Key Takeaways

- Florida condos and HOAs face complex regulations, high application volume, and diverse resident populations that strain manual, paper-based processes.

- Property management automation platforms centralize applications, screening, documents, payments, and communication to reduce delays, errors, and administrative workload.

- Florida-focused automation supports compliance with state community association laws, handles international applicants, and provides multilingual tools for diverse communities.

- Well-planned adoption helps boards cut labor and printing costs, improve cash flow, reduce risk, and make better decisions with data and audit trails.

- Tenant Evaluation offers a Florida-specific automation platform for condos and HOAs; schedule a demo to explore potential ROI for your association.

Understanding the Core: What is a Property Management Automation Platform?

Strategic Context: The Evolution of Property Management

Florida condominium and HOA associations are shifting from paper files and manual checklists to integrated digital platforms. This change responds to growing regulatory requirements, higher resident expectations, and a need for clear records and transparency. Manual processes often create delays, increase the chance of errors, and add liability for boards and managers. Automation supports long-term stability by standardizing workflows, centralizing information, and making financial and compliance oversight easier.

Defining Modern Property Management Automation

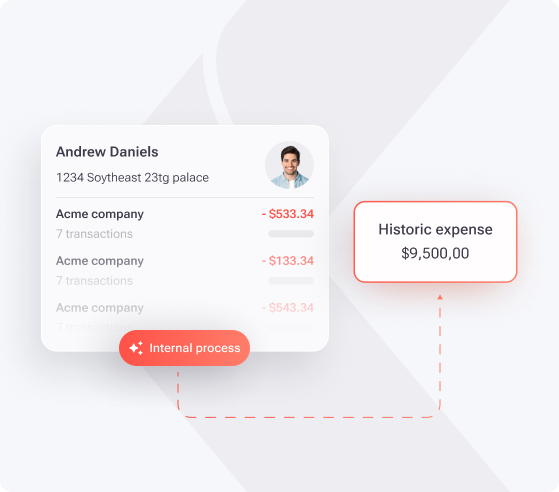

A property management automation platform is a digital system built to manage resident screening, onboarding, and ongoing community operations in one place. These platforms connect application intake, background checks, document collection, approvals, payments, and communications in a single environment. For HOAs and condominiums, this replaces scattered email chains and paper folders with structured online workflows. Boards gain faster decisions, clearer documentation, and better compliance, while staff spend less time on repetitive tasks and more time on resident service.

Schedule a demo today to see how Tenant Evaluation can organize applications, support compliance, and simplify workflows for your condominium or HOA.

The Florida Landscape: Driving the Need for Automation in Condos and HOAs

Florida’s Unique Challenges for Community Associations

Florida community associations must navigate state-specific statutes, evolving legislative changes, and detailed record-keeping rules. Rapid population growth, especially in South Florida, increases application volume and turnover. Many communities also serve international buyers, tenants, and seasonal residents who bring varied identification and documentation. These conditions place pressure on boards and managers who rely on manual tracking, spreadsheets, or email-based processes.

How Automation Addresses Florida-Specific Needs

Property management automation platforms support Florida associations with workflows designed around state laws and local practices. Systems can embed Florida community association requirements into approval steps, store documents securely, and track every action with time-stamped logs. Automation also supports higher application volume through online portals, real-time status updates, and multilingual interfaces. These capabilities help boards reduce compliance risk, respond more quickly to applicants, and maintain a consistent experience for residents and managers.

Measuring the Returns: Concrete ROI Metrics from Automation

Reduced Operational Costs

Automation can cut labor costs by up to 50% by reducing data entry, scanning, filing, and manual follow-ups. Staff no longer spend as much time chasing missing documents or updating spreadsheets. Digital workflows also reduce printing, mailing, and storage expenses, since most records remain in an online repository that is searchable and secure.

Increased Revenue and Cash Flow

Automation platforms support revenue generation through consistent application fee collection and faster payment processing. Instant fund deposits improve cash flow for HOAs by replacing mailed checks and manual bank runs with online payments. Digital systems can also reduce failed or late payments and provide clear records for audits. Some specialized platforms, including Tenant Evaluation, offer revenue-sharing options that convert the screening and onboarding process into an additional income source for associations.

Enhanced Efficiency and Productivity

Automated workflows speed up tasks such as processing applications, routing maintenance requests, and preparing budgets. AI tools can cut budget preparation time from weeks to minutes, which frees managers and board members to focus on planning instead of manual calculations. Automated systems also lower administrative and labor costs by reducing manual workloads. The result is faster turnaround for residents and less backlog for management teams.

Improved Compliance and Risk Mitigation

Automation improves compliance by reducing human error in routine regulatory tasks and standardizing workflows. Platforms can require specific steps before approvals, log every decision, and store documents in formats that support audits or legal reviews. Security features such as encryption, role-based access, and automatic redaction reduce exposure of sensitive data. Systems designed for background screening also support FCRA requirements, which helps associations manage risk when evaluating applicants.

The Tenant Evaluation Impact

Tenant Evaluation focuses on Florida HOAs and condominiums with tools tailored to their screening and approval needs. The platform combines online applications, identity verification, background checks, and payment collection in one system. Boards gain a clear dashboard for tracking files and decisions, while staff see reductions in processing time and manual follow-ups. Many communities report lower administrative costs, stronger compliance controls, and higher satisfaction from applicants who can complete steps online.

Comparison Table: Manual vs. Automated Property Management

|

Feature |

Manual Process |

Automated Platform |

ROI Impact |

|

Application Processing |

Paper forms, physical signatures, manual checks |

Online forms, e-signatures, instant status updates |

70% time reduction |

|

Document Collection |

Physical copies, unorganized storage |

Digital uploads, secure central repository |

50% cost savings |

|

Background Checks |

Outsourced, time-consuming |

Integrated, real-time, FCRA-compliant |

Enhanced compliance |

|

Fee Collection |

Checks, manual tracking |

Online payments, automated reconciliation |

Improved cash flow |

Navigating the Hurdles: Common Challenges in Adopting Automation

Common Challenges and Pitfalls

Board members and staff sometimes hesitate to adopt automation because they worry about cost, complexity, or disruptions during setup. Some communities focus only on subscription fees and overlook long-term savings in labor and printing. Others have concerns about data security, training needs, or integrating new systems with existing accounting or access-control tools. These concerns can slow decision-making and delay upgrades that would reduce daily workload.

Overcoming Resistance and Ensuring Successful Implementation

Boards that succeed with automation usually start with a clear business case that links platform features to specific savings and risk reductions. Management teams can model labor hours saved, reduced printing, and improved fee collection. Phased rollouts and pilot buildings limit disruption while staff gain confidence. One Florida management company documented annual savings of about $240,000 after moving screening and approvals to Tenant Evaluation, which helped build support among board members. Training, clear written procedures, and responsive vendor support keep adoption on track.

Best Practices for Maximizing Your Automation Investment

Strategic Implementation and Usage

To maximize automation ROI, boards should choose platforms built for HOA and condo workflows instead of generic tools. Strong implementations align digital workflows with existing policies, then refine those policies using data from the platform. Staff need clear roles, permissions, and training so that everyone follows the same process. Data from automated systems can reveal trends in applications, amenities, and resident engagement, which supports better planning and communication.

Embracing Emerging Technologies for Future ROI

Associations looking ahead are adding advanced features on top of core automation. Predictive maintenance tools using AI can forecast equipment issues and lower emergency repair costs. Smart sensors tied to AI monitoring provide continuous insight into building systems and infrastructure. These technologies support proactive planning, more stable budgets, and clearer communication with residents about how the association maintains common areas.

Frequently Asked Questions (FAQ) about Property Management Automation ROI

Q1: How quickly can a Florida HOA or condo association expect to see ROI from an automation platform?

Most associations begin to see operational improvements within the first month, especially in application processing and communication. Financial ROI usually becomes clear within six to twelve months as labor hours decrease, printing and mailing costs drop, and fee collection becomes more reliable. Some Florida management companies report processing time reductions of around 50 percent and annual savings in the six-figure range after adopting automation.

Q2: Beyond cost savings, what other significant benefits contribute to overall ROI for Florida HOAs?

Automation supports regulatory compliance, clearer communication, and better resident experiences. Residents can submit applications, payments, and requests online at any time, while boards have real-time visibility into status and history. Transparent tracking of maintenance, violations, and payments reduces disputes and helps maintain community reputation and property values. These outcomes support long-term financial health even though they do not appear only as line-item savings.

Q3: How does automation help with compliance and risk mitigation in Florida’s regulated HOA environment?

Automation platforms can build Florida-specific requirements into checklists, forms, and approval paths, which reduces the risk of skipped steps or missing documents. Features such as automatic redaction, PCI-compliant payment processing, and FCRA-aligned background checks protect sensitive data. Detailed audit trails create a clear record of who did what and when, which is valuable in responding to regulatory reviews, insurance questions, or legal inquiries.

Conclusion: The Strategic Imperative of Automation for Florida HOAs

Property management automation platforms have become essential tools for Florida condominium and HOA associations that want sustainable operations in 2026. These systems reduce manual workload, support compliance, improve cash flow, and provide better experiences for residents and applicants. Associations that invest in automation position themselves to handle higher volumes, tighter regulations, and changing expectations with less strain on volunteers and staff.

Associations ready to improve ROI and streamline their management processes can take the next step now. Schedule a demo today to see how Tenant Evaluation can support applications, compliance, and revenue for your Florida condominium or HOA.