Key Takeaways

- HOA screening in Florida carries high legal and operational risk, so purpose-built PropTech helps standardize decisions, reduce delays, and support fair housing compliance.

- Automated applications, intelligent forms, and identity and background tools reduce manual work for Community Association Managers and boards while improving accuracy.

- Digital document management, e-signatures, and automated notifications create a clear, auditable record that protects communities and improves the applicant experience.

- Centralized dashboards and reporting help HOAs monitor timelines, spot bottlenecks, and align screening practices with community bylaws and state regulations.

- Platforms like Tenant Evaluation give HOAs an integrated way to manage applications, run screenings, and keep records organized. Get started with Tenant Evaluation.

Why Specialized PropTech for HOA Screening Is Essential for Florida Communities

Florida communities operate in a fast-moving real estate market and a strict regulatory environment. Efficient, compliant HOA screening has become a core requirement rather than an optional upgrade.

Manual workflows often slow approvals and increase risk. Many boards still rely on email chains, paper packets, and spreadsheets, which raise the chance of errors and inconsistent decisions. These challenges grow when a meaningful share of applications include misleading or false information. Nearly 15% of applications contain falsified information, such as fake pay stubs and manipulated credit reports.

HOAs that fall under Chapter 718, the Condominium Act, and Chapter 720, the Homeowners’ Association Act, face strict obligations. Screening delays of days or weeks frustrate applicants, realtors, and board members and can expose communities to claims of unfair treatment. Specialized PropTech for HOA screening helps Florida communities move faster while aligning with state law, fair housing expectations, and community-specific bylaws.

1. Automated Application And Document Collection Platforms

Automated application platforms give HOAs a single online portal for submissions and document uploads. Applicants complete digital forms, attach supporting files, and see status updates without repeated calls or emails.

These tools reduce manual data entry and file handling for CAMs and board members. Staff can focus on review and compliance instead of sorting paperwork. Applicants gain clear instructions, 24/7 access, and fewer surprises about what they need to provide.

Complete, structured applications also move faster. Modern automated platforms can reduce application cycles by up to 70% by preventing missing documents and unclear responses. Faster decisions support smoother move-ins, better occupancy stability, and less friction with realtors.

2. Intelligent Form Logic And Custom Compliance Setups

Intelligent forms tailor each application to the right scenario. The system can adjust questions and required documents based on applicant type, such as tenant, purchaser, or additional adult resident.

Custom compliance rules align each form with community bylaws and Florida regulations. HOAs can standardize criteria like minimum credit scores, income ratios, occupancy limits, and documentation rules. Consistent criteria support fair housing compliance and reduce discrimination claims because decisions follow documented standards instead of case-by-case judgment.

Clear, guided forms also reduce confusion. Confusing application processes and manual submissions often cause delays and extended vacancies. Smart logic, conditional questions, and real-time checks for completeness help HOAs receive accurate, usable information the first time.

3. Identity Verification And Fraud Detection Tools

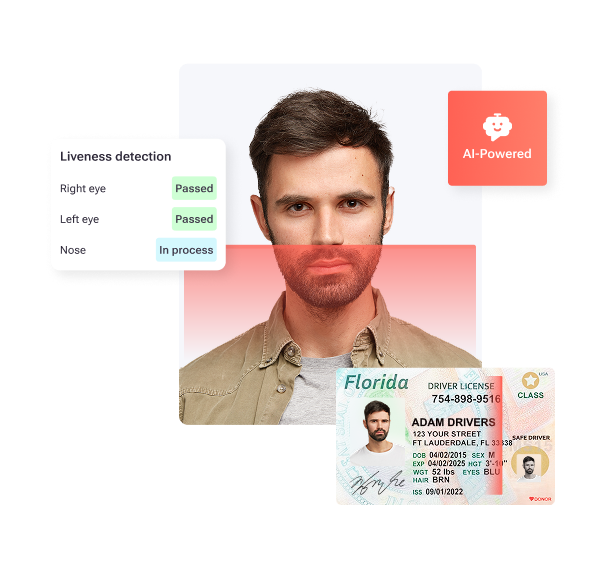

Identity verification technologies help HOAs confirm that each applicant is who they claim to be. These tools validate government IDs, match photos, and flag signs of tampering or stolen identities.

Many platforms now include liveness checks and biometric analysis. These features compare the person on camera to the ID photo and confirm that a real person is present during verification. This approach limits impersonation risk, especially in remote or fully online screening processes.

Identity verification also supports compliance. HOAs that screen out false identities and synthetic applicants protect residents, reduce future disputes, and keep community records accurate. Platforms that integrate identity checks into the same portal as applications and background reports further simplify workflows for CAMs.

4. Credit, Criminal, And Eviction Screening Platforms

Credit, criminal, and eviction reports form the backbone of most HOA screening decisions. Specialized PropTech platforms pull data from major credit bureaus, court systems, and public records to give boards a clear view of risk.

Credit reporting tools provide scores, payment history, and debt levels. Trusted insights into financial responsibility help HOAs evaluate whether applicants can reliably meet assessments and fees. Criminal and eviction searches reveal prior serious issues that could affect community safety or rule compliance.

Advanced platforms organize these checks into easy-to-read reports and apply community rules automatically, such as lookback periods or disqualifying offenses. HOAs gain consistent decisions and a clear documentation trail if an applicant disputes a denial.

5. E-Signature And Digital Document Management

E-signature tools and digital archives give HOAs a structured way to manage approvals, addendums, and acknowledgement forms. Applicants can sign required documents from any device, and the system tracks timestamps and IP details for legal validity.

Digital storage keeps every file connected to the right unit, applicant, and decision date. CAMs and board members can quickly retrieve the full history of an applicant, including applications, approvals, denials, and correspondence. This level of organization supports audits, legal reviews, and board transitions.

When e-signature tools integrate with the application portal, staff avoid duplicate uploads or manual filing. Templates and standard packets ensure every applicant receives the same disclosures and community rules.

6. Automated Communication And Status Notifications

Automated communication tools keep applicants and stakeholders informed at each step. These systems send emails or text messages when applications are received, when additional information is needed, and when a decision is made.

Clear, predictable communication reduces inbound calls and follow-up emails to CAMs. Realtors gain faster visibility into status, which helps them manage closings and move-in timelines. Applicants feel informed and treated fairly when they see consistent updates and documented reasons for delays.

Boards benefit from templates that align language with fair housing considerations and community policies. Consistent messaging lowers the risk that an offhand comment or improvised email creates confusion or liability.

7. Centralized HOA Screening Dashboards And Analytics

Centralized dashboards give HOAs a single view of all in-progress and completed applications. CAMs and board members can track where each file sits in the process and which tasks remain open.

Analytics tools highlight bottlenecks, such as frequent delays in board review or recurring incomplete documents from applicants. HOAs can use these insights to adjust rules, clarify instructions, or re-balance responsibilities between management and the board.

Dashboards also support governance. Boards can confirm that decisions follow the documented criteria in their governing documents and that similar applicants receive similar treatment. Over time, this visibility builds trust with owners and reduces disputes about perceived inconsistencies.

How Tenant Evaluation Supports HOA Screening In 2026

Tenant Evaluation focuses on the specific needs of HOAs and condominium associations, particularly in Florida. The platform brings applications, identity checks, credit and background screening, and board-ready reports into one system designed for community approvals.

CAMs can configure rules to align with bylaws, track every application from submission through decision, and maintain a centralized archive of documents and communication. Boards receive organized, easy-to-review files rather than scattered emails and paper packets.

HOAs that adopt modern screening technology reduce processing times, lower administrative stress, and maintain stronger compliance with state law and fair housing expectations. Get started with Tenant Evaluation to modernize your HOA screening process for 2026 and beyond.