Key Takeaways

- Clear, objective screening criteria help Florida community associations reduce discrimination risk and support consistent approval decisions.

- Comprehensive, FCRA-compliant background checks and careful criminal history policies improve safety while staying within Fair Housing rules.

- Secure, digital screening workflows protect sensitive applicant data, cut processing time, and reduce administrative workload.

- Regular policy reviews, accurate records, and thoughtful handling of accommodation requests lower the chance of costly disputes and litigation.

- Tenant Evaluation offers an automated, compliant screening platform that simplifies applications and decisions for boards and managers. Get started with Tenant Evaluation to modernize your process.

Why Robust Resident Screening Matters for Florida Associations

Strong resident screening supports safer, more stable communities. For Florida associations, thoughtful screening affects security, legal compliance, and financial health.

Screening policies that are not carefully designed can create Fair Housing Act exposure. Screening procedures that fall more heavily on certain racial or national origin groups can trigger claims and lead to penalties and litigation. Weak screening also increases staff workload, introduces safety concerns, and may harm property values when unqualified residents cause problems.

Well-structured screening reduces legal risk, speeds up approvals, and improves board decision-making. Request a Tenant Evaluation demo to see how a digital platform can support compliance while simplifying day-to-day work.

1. Establish Clear, Non-Discriminatory Screening Criteria

Objective criteria create the foundation for fair, defensible decisions. Written standards should focus on financial stability and safety, and they must comply with the Fair Housing Act.

Consistent application of criteria is essential. Every applicant needs to be evaluated under the same rules, regardless of race, religion, national origin, family status, disability, or other protected characteristics.

Criminal history policies require special care. HUD guidance identifies blanket exclusions based only on arrests as a potential source of discrimination. A practical approach includes:

- Defining a substantial, legitimate, non-discriminatory interest, such as safety.

- Reviewing the nature, severity, and recency of convictions case by case.

- Documenting how each decision aligns with written policy.

2. Conduct Comprehensive and FCRA-Compliant Background Checks

Thorough background checks give boards the information needed to make measured decisions. Standard checks often include criminal history, credit reports, eviction history, employment verification, and prior landlord references.

Compliance with the Fair Credit Reporting Act is mandatory. Associations must obtain written consent before screening and use consumer reporting agencies that follow FCRA rules for data accuracy and dispute handling.

Associations need to distinguish between arrests and convictions. Denials based solely on arrests create risk. The Fair Housing Act allows denial when applicants were convicted of illegal manufacture or distribution of controlled substances, but other convictions call for individual review that weighs relevance to safety and time elapsed.

3. Protect Applicant Data and Privacy

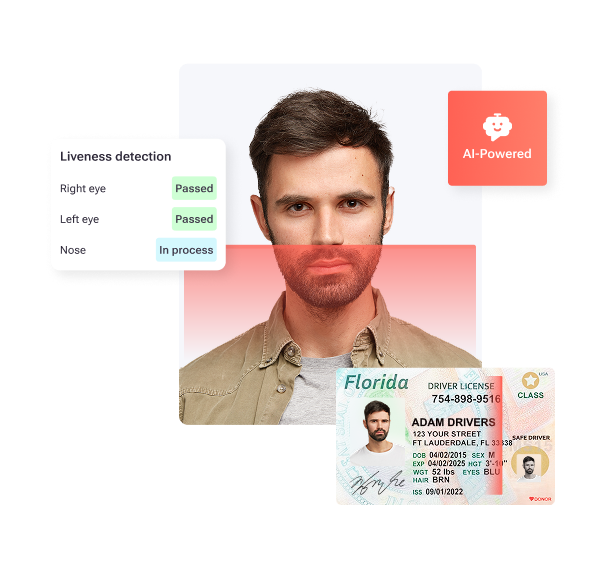

Safeguarding applicant information is both a legal requirement and a trust issue. Screening applications often contain Social Security numbers, bank details, and government IDs, which demand careful handling.

Paper applications and emailed documents increase exposure to loss, theft, or unauthorized access. Unsecured drives and shared inboxes also create problems if a breach occurs.

Secure digital platforms lower these risks through encryption, access controls, and automatic redaction of sensitive data. Many systems include PCI Level 1 compliant infrastructure and audit logs that show who viewed or changed information, which supports both privacy and compliance.

4. Handle Accommodation Requests Consistently Under the Fair Housing Act

Clear procedures for disability-related accommodation requests reduce confusion for both applicants and boards. The Fair Housing Act requires reasonable accommodations when needed for equal use and enjoyment of a dwelling.

Associations benefit from a standard process that explains what information they may request. For assistance animals, boards may ask if the animal is required because of a disability and what work or task it performs, but they may not demand details about the disability itself.

Florida law makes misrepresenting a pet as a service animal a criminal offense. Thoughtful questioning and documentation help boards honor legitimate requests while addressing possible misuse in a compliant way.

5. Improve Efficiency by Automating Screening Workflows

Digital screening tools help move applications from submission to decision more quickly and with fewer errors. Online forms, electronic signatures, and automated reminders replace manual data entry and paper tracking.

Automation can:

- Collect documents in a single, secure portal.

- Run standardized checks for income, credit, and criminal history.

- Notify applicants and managers when files move through each step.

Many associations see shorter processing times and lower administrative effort when they move away from paper-heavy processes and spreadsheets.

Explore Tenant Evaluation to see how automated workflows can support faster, more consistent decisions.

6. Use Detailed Records and Audit Trails to Reduce Risk

Accurate records give boards a strong defense if an applicant challenges a decision. Each file should clearly show the application, supporting documents, criteria applied, and the final outcome.

Consistent documentation demonstrates that the association applied the same standards to everyone. During a fair housing investigation, complete records can show that the decision was based on objective factors, not on a protected characteristic.

Digital screening systems help by time-stamping actions and storing decisions in one place. This approach reduces the chance of missing paperwork and gives current and future board members clear insight into past decisions.

7. Update Screening Policies Regularly to Stay Compliant

Screening policies that made sense in 2024 or 2025 may not reflect current laws or community expectations in 2026. Regular review helps keep your documents current and enforceable.

Boards should work with qualified legal counsel at least once a year to:

- Check alignment with federal, state, and local housing rules.

- Confirm that criteria still match the community’s risk tolerance and goals.

- Review screening fees, timelines, and appeal procedures.

Florida law allows tenant screening fees when governing documents authorize them. HOAs have no specific statutory cap but must keep fees reasonable, while condos follow separate application-fee rules. Periodic updates help keep fee structures compliant and transparent.

Common Questions About Community Association Screening

Primary risks for community associations in resident screening

The central risk involves Fair Housing Act violations, especially when policies have a greater impact on certain protected classes. Policies that rely on broad criminal history exclusions or rigid credit score cutoffs can create disparate impact on racial or national origin groups. Associations lower this risk by tying criteria to legitimate interests, writing them clearly, and applying them the same way to every applicant.

Use of criminal records when deciding on applicants in Florida

Community associations may consider criminal records, but they should avoid automatic denials for any conviction. A safer method is to define how specific types of convictions relate to community safety, review each case individually, and keep written notes on the reasoning. The Fair Housing Act allows denial when a person was convicted of illegal manufacture or distribution of controlled substances, while other offenses require more careful evaluation.

Screening fees and board member background checks in Florida

Florida associations may charge screening or application fees when their governing documents permit it. HOAs must keep fees reasonable, and condos may include screening in their application fees under state statute. Background checks for board candidates are not mandatory in all cases, but Florida law does bar certain felons from serving until civil rights have been restored for at least five years. Policies that address candidate screening should be drafted with legal guidance to avoid election disputes.

Conclusion: Strengthen Your Screening Process and Protect Your Community

Clear criteria, reliable background checks, strong data security, consistent accommodation practices, automation, thorough records, and regular policy reviews form a practical roadmap for better resident screening in 2026. Associations that follow these best practices are better prepared to support safety, reduce legal exposure, and manage applications efficiently.

Tenant Evaluation provides an automated, FCRA-aware platform that supports these goals for Florida HOAs and condominium associations. Get started with Tenant Evaluation to streamline applications, strengthen compliance, and give your board clearer insight into every approval decision.