Key Takeaways

- Florida HOAs must follow strict background check fee limits and documentation rules, so noncompliance can quickly become expensive.

- Manual, paper-heavy screening processes increase administrative workload, delay approvals, and reduce resident and realtor satisfaction.

- Generic background check tools may look affordable but can create hidden costs through extra manual work, compliance gaps, and limited transparency.

- Specialized HOA screening platforms help boards standardize decisions, automate workflows, and reduce risk while supporting fair, consistent approvals.

- Florida HOAs can use TenantEvaluation to centralize applications, automate compliance checks, and support boards through an HOA-focused screening platform, with an easy way to get started at Schedule a demo with TenantEvaluation.

The True Cost of HOA Background Checks: Why Florida HOAs Need More Than Just a Price List

Florida HOAs manage unique legal requirements and community expectations, so background checks affect more than simple screening costs. Process design, compliance controls, and transparency all influence the total cost of ownership.

Administrative burden is often the largest hidden expense. Manual applications require:

- Collecting and verifying documents from applicants, realtors, and owners

- Tracking incomplete files and chasing missing paperwork

- Coordinating communication between multiple parties for each application

Compliance risks create direct financial exposure. Florida condo associations must follow fee limits and documentation rules, and HOA boards must not exceed their authority. Florida condo associations face strict regulations that limit nonrefundable fees to 100 dollars per applicant, and HOAs must confirm that their governing documents authorize background check fees to reduce legal disputes and refund claims.

Lack of transparency slows decisions and increases frustration. When board members cannot easily see application status, supporting documents, and a clear approval history, they must rely on email threads and manual updates. This situation often delays move-ins and creates complaints from residents and agents. Schedule a demo to see how a centralized platform can improve visibility for your HOA.

Understanding Your Options: A Comparison of Background Check Solutions for Florida HOAs

Florida HOAs can choose from several types of background check solutions. Each option carries different levels of automation, compliance support, and board visibility.

Option 1: Generic Background Check Providers

Generic providers focus on basic screening for many industries and often list attractive base prices.

Pros include:

- Broad availability and simple pricing

- Basic criminal and credit checks

Cons include:

- Little or no support for Florida HOA fee rules or community-specific requirements

- Limited automation, which forces managers to handle data entry and follow-ups

- Gaps in board reporting, which makes it harder to support consistent, documented decisions

Option 2: Broader Property Management Software

Platforms such as AppFolio and RealPage often include background checks as part of a larger property management suite.

Pros include:

- Integration with accounting, communications, and other property management tools

- Some automation of applications and document collection

Cons include:

- Features that may be designed mainly for rentals, not association approvals

- Extra configuration to align with HOA rules and Florida-specific limits

- Higher overall software cost when many features are not used by the association

Option 3: Specialized HOA Screening Platforms such as TenantEvaluation

Specialized HOA platforms focus on resident screening and approvals for condominium and homeowner associations, with tools tailored to Florida communities.

Pros include:

- Support for Florida-specific compliance and community-level rules

- Online applications with built-in logic, redaction, and secure document handling

- Board dashboards that organize applications, voting, and audit history

- Integrated modules for identity, income, and background verification

- Revenue-sharing models that offset screening costs for the association

Cons include:

- Feature set that may exceed the needs of very small, self-managed HOAs with minimal activity

Why the Cheapest Background Check Can Cost Florida HOAs More in the Long Run

Low sticker prices do not reflect the full cost of a background check process. Florida HOAs need to account for legal risk, staff time, and community impact.

Legal and compliance penalties can be significant. Florida condo associations that exceed the 100 dollar nonrefundable fee limit face legal exposure for improper fees. Once challenged, these fees may be unenforceable and can result in refunds, attorney fees, and board turnover pressure.

Operational inefficiencies drive up real costs. Manual processing forces Community Association Managers to spend hours each week on intake, data validation, status updates, and scheduling board reviews. These tasks reduce the time available for maintenance, resident communication, and vendor management.

Increased risk and reputation damage affect long-term value. Comprehensive checks for residents and HOA board members help limit fraud, conflicts of interest, and safety issues. When screening is inconsistent or incomplete, even a single high-profile incident can lead to legal claims and loss of homeowner trust.

Missed revenue opportunities also matter. Structured application fees, when compliant with Florida limits and governing documents, can offset costs. Platforms that automate fee collection and share revenue with the association turn screening into a small income source instead of a pure expense.

TenantEvaluation: The Smart Choice for Florida HOA Background Checks

TenantEvaluation offers an all-in-one screening and onboarding platform built for condominium and homeowner associations in Florida. The system focuses on compliance, automation, and board decision support.

Key features and benefits include:

- Florida-specific compliance: Configuration for each community’s rules and document requirements, with support for state fee limits and approval procedures.

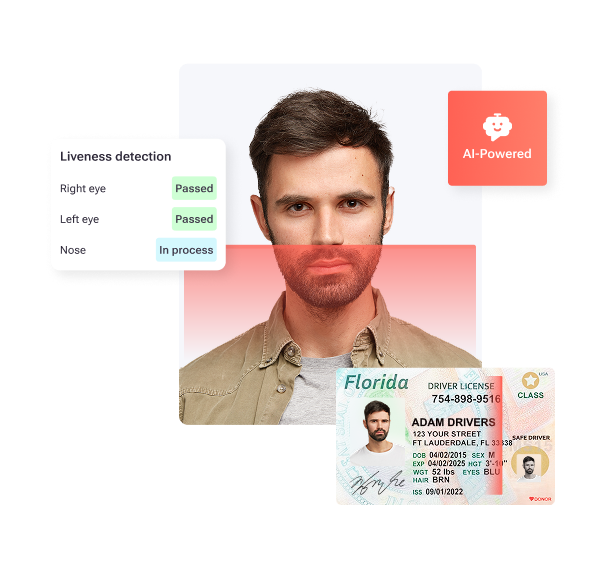

- Advanced automation: A fully online application process with guided questions, automatic redaction of sensitive details, and secure storage that meets PCI Level 1 standards with end-to-end encryption.

- Transparency and control for boards: A QuickApprove dashboard that shows real-time status, summarized reports, and structured voting with audit trails for each decision.

- Comprehensive resident screening: Integrated tools such as IDverify, IncomeEV, and SafeCheck Plus for identity checks, income verification, and criminal and credit screening.

- Revenue-sharing model: Automated fee collection, with an option for associations to receive a share of eligible fees while staying within regulatory limits.

- Applicant and realtor support: Multilingual help, AI chat in 11 languages, and automated notifications that keep all parties informed and reduce back-and-forth emails.

Schedule a demo to see how TenantEvaluation can support your board and management team.

HOA Background Check Service Comparison Table

|

Feature or Provider |

Generic Background Check |

Property Management Software |

TenantEvaluation |

|

Florida-specific compliance |

Limited and manual |

Partial support |

Comprehensive and automated |

|

Automation and manual effort |

Low automation, high manual work |

Moderate automation |

High automation, minimal manual work |

|

Board member dashboard |

No |

Limited integration |

Yes, with QuickApprove tools |

|

Comprehensive screening |

Varies by provider |

Basic to moderate depth |

Full suite for identity, income, and background checks |

Frequently Asked Questions (FAQ) About HOA Background Checks in Florida

Q: Can Florida HOAs charge any amount for background checks?

A: Florida law limits nonrefundable application and background check fees for most condo associations to 100 dollars per applicant per lease term. Additional fees for lease renewals with the same lessee are typically not permitted. HOAs must also confirm that their governing documents authorize these fees. Boards that exceed fee limits or charge fees without clear authority increase their legal and financial risk.

Q: What constitutes a comprehensive background check for an HOA in Florida?

A: A comprehensive background check usually includes criminal history searches, credit reports, employment or income verification, and identity confirmation. These elements give boards enough information to apply their criteria consistently.

Q: How does compliance affect the cost of background check services?

A: Noncompliance can lead to disputes, fines, and reputational harm that far exceed the price of a screening report. Platforms that integrate Florida fee limits, documentation rules, and audit-ready records help HOAs avoid those downstream costs.

Q: How can background check processes generate revenue for HOAs?

A: When allowed by governing documents and state law, HOAs can structure application fees so that part of the amount collected offsets administrative costs. Automated revenue-sharing arrangements simplify this process and reduce manual tracking.

Q: What are the hidden costs of manual background check processes?

A: Manual processes create costs through staff time, slower approvals, lost applications, and greater error risk. Once legal exposure and potential disputes are included, manual systems often cost more than automated platforms that look more expensive at first glance.

Make the Smart Choice for Your HOA’s Background Checks in Florida

Background check decisions affect compliance, workload, and community trust. Transparent fee structures and adherence to governing documents help maintain homeowner confidence and reduce legal exposure, as described in this overview of HOA fees, rules, and rights.

TenantEvaluation provides a focused option for Florida HOAs that want clear workflows, documented decisions, and reliable compliance support. The platform offers Florida-specific configuration, strong automation, tools for board transparency, and revenue-sharing options that can offset administration costs.