Key Takeaways

- Condo and HOA boards in 2026 face stricter compliance expectations, higher application volumes, and stronger pressure to process approvals quickly and fairly.

- Specialized tenant evaluation tools support consistent decisions, reduce manual work, and help boards follow laws such as the Fair Credit Reporting Act (FCRA) and Florida regulations.

- Key evaluation criteria include compliance, automation, security, board transparency, support quality, and the impact on association revenue.

- TenantEvaluation focuses on Florida condo and HOA communities with online applications, configurable rules, board voting tools, and a revenue-sharing model.

- Boards that want faster, more compliant screening can explore TenantEvaluation by using this CTA: Get started with TenantEvaluation.

Why Condo Boards Benefit From Specialized Tenant Evaluation Tools

Condo and HOA boards manage more than simple tenant checks. They must follow federal rules like the Fair Credit Reporting Act (FCRA), align with Florida statutes, and honor their own governing documents. Manual or fragmented processes make those duties harder and increase the risk of delays or mistakes.

Specialized tenant evaluation tools for condo boards centralize applications, standardize criteria, and create a clear record of each decision. This approach improves fairness, reduces administrative load, and gives boards, managers, and applicants a shared view of status and requirements.

How To Evaluate Tenant Screening Tools for Condo and HOA Boards

Boards and community association managers can compare tools by focusing on factors that directly affect risk, workload, and resident experience.

Compliance and Condo-Specific Features

Effective platforms support FCRA-compliant background checks and community-specific rules. Florida communities benefit from tools that capture association documents, pet rules, move-in policies, and other provisions inside the same workflow.

Automation and Administrative Efficiency

Efficient tools reduce follow-up calls, email chains, and paper handling. Look for:

- Online applications and e-signatures

- Automated document collection and reminders

- Integrated background and credit checks

- Automatic routing to the right decision-makers

Board Transparency and Engagement

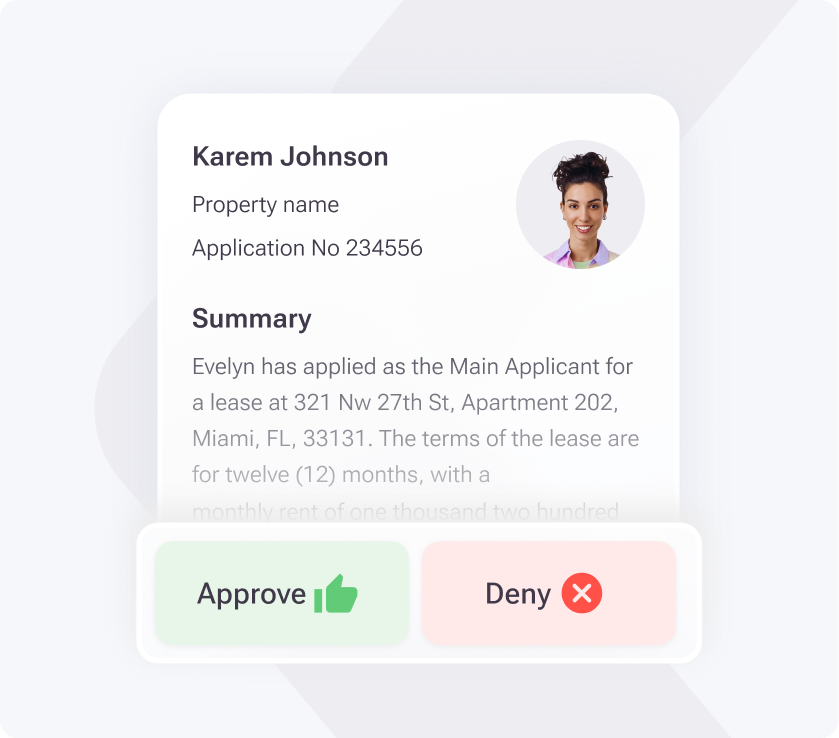

Board members need clear, concise information at the moment of decision. Dashboards such as TenantEvaluation QuickApprove allow boards to review summaries, see supporting documents, record votes, and preserve a complete audit trail.

Security and Data Privacy

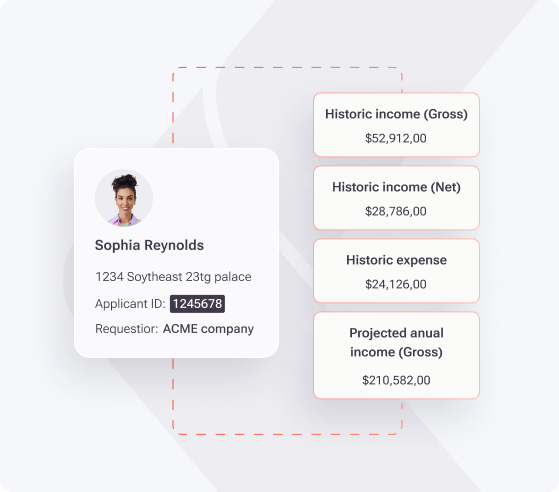

Screening tools handle sensitive personal and financial data. Strong platforms use safeguards such as PCI Level 1 controls, encryption in transit and at rest, and automatic redaction of items like Social Security numbers.

Integration and Support

Tools that connect with existing association or property management systems reduce duplicate data entry. Reliable support, including multilingual phone and chat assistance, helps both applicants and staff resolve issues quickly.

ROI and Revenue Impact

Boards can evaluate tools by estimating time saved, reduction in errors, and potential new income. Some providers support revenue-sharing models that let associations earn a portion of each application fee while avoiding setup costs.

TenantEvaluation: A Florida-Focused Platform for Condo and HOA Boards

TenantEvaluation provides a screening and onboarding platform designed for Florida condominium and homeowner associations. The company, founded in 2007 by property managers, board members, and software engineers, has processed more than 100,000 applications per year and generated over $150 million in revenue for communities.

Online Applications and Background Checks

Applicants complete everything online through desktop or mobile, including e-signatures, document uploads, and ID verification through IDVerify. Background checks run through SafeCheck+ so boards receive consistent, FCRA-compliant reports.

Florida Rules and Custom Community Setup

Each community’s criteria, timelines, and documents are configured inside the platform. This setup aligns screening with Florida laws and the association’s governing documents without requiring custom spreadsheets or manual checklists.

Intelligent Forms and Fewer Errors

Forms adjust to applicant type and community rules, so renters, purchasers, and occupants see only the fields they need. This approach reduces confusion, incomplete files, and back-and-forth with applicants.

Security, Redaction, and Audit Trails

TenantEvaluation applies PCI Level 1 data protections, encryption, and automatic redaction of sensitive data. Every action during the review and voting process is logged for future reference.

Board Voting Dashboard

The QuickApprove dashboard gives board members application summaries, supporting documents, and a simple way to cast approvals or denials. This structure supports consistent decisions and reduces the risk of informal or undocumented approvals.

Multilingual Support and Revenue Sharing

Applicants and staff can access phone and AI chat support in multiple languages at any time. The revenue-sharing model allows associations to offset administrative costs and turn screening into a predictable income stream.

Schedule a demo to see TenantEvaluation in action.

Comparing TenantEvaluation With Other Screening Options

Boards often compare specialized platforms with generic background services or fully manual workflows. The table below outlines core differences that affect risk, workload, and transparency.

|

Feature or Solution |

TenantEvaluation |

Generic Background Services |

Manual Processes |

|

Target Audience |

Florida condo and HOA boards, CAMs |

General landlord and rental screening |

Any community using forms, email, and paper |

|

Compliance Focus |

Built for Florida HOA and condo rules with configurable criteria |

FCRA-focused, limited HOA-specific tools |

High risk of inconsistent or non-compliant handling |

|

Application Automation |

Online portal, intelligent forms, and auto-redaction |

Basic online intake plus reports |

Paper or PDF forms, manual follow-up |

|

Board Transparency |

QuickApprove dashboard for review and voting |

Little or no board-facing interface |

Decisions tracked by email, text, or spreadsheets |

Matching Tenant Evaluation Tools to Common Community Scenarios

Smaller, Self-Managed Associations

Volunteer-led boards benefit from tools that require little setup and minimal training. TenantEvaluation’s online applications and automated workflows reduce the time board members spend collecting forms, chasing documents, and organizing votes.

Larger Associations and Management Companies

High-volume environments need scale, consistency, and clear reporting. TenantEvaluation supports these needs through configurable rules, standardized reporting, and integrations that serve professional managers and partners such as RealManage and Castle Group.

Communities With Elevated Compliance or Risk Concerns

Communities that receive legal scrutiny or handle frequent sales and rentals gain value from specialized Florida compliance, FCRA-aligned checks, and audit trails. TenantEvaluation helps document each step in the review and decision process.

Request a tailored walkthrough for your board.

Decision Checklist for Condo and HOA Boards

Boards can use this checklist when comparing tenant evaluation tools:

- Confirm that the platform supports FCRA requirements and your state and local regulations.

- Estimate how many staff or volunteer hours per week the tool can save.

- Verify that board members get clear dashboards, summaries, and voting tools.

- Review security measures, including encryption, redaction, and payment protections.

- Assess pricing and any revenue-sharing structure against your budget and goals.

Frequently Asked Questions About Tenant Evaluation Tools for Condo Boards

How does the Fair Credit Reporting Act (FCRA) affect HOA and condo screening?

The Fair Credit Reporting Act regulates how consumer credit and background information is collected, shared, and used. HOAs and condo boards that use background reports must obtain consent, handle data securely, and follow specific steps when issuing adverse action notices if an application is denied or conditioned on the report.

How do specialized HOA and condo tools differ from generic background services?

Specialized tools such as TenantEvaluation include configurable community rules, Florida-focused compliance settings, and built-in board workflows. Generic services usually focus on delivering reports to landlords and may not support board voting, audit trails, or association-specific requirements.

How can boards evaluate the return on investment of a tenant screening platform?

Boards can compare the cost of the tool with time saved on processing, the reduction in errors or disputes, and any additional revenue. TenantEvaluation also offers a revenue-sharing model that allows a portion of each application fee to flow back to the association.

Conclusion: Selecting the Right Tenant Evaluation Tool for 2026

Condo and HOA boards in 2026 operate under tighter timelines, higher expectations, and more complex regulations than in 2025 or 2024. The right tenant evaluation platform improves compliance, organizes board decisions, and reduces the manual work involved in each application.

TenantEvaluation offers a Florida-focused option that combines online applications, automated workflows, board dashboards, and revenue-sharing for associations that want a structured, defensible process. Boards that want to modernize screening and onboarding can take the next step by exploring the platform directly.

Get started with TenantEvaluation and streamline your community’s applicant review process.