Key Takeaways

- Price alone rarely reflects the true cost of an HOA management system for Florida communities, especially once compliance, staffing, and payment fees are included.

- Florida-specific features, such as tools aligned with state condo and HOA laws and secure handling of resident data, help reduce legal and financial risk.

- Modern resident screening and onboarding tools shorten approval times, reduce manual work, and improve the experience for applicants, realtors, and Board members.

- Revenue-sharing models and automation can offset subscription costs, and in some cases, help HOAs generate net income from the application process.

- Tenant Evaluation offers Florida-focused screening, automation, and Board tools; to compare options directly, schedule a demo with Tenant Evaluation and review pricing for your community.

The True Cost of HOA Management Software in Florida: Why Price Tags Deceive

Focusing only on upfront subscription fees often leads to higher long-term costs for Florida HOAs. Systems that appear inexpensive at first may lack tools for Florida compliance, automated document handling, or resident screening, which shifts work back to staff and increases risk.

Florida has distinctive condominium and homeowner association regulations. Generic property management platforms often do not address details such as statutory timelines, record requirements, or association document nuances. When software does not include PCI Level 1 compliance, automatic redaction of sensitive information, and FCRA-compliant background checks, associations face added exposure to fines, disputes, and data issues.

Manual applications and paper-based review also create significant opportunity costs. Communities that rely on email, spreadsheets, and manual checks give up the efficiency that automated workflows provide. A specialized system can reduce application cycles by up to 70 percent and free dozens of staff hours each day for owner relations, maintenance planning, and financial oversight.

Schedule a demo today to see how Tenant Evaluation can streamline applications, support Florida compliance, and help stabilize operating costs for your association.

Understanding HOA Management System Pricing Models in 2026: What to Expect

Common Pricing Structures

Per-unit pricing: The range typically spans $1–$5 per unit per month, often found for larger HOAs. More specifically, per-unit pricing models typically charge $1.49–$6.50 per unit with minimum monthly fees ranging from $280–$375. This structure fits communities with 200 or more units and management firms serving multiple properties.

Flat-tier pricing: Monthly costs range from $29–$200+ monthly, ideal for smaller HOAs under 100 units. Entry-level HOA management software ranges from $45–$75 per month for smaller communities or basic plans. This model keeps costs predictable and usually includes access for multiple administrators.

Enterprise or custom pricing: Larger portfolios and feature-rich platforms often require custom quotes. Enterprise solutions often cost $500–$2000+ monthly for 200+ units, while advanced platforms serving larger associations range from $150–$4,500+ per month depending on unit count and feature set.

Hidden Costs and Overlooked Expenses

Transaction fees of 2–3 percent for card payments represent a common industry standard. Associations should also factor in setup fees, training, add-on modules, data migration, and integration work. Additional costs include online payment processing fees that should be factored into the total budget.

Cloud-based solutions use subscription models with no infrastructure costs, while on-premise solutions require one-time license fees plus annual maintenance for on-premise systems. Cloud platforms usually deliver ongoing security updates and easier scalability, while on-premise systems may demand more internal IT support and hardware spending.

Key Features Beyond Cost: Evaluating HOA Management Systems for Florida’s Needs

Streamlined Resident Screening and Onboarding

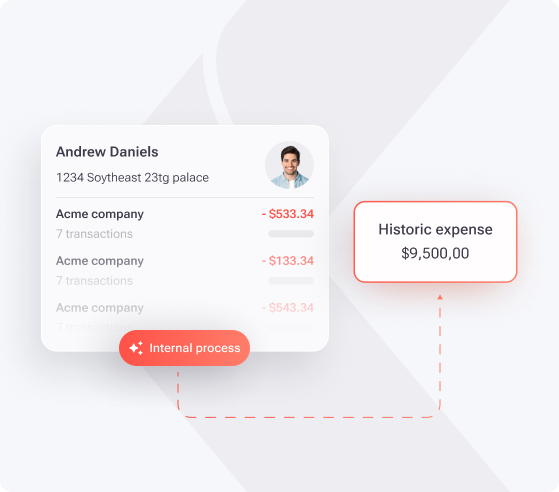

Modern HOAs benefit from 100 percent online applications, conditional questions, and automated document checks. Effective systems verify IDs, income, and background information while adjusting forms to each applicant’s responses. Tenant Evaluation supports resident screening with ID verification through IDverify, income checks via IncomeEV, background screening with SafeCheck+, and reference verification, which can shorten application cycles by up to 70 percent.

Florida-Specific Compliance and Risk Management

Florida communities benefit from software that aligns with state regulations and handles sensitive data securely. Examples include PCI Level 1 compliance, automatic redaction of personal identifiable information, and FCRA-compliant background checks through services such as SafeCheck+. These tools support consistent processes and help reduce the likelihood of disputes, fines, or breaches.

Enhanced Experience for Applicants, Realtors, and Boards

Clear workflows and simple interfaces improve the process for every stakeholder. Applicants and realtors value straightforward online forms and real-time status updates. Board members benefit from dedicated dashboards such as QuickApprove, which present consolidated reports, application queues, and structured voting panels for faster, documented decisions.

Revenue Generation and Cost Offset Opportunities

Some platforms allow HOAs to recover costs or create modest income through application fees and revenue sharing. Tenant Evaluation deducts its service fee from collected application fees and rebates the remaining portion back to the association. This approach can offset software expenses or contribute to reserves.

Scalability, Configuration, and Support

HOAs need systems that can match governing documents, approval rules, and growth over time. Flexible configuration and reliable support help associations adjust as policies or state rules change. Tenant Evaluation offers 24/7 multilingual AI chat in 11 languages, which supports the diverse resident base common in many Florida communities.

Comparison: Tenant Evaluation vs. Other Leading HOA Management Systems for Florida

Tenant Evaluation focuses on application processing and compliance for Florida condos and HOAs. Broad-based property management platforms cover more asset types but may offer fewer Florida-specific safeguards and workflows.

|

Feature Category |

Tenant Evaluation |

Competitor A (Buildium/Vantaca) |

Competitor B (AppFolio/RealPage) |

|

Targeted Focus |

Florida condos and HOAs |

Broad HOA management |

General property management |

|

Resident Screening |

ID, income, background, and references in one flow |

Basic integrations, often third party |

Integrated screening with less Florida customization |

|

Application Automation |

Fully online workflows, conditional forms, auto review, up to 70 percent time reduction |

Partial automation with generic templates |

Some automation with limited tailoring |

|

Florida Compliance and Security |

Florida-oriented rules, PCI Level 1, auto-redaction, audit trails |

General compliance and security controls |

General compliance and security controls |

|

Board Access and Approval |

QuickApprove dashboard with voting panel and status tracking |

Reporting tools with more manual steps |

Board access available on selected plans |

|

Operational Efficiency |

Up to 70 percent time reduction and significant staff time savings |

Moderate gains |

Moderate gains |

|

Revenue Potential |

Revenue sharing and automated application fee collection |

Fee management, usually without sharing |

Fee management, no revenue share |

|

Support and Languages |

24/7 AI chat with 11 languages |

Extended support options |

Extended support options |

Schedule a demo today to review how Tenant Evaluation compares with your current tools and understand potential efficiency gains for your board and management team.

Calculating the Total Value of Ownership for Your Florida HOA

Quantifiable ROI: Beyond Monthly Subscriptions

Reduced administrative costs: Automation cuts repetitive work and the need for extra staff. One Tenant Evaluation client reported saving $240,000 per year and freeing roughly 50 staff hours per day after shifting from manual processes. At a conservative $10 per hour per property, labor savings can outweigh subscription fees.

Lower legal and data risk: Non-compliance, records disputes, and data breaches can exceed software costs by a wide margin. Tenant Evaluation’s PCI Level 1 compliance and automatic redaction features help lower exposure related to payment data and sensitive resident information.

Intangible Benefits: Resident Experience and Reputation

Faster approvals, clear communication, and predictable workflows support a calmer community environment. Smooth onboarding creates a better first impression for new residents and realtors, and modern processes reflect positively on both management and the board, which can strengthen trust in association leadership.

Choosing the Right Fit: Scenarios for Different Florida Communities

Small self-managed communities benefit from flat-tier systems that still offer Florida-aligned compliance features and straightforward workflows. Larger management companies often prefer per-unit pricing with volume discounts and advanced automation to standardize processes across multiple associations. Communities that place a high priority on risk management usually favor platforms with detailed Florida configuration, strong security, and clear audit trails, even when upfront fees are higher.

Ready to compare HOA management systems on more than just price? Schedule a demo today to see Tenant Evaluation in action and review pricing for your specific portfolio.

Frequently Asked Questions (FAQ) About HOA Management System Costs and Features

Q1: Typical pricing models for HOA management software in Florida

A1: Most vendors use per-unit, flat-tier, or custom enterprise pricing. Per-unit models often range from $1–$5 per unit per month for larger communities with 200 or more units. Flat-tier plans, often between $29 and $200 or more per month, usually suit smaller HOAs under 100 units. Enterprise arrangements use custom quotes based on unit count, support, and advanced features.

Q2: Other costs to budget beyond the subscription fee

A2: Associations should plan for card transaction fees, often around 2–3 percent, as well as onboarding, data migration, and optional add-ons for features such as advanced accounting, custom integrations, or expanded storage. These items can materially change the total cost per unit.

Q3: Cost and value benefits of a Florida-focused system like Tenant Evaluation

A3: Tenant Evaluation concentrates on Florida association workflows and rules. The platform can cut application cycle times by up to 70 percent and save substantial staff hours each day, while features like PCI Level 1 security, automatic redaction, and FCRA-compliant background checks help manage regulatory and data risk. Its revenue-sharing structure and automated fee collection can also offset or exceed subscription costs for some associations.

Q4: Role of a Board-specific dashboard in overall system value

A4: A dashboard tailored for board members, such as Tenant Evaluation’s QuickApprove, provides real-time status views, standardized applicant summaries, and voting panels for approvals. These tools speed up decisions, reduce email back-and-forth, and maintain clear records of who voted and when.

Q5: Potential for an HOA management platform to generate revenue

A5: Some systems, including Tenant Evaluation, allow associations to collect application fees electronically and share in that revenue. After the service fee is deducted, the remaining amount is rebated to the association, which can make the onboarding solution cost-neutral or produce net positive income.

Conclusion: Make an Informed Investment for Your Florida HOA’s Future

Effective HOA management software does more than process payments or store records. The best choice for a Florida community supports state-specific compliance, reduces administrative workload, and improves transparency for residents and board members, all while fitting within a clear, predictable budget.

Tenant Evaluation offers Florida-focused application processing, screening, and board tools that help HOAs evaluate applicants consistently and manage risk. The combination of automation, configurable workflows, and revenue-sharing can position the platform as a long-term operational investment rather than a simple software expense.

To evaluate whether Tenant Evaluation fits your community, schedule a demo today and review how the platform can support your Florida HOA in 2026 and beyond.