Key Takeaways

- Automated rental approval systems reduce manual work for Florida HOAs and speed up rental decisions.

- Built-in rules, records, and redaction help associations stay compliant and reduce legal and data security risk.

- Online workflows give boards, residents, and realtors clear visibility into every step of the rental application process.

- Digital payments and analytics help HOAs manage costs, generate revenue, and plan community improvements with better data.

- Florida communities can streamline rental approvals in 2026 with Tenant Evaluation; get started here.

Streamline Applications and Reduce Administrative Work for Florida HOAs

Florida HOAs handle complex rental applications that often require extra income, credit, pet, and documentation standards beyond typical landlord screening. Many communities add higher credit thresholds, stricter pet rules, and more paperwork and fees, which quickly multiplies admin work.

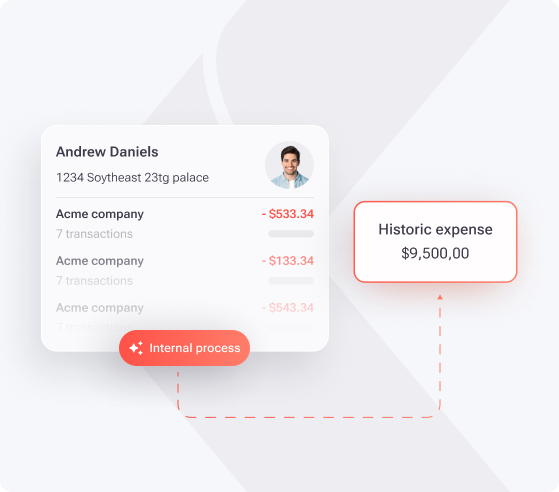

Automated rental approval platforms digitize the full workflow, from application to decision. The system collects documents, validates completeness, routes files for review, and tracks status in one place. A 2025 update to Florida Statute 83.683 emphasized prompt application processing, so faster workflows now help reduce both risk and friction.

An automated system can:

- Guide applicants through a structured online form that reduces incomplete files

- Trigger reminders when documents are missing or deadlines approach

- Standardize screening rules so staff do not recheck criteria on every file

One large Florida community freed about 50 staff hours per day and saved roughly $240,000 per year after automating approvals, with processing times cut by around half.

Strengthen Compliance and Reduce Legal Risk for Florida Associations

Florida HOAs operate under overlapping state and federal rules, including the Homeowners Association Act, Condominium Act, Fair Housing Act, and Fair Debt Collection Practices Act. Each framework adds obligations around fair treatment, notices, and documentation. Manual processes make consistent enforcement hard and can open the door to complaints.

Automated platforms embed compliance into the workflow. These systems can:

- Apply the same screening criteria to every applicant

- Log each action taken on a file with time stamps

- Store decisions and supporting documents in a secure audit trail

Florida landlords have been reminded that screening rules must apply consistently and cannot discriminate based on protected characteristics. Automated, rule-based decisions support that standard and reduce the chance of inconsistent treatment that could appear biased.

Give Florida HOA Boards Clear Visibility into Every Application

Board members need quick access to the right information so they can review applications without digging through email threads or paper stacks. Delays in receiving and analyzing information can slow decisions and frustrate residents.

Automated rental approval systems typically provide board dashboards with:

- Real-time status for every application

- Condensed reports that highlight key risk and eligibility factors

- Built-in voting tools that record each director’s decision

This central, digital process shortens review cycles and reduces confusion. Boards gain a documented trail of how and when each decision was made, which supports better governance and clearer communication with owners and residents.

Speed Up Rental Approvals for Florida Residents and Realtors

Slow approvals disrupt move-in timelines, leasing dates, and commission schedules. Florida law highlights timely handling of landlord and tenant obligations, so long waits can also raise compliance concerns.

Automated systems shorten timelines by:

- Offering a mobile-friendly, fully online application

- Checking for completeness before submission

- Sending automatic status updates to applicants and agents

Many communities see approval times drop by as much as 70 percent once they move away from paper files and manual email reviews. Faster decisions improve resident satisfaction, help owners fill vacancies sooner, and support realtors who depend on predictable closing dates. Schedule a demo today to see how an automated workflow can shorten your approval queue.

Protect Applicant Data and Association Reputation

Florida HOAs handle sensitive data, including Social Security numbers, bank statements, and employment records. Storing that information in email, shared drives, or paper files increases exposure to data leaks and identity theft concerns.

Modern automated platforms add multiple layers of protection. Strong systems include PCI Level 1 compliant payment processing, end-to-end encryption for data in transit and at rest, and automatic redaction of sensitive details from shared documents.

These controls limit who can view personal information and reduce the chance that a mishandled file leads to a breach. Applicants gain confidence that the association treats privacy seriously, and boards reduce both regulatory and reputational risk.

Create New Revenue Opportunities for Florida HOAs

Application review often feels like a cost center for associations, especially when staff hours and paper processes add up. Florida law allows reasonable, clearly disclosed application fees to cover screening costs, which opens the door to a more sustainable model.

Automated rental approval platforms support:

- Online collection of application, move-in, and background check fees

- Transparent fee disclosures and receipts for applicants

- Optional revenue-sharing programs that return a portion of fees to the association

Tenant Evaluation has already helped communities generate about $150 million in screening-related revenue, giving boards more flexibility to fund amenities, offset rising expenses, or stabilize assessments.

Use Community Analytics to Guide Smarter Decisions

Board members make better decisions when they understand who lives in the community and how it is changing over time. Manual tracking rarely captures that level of insight.

Automated systems collect structured data during the application process and can report on:

- Median rent and purchase prices

- Common income ranges and employment types

- Pet ownership and service animal trends

- Electric vehicle usage and charging needs

These insights help boards align policies and investments with real resident needs, from pet amenities to EV charging to communication preferences. Schedule a demo today to explore how analytics can support your long-term planning.

Frequently Asked Questions (FAQ) About Automated Rental Approvals for Florida HOAs

Can automated rental approval systems integrate with our current property management software?

Many platforms connect with popular property management systems so resident data can sync between tools. This reduces duplicate data entry, lowers error rates, and keeps owner, resident, and lease information aligned across accounting and operations.

How do automated systems handle screening rules that are unique to our HOA?

Configurable platforms let associations build their own rules into the workflow, including credit score minimums, income-to-rent ratios, pet policies, and lease term requirements. The system then applies those rules the same way to every applicant, while still honoring Florida-specific regulations and each community’s governing documents.

What support do applicants and HOA staff receive when using these systems?

Robust solutions usually provide several support channels, such as AI chat in multiple languages, phone support during extended hours, and online help centers with step-by-step guides. This support structure reduces confusion and keeps association staff from fielding the same questions over and over.

How do automated systems help HOAs stay aligned with Florida fair housing laws?

Automation enforces consistent criteria and records each decision, which helps prevent different treatment of similar applicants. Detailed logs of who reviewed a file, when they acted, and why a decision was made create a clear record that supports compliance with federal and Florida fair housing standards.

What kind of return on investment can a Florida HOA expect?

Communities often see savings from fewer staff hours spent on paperwork, faster approvals that reduce vacancy risk, and more accurate fee collection. When revenue-sharing models are available, rental approvals can shift from a cost to a modest income source that grows with application volume.

Conclusion: Simplify Florida HOA Rental Approvals in 2026

Florida HOA rental approvals have grown more complex as regulations tighten and resident expectations rise. Automated systems give boards and managers a practical way to reduce manual work, improve compliance, increase transparency, strengthen data security, and capture meaningful analytics and revenue.

Associations that modernize their rental workflows in 2026 can offer a smoother experience to residents and realtors while protecting the community’s long-term interests. Schedule a demo today to see how Tenant Evaluation can support your board and management team.