents, boards, and regulators.

Key Features: Manual vs. Automated Compliance-Focused Tenant Verification for 2026 Florida Regulations

|

Feature Area |

Manual Process (Pre-2025 Risk) |

Automated Compliance-Focused System (2026 Solution) |

|

Compliance |

High risk of errors and difficulty tracking evolving laws such as HB 913 and HB 1203 |

Florida-specific rules, clear audit trails, and structured regulatory support |

|

Efficiency |

Heavy administrative workload, repeated data entry, and slow approvals |

Online applications, automated workflows, and shorter processing times |

|

Fraud Detection |

Limited tools to detect sophisticated fake IDs, income, or employment |

ID verification, income analysis, and enhanced background checks |

|

Data Security |

Greater risk of breaches from paper files and unencrypted email attachments |

Automatic redaction, PCI Level 1 controls, and encrypted storage |

|

Board Engagement |

Delayed reviews, fragmented information, and informal email voting |

Board dashboards with real-time status, online voting, and stored decisions |

|

Revenue Generation |

Missed application fees and no structured revenue-sharing options |

Automated fee collection and potential revenue-sharing programs |

Frequently Asked Questions (FAQ) About Compliance-Focused Tenant Verification Systems

Compliance-focused tenant verification and Florida HB 913

Modern platforms incorporate DBPR oversight requirements and record-retention rules into their core setup. Systems can maintain at least 7 years of financial records and 15 years of structural reports in organized, searchable archives. Boards also receive transparent access to application data and decision histories, which supports the higher level of scrutiny expected under HB 913.

The growing importance of fraud detection for Florida associations

Fraud detection in tenant screening uses technology to uncover manipulated documents, false identities, and misrepresented income. Florida HOAs and condos face greater risks from applicants who rely on professional forgeries or fabricated credentials. By adding ID authentication, employer verification, and multi-database checks, associations reduce the chance that high-risk applicants enter the community.

Faster and more transparent approvals for boards and managers

Compliance-focused systems provide board members with standardized applicant summaries, secure document access, and structured voting workflows. Directors can review files on their own schedules without digging through email threads. Every action is logged, so the association retains clear records of how and when decisions were made.

Data security practices that protect resident information

Automated systems apply encryption to data in transit and at rest, restrict access by user role, and redact sensitive fields from shared documents. These controls exceed what typical manual processes can provide and support FCRA-compliant handling of background information. Associations benefit from lower breach risk and stronger evidence of due diligence if questions arise.

If your association needs help evaluating screening options, the Tenant Evaluation team can review your current process and suggest practical next steps. Schedule a demo today to see how Tenant Evaluation supports Florida-specific compliance while simplifying daily operations.

Conclusion: Preparing Your Community for 2026 and Beyond

Florida HOAs and condos face higher expectations in 2026 because of the regulatory foundation set in 2025, rising fraud risks, and limited staff resources. Manual screening methods now struggle to keep pace with HB 913, HB 1203, DBPR oversight, and modern data-security standards.

A compliance-focused tenant verification system such as Tenant Evaluation functions as a risk-management tool as much as an operational upgrade. Associations gain consistent workflows, better fraud controls, stronger data protection, clearer board oversight, and more reliable financial outcomes.

Communities that adopt structured, technology-based screening today will be better positioned to meet future regulatory changes and resident expectations. Schedule a demo today to see how Tenant Evaluation can support your board, your residents, and your long-term compliance strategy.