Key Takeaways

- Manual background checks consume staff time, slow approvals, and increase risk for HOAs and condominium associations.

- Automated applicant screening centralizes applications, documents, and background checks in a single secure workflow with faster turnaround.

- Built-in compliance tools support FCRA, fair housing rules, and Florida-specific requirements while maintaining detailed audit trails.

- Board dashboards, clear summaries, and structured voting tools improve transparency and speed up decisions that protect community revenue.

- Tenant Evaluation provides an automated screening platform tailored to community associations, and boards can schedule a demo to see it in action.

Manual Background Checks Create Risk And Delay For HOAs

Community association managers and HOA board members often rely on manual screening workflows that require extensive document collection, ID checks, employment verification, and detailed background research. Busy management companies can spend dozens of staff hours each day on applicant review, data entry, and follow-up.

Every missing document, unclear application, or incomplete form adds more time. Staff members chase pay stubs, call employers, and search for criminal, eviction, and credit information across multiple systems. Sensitive personal information moves through long email chains and paper files, which creates data security and privacy concerns.

Compliance adds more pressure. FCRA rules, fair housing laws, and Florida-specific regulations require consistent handling of background data and clear records of decisions. Manual processes often lack standardized audit trails, which can expose associations to legal disputes, regulatory findings, and reputational risk. Approvals sit in inboxes, decisions drag on for weeks, and delayed move-ins slow assessment revenue.

Associations that want to remove this manual bottleneck can book a Tenant Evaluation demo and review automated screening options.

Automated Applicant Screening Simplifies HOA Background Checks

Automated applicant screening replaces scattered manual tasks with a structured digital process. Applicants submit everything through an online portal, and the platform runs credit checks, criminal searches, eviction history, and employment verification in a unified workflow.

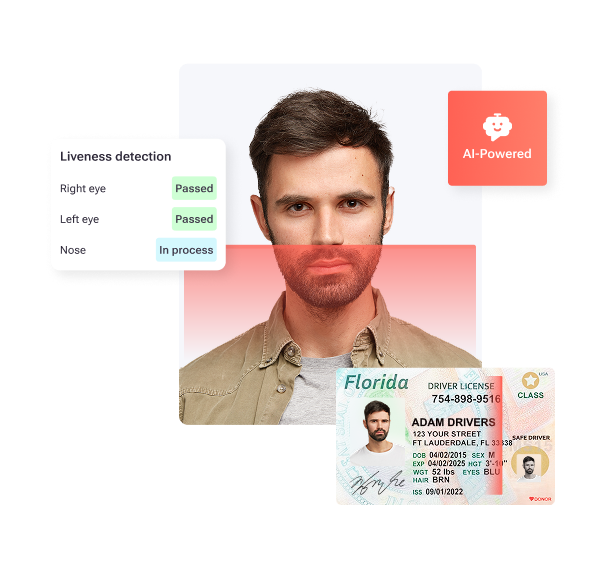

AI-powered screening can analyze credit, rental history, criminal records, and other data in real time, which shortens review cycles while preserving thorough due diligence.

Modern platforms enhance compliance by embedding FCRA rules, standardizing communications, redacting sensitive information automatically, and logging every action for audit. Encryption and PCI Level 1 controls protect payment and identity data, which reduces exposure for HOAs and condominium associations. Managers spend less time on repetitive checks and more time on resident service and strategic work.

Key Features HOAs Should Expect In An Automated Background Check Solution

Comprehensive Background Checks For A Complete Applicant View

Strong screening systems pull multiple data sources into one clear report. AI tools can automate credit checks, criminal records, rental history, and income validation so associations receive a consistent applicant profile with fewer manual steps.

Tenant Evaluation SafeCheck+ gives communities access to nationwide and global criminal checks, including federal databases and offenses registries. Income reports validate employment rather than relying only on self-reported information. Eviction searches and prior landlord references help boards judge payment reliability and behavior history before approving a new resident.

Compliance And Data Security Built Into The Process

Automated screening tools reinforce compliance with FCRA and fair housing by applying the same criteria to every applicant and generating standardized disclosures and adverse action notices. Tenant Evaluation uses automatic redaction of personally identifiable information, secure storage, and strict access controls so only authorized users see sensitive details.

Consistent, rules-based evaluations reduce subjective judgments and promote fair housing compliance. End-to-end encryption and PCI Level 1 certification further limit the risk of data exposure or unauthorized access.

Streamlined Document Collection And ID Verification

Intelligent application forms adjust questions based on applicant type, co-applicants, and each community’s rules. This logic helps applicants submit complete packages the first time, which reduces back-and-forth emails and phone calls.

Tenant Evaluation IDVerify automatically validates government-issued IDs and flags issues for review. Smart checks confirm that leases and association documents are signed and that all required forms are in place before a file reaches the board. Around-the-clock multilingual support guides applicants through the process and keeps timelines on track.

Transparent Board Dashboards And Structured Voting

Board members gain a single view of pending applications, background summaries, and key risk indicators. Tenant Evaluation QuickApprove presents AI-generated summaries with the underlying reports so directors can focus on what matters most.

Board members review, comment, and vote inside the platform instead of working through long email threads. The system keeps complete audit logs of who reviewed what and when, which supports association records and clarifies the basis for each decision.

Boards that want a closer look at these dashboards can request a Tenant Evaluation demo for their association.

Automated Screening Gives HOAs A Clear Edge Over Manual Processes

|

Feature/Attribute |

Manual Background Check Process |

Automated Background Check Process |

|

Processing Time |

7-14 days for complete screening |

About 24-48 hours with real-time updates |

|

Accuracy |

Higher risk of human error and oversight |

Consistent, rules-based data analysis |

|

Compliance Risk |

Greater chance of missed FCRA steps |

Built-in compliance workflows and logs |

|

Data Security |

Email chains and paper file exposure |

Encrypted storage with PCI-compliant payments |

|

Board Oversight |

Limited visibility and slow email approvals |

Real-time dashboards with voting panels |

|

Staff Time Required |

Dozens of staff hours each day |

Minimal manual intervention |

Answers To Common HOA Screening Questions

How do automated screening systems support fair housing compliance?

Automated platforms rely on standardized, objective criteria such as income ratios, credit scores, and clearly defined background thresholds. The system applies these rules the same way for every applicant, which reduces inconsistent judgments. Documented workflows and stored decisions help associations demonstrate that approvals and denials follow neutral standards that align with federal and state fair housing laws.

Can automated background checks connect to existing HOA management software?

Most current screening tools use cloud-based APIs that exchange data with association management platforms. Once integrated, approved applicant records flow directly into the main HOA database, which limits duplicate data entry and keeps resident information synchronized across accounting, access control, and communication systems.

How do automated platforms handle Florida-specific background check rules?

Vendors can configure screening criteria, notices, and workflows to match Florida requirements on disclosures, background limits, and association documents. The platform updates these rules as laws change so managers do not have to track every policy adjustment manually. Generated reports and logs provide evidence that the association followed state guidelines if a complaint or audit arises.

What support do managers and applicants receive during screening?

Robust systems combine help center content with live support. Managers typically receive onboarding, training, and technical assistance for configuration and daily use. Applicants benefit from guided forms, status updates, and access to phone or chat support so they can complete applications correctly and on time.

How is sensitive personal information protected in automated checks?

Leading providers encrypt data in transit and at rest, limit access through role-based permissions, and remove sensitive identifiers from stored documents. Many platforms follow PCI Level 1 standards for payment information and maintain detailed access logs. These safeguards reduce the risk of unauthorized use of Social Security numbers, financial records, and other personal data.

Conclusion: Prepare Your Community For Secure, Efficient Screening In 2026

Manual screening and paper-heavy background checks no longer meet the needs of modern HOAs and condominium associations. The workload strains staff, slows move-ins, and creates compliance and data security exposure that boards cannot ignore.

Automated applicant screening with integrated background checks now serves as a practical requirement for efficient, compliant community operations. Online tools that automate credit, rental history, and criminal checks reduce processing time and improve applicant quality, while also cutting administrative cost and risk.

Boards that adopt a structured, automated approach gain clearer visibility into each decision, better records for regulators, and a smoother experience for incoming residents. Associations that want to upgrade their screening process can schedule a Tenant Evaluation demo and see how a modern platform supports compliance, protects data, and accelerates approvals.