Key Takeaways

- Condo tenant screening in 2026 requires more than basic background checks, especially for Florida communities with association bylaws and state regulations.

- Automated tools that verify identity, income, and credit reduce risk, shorten approval times, and limit manual work for boards and community association managers.

- Configurable workflows, secure data handling, and clear audit trails help Florida condos stay aligned with FCRA, PCI, and Chapter 718 requirements.

- Board-focused dashboards, analytics, and multilingual support improve collaboration, transparency, and long-term planning for associations.

- Tenant Evaluation provides an all-in-one screening and approval platform for condos and HOAs; get started with Tenant Evaluation here.

Why Effective Tenant Screening Tools are Crucial for Condos Today

Condo tenant screening in 2026 involves more stakeholders, stricter rules, and higher expectations than a typical rental. Florida condo boards and property managers must balance fast move-ins with security, FCRA compliance, and alignment with Chapter 718 of the Florida Statutes.

Manual, email-based processes slow down approvals, increase room for inconsistency, and expose associations to legal and data privacy risks. Screening tools built for condos support complex approval workflows, standardize decisions, and give boards clear records that protect both the community and individual decision-makers.

1. Comprehensive Background and Credit Checks for Condo Applicants

Effective condo screening starts with comprehensive background and credit data. Current tools combine nationwide criminal and eviction records, sex offender registries, global watchlists, and in-depth credit reports to give boards a clear view of financial responsibility and potential risk.

Some platforms include Social Security and CPN fraud detection, rental payment histories, eviction and court records, and detailed credit reports. This level of detail helps associations reduce delinquency risk and support a safer community environment.

Platforms that pull data from major bureaus like TransUnion and Equifax, and from national and local criminal databases, provide stronger coverage. FCRA-compliant reports and identity checks support fair decisions and help Florida condos lower legal exposure while protecting owners and residents.

2. Advanced Identity and Document Verification for Condo Onboarding

Identity fraud continues to rise, so condo boards benefit from digital ID and document verification. Modern systems match ID photos to live selfies, read and validate government IDs from many countries, and check documents like leases and financial statements for signs of tampering.

Renter ID verification that matches document images with live biometrics adds a layer of protection beyond manual review. Three-way ID verification that supports thousands of ID types from more than 200 countries helps Florida communities serve a diverse applicant base with consistent standards.

Real-time biometric checks, AI-driven document authentication, and automated flags for suspicious or incomplete documents reduce the chance that forged IDs or leases reach the board. This protects access-controlled buildings, shared amenities, and association finances.

3. Real-Time Income Verification and Rent-to-Income Analysis for Associations

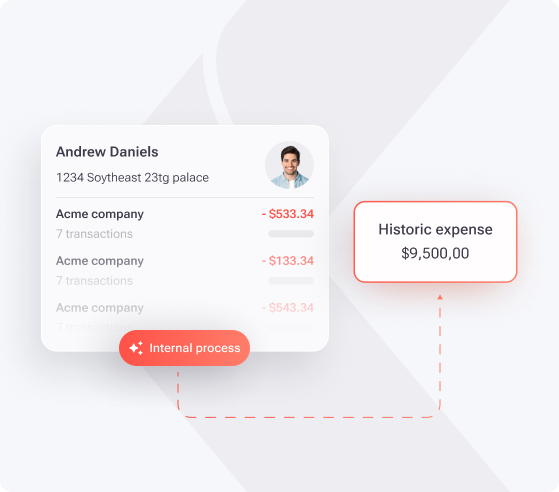

Income verification tools now move beyond static paystubs and bank PDFs. Many screening platforms connect directly to bank accounts or payroll providers and then compare verified income to the association’s rent-to-income or assessment standards.

Real-time income verification with automatic rent-to-income calculations supports faster, more consistent decisions. Bank-verified income data gives boards a clearer picture than self-reported numbers alone.

Screening tools that support flexible income thresholds and side-by-side comparisons make it easier to apply community rules consistently. Automated checks can save managers several hours per application, which is important for CAMs handling multiple buildings and high application volume.

Schedule a demo today to see how comprehensive screening tools can streamline your condo’s application process while keeping financial qualifications objective and reliable.

4. Customizable Screening Criteria and Workflow Automation for Florida Condos

Florida condos operate under different bylaws, house rules, and approval standards. Screening platforms that allow full customization of credit score minimums, income ratios, document requirements, co-applicant types, and pet policies support these differences without relying on manual checklists.

Intelligent forms can route tenants, purchasers, and additional residents through tailored question sets and document uploads. Automated workflows apply pre-approved rules, flag incomplete applications, and can decline applicants who clearly do not meet minimum standards, which shortens processing times and reduces back-and-forth with applicants.

Systems that reference uploaded governing documents directly in the screening logic help boards apply their rules uniformly. Automated routing, reminders, and status updates give managers and applicants a clear view of where each file stands, which reduces uncertainty and phone calls.

5. Secure Data Handling and Compliance Features for Condo Boards

Tenant screening involves sensitive personal and financial information, so strong security and compliance controls are essential. Look for platforms with PCI DSS Level 1 compliance, encryption in transit and at rest, and granular access controls for staff and board members.

Automatic redaction of Social Security numbers, full account numbers, and other sensitive fields limits who can see raw data while still giving decision-makers the context they need. FCRA-compliant reports and clear audit trails support fair housing practices and document how each decision was made.

Secure platforms reduce the chance of data breaches, regulatory fines, and reputational damage for condo associations. Clear compliance features also give board members confidence that their approval process protects both residents and the association.

6. Centralized Board Review and Voting Dashboards for HOAs

Condo approvals often require review and sign-off from several board members. Centralized dashboards bring all applicant information, screening results, and notes into one secure view, which removes the need for long email threads and shared spreadsheets.

Board portals that present AI-generated summaries, side-by-side applicant comparisons, and structured voting panels support quicker, more transparent decisions. Members can review files on their own schedule, record their votes, and see when an application is fully approved or denied.

Features similar to QuickApprove give condos the ability to cut approval times from days to hours, reduce vacancies for owners, and maintain a complete, auditable record of every decision for future reference.

7. Integrated Support and Community Analytics for Condo Management

Strong screening platforms do more than approve or deny applicants. Many include help centers and live or AI-powered chat for managers and applicants, often in multiple languages, which fits the needs of Florida’s diverse communities.

Community analytics turn application and resident data into insight. Boards can review demographic trends, income bands, pet ownership rates, vehicle counts, and other patterns to guide decisions about amenities, rules, and capital projects. Insights about EV ownership, for example, help boards plan for charging stations, while data on families or pet owners can guide amenity upgrades.

Reporting tools that present data in clear dashboards help condo leaders move from reactive decisions to longer-term planning that supports property values and resident satisfaction.

Frequently Asked Questions (FAQ) About Condo Tenant Screening

What legal considerations are unique to tenant screening for condos in Florida?

Florida condos must align screening with Chapter 718, the Fair Housing Act, and FCRA while following their own bylaws on age limits, pets, occupancy, and common area use. Customizable tools and audit trails help boards apply these rules consistently and defend decisions if disputes arise.

How can tenant screening tools help condo associations mitigate risk beyond criminal records?

Screening platforms lower risk by combining criminal checks with credit data, eviction history, verified income, identity verification, and landlord references. This combination supports timely payments, reduces fraud, and promotes residents who fit community rules and expectations.

Is it possible for tenant screening to generate revenue for our condo association?

Many systems process application fees online and can share a portion of those fees with the association. That structure turns screening from a pure cost into a modest revenue source that can help offset administrative work or supplement reserves.

How do AI and automation improve the tenant screening process for condo boards?

AI analyzes large data sets quickly, flags inconsistencies, highlights potential fraud, and summarizes key facts for board review. Automation routes applications through the correct workflow, applies preset rules, and sends notifications, which reduces manual effort for managers and volunteers.

What should we look for when comparing tenant screening tools for our condo association?

Boards benefit from tools that offer deep background and credit checks, advanced ID and income verification, configurable criteria, PCI and FCRA compliance, board dashboards, and analytics. Florida-ready platforms with multilingual support and smooth integration into existing property management processes are especially useful.

Conclusion: Secure Your Condo Community with Smart Tenant Screening Tools

Condo and HOA leaders who use modern screening tools in 2026 gain faster approvals, clearer decisions, and stronger protection for their communities. Background checks, identity verification, income analysis, and automated workflows work together to support fair, consistent, and secure onboarding.

The seven tools outlined here give Florida condos a practical framework for updating their process and replacing manual steps with structured, compliant workflows. Schedule a demo today to see how Tenant Evaluation can streamline applications, enhance compliance, and support new revenue opportunities for your condominium or homeowner association.