Key Takeaways

- Florida HOAs and condos in 2026 need clear, consistent rental history verification policies to navigate new rules, protect property values, and reduce disputes.

- The 2025 reusable tenant screening report law reshapes fees and workflows, so communities must adjust processes to handle standardized reports and maintain compliance.

- Effective rental history verification combines income, credit, rental references, and criminal background checks under Fair Housing and FCRA requirements.

- Digital, all-in-one screening platforms reduce administrative work, improve data security, and give boards better visibility into applications and decisions.

- Tenant Evaluation offers a streamlined, compliant rental history verification platform for Florida associations; learn more or get started at Tenant Evaluation’s online demo page.

Why Strategic Rental History Verification Matters For Florida HOAs & Condos In 2026

Florida community associations now manage more complex resident onboarding, tighter timelines, and higher expectations from applicants, owners, and regulators. Basic background checks no longer provide enough insight to manage risk or meet legal standards.

Structured rental history verification supports operational efficiency, legal compliance, and community stability. Consistent screening helps reduce delinquencies, protect property values, and limit conflicts by admitting residents who meet financial and behavioral expectations.

Core Concepts In Modern Resident Screening

Effective programs distinguish between related but different elements:

- Rental history verification confirms past rent payments, lease compliance, and landlord references.

- Background checks include criminal history, employment verification, and broader financial information.

- Resident screening combines these items under FCRA rules, Fair Housing requirements, and clear adverse action procedures.

The “3-Pillars of Screening” model gives boards and CAMs a practical checklist: compliance with law, financial risk mitigation, and community fit. A written policy built on these pillars supports consistent decisions across all applications.

Florida’s Evolving Landscape: 2026 Screening Trends

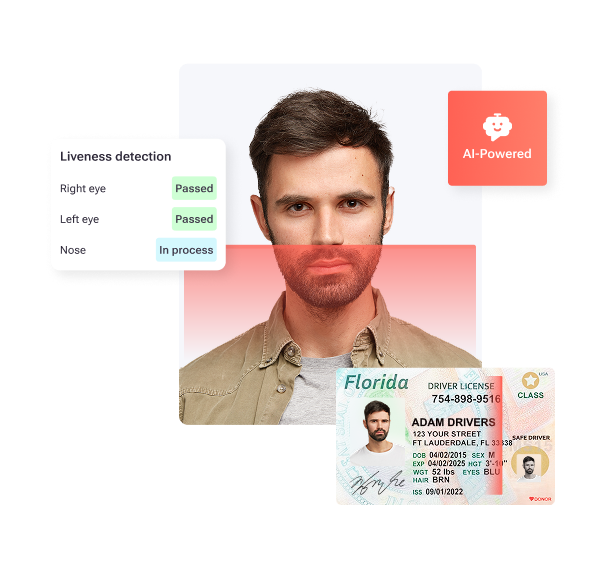

Resident screening now relies heavily on digital tools. Platforms use automation and AI to detect document fraud, verify IDs, and centralize communication with applicants. Applicants increasingly expect online applications, status updates, and faster decisions.

Impact Of Florida’s 2025 Reusable Tenant Screening Report Law

The reusable tenant screening report law that took effect July 1, 2025, lets applicants generate one screening report valid for 30 days and share it with multiple housing providers. Landlords must accept these reports without charging another screening fee.

HOAs and condos now need workflows that can process reusable reports while applying their own criteria. Key concerns include handling different report formats, protecting stored data, and keeping written standards current with any later regulatory updates.

Building A Practical Rental History Verification Process

Strong processes start with written criteria aligned with Fair Housing and Florida law. Standard forms and checklists make decisions more consistent and reduce the chance of mistakes or bias.

Essential Components Of Comprehensive Screening

Income verification should rely on more than self-reported information. Associations benefit from employer verification, pay stubs or tax returns, and review of job stability. Credit checks must follow FCRA rules, including permissible purpose and clear adverse action notices when credit data contributes to a denial.

Thorough rental history verification generally includes at least 12 months of verifiable history, records of late payments, outstanding balances, and a distinction between eviction judgments and dismissals. This information helps predict future payment behavior and reliability.

Background checks should treat arrests and convictions differently and apply individualized assessments in line with HUD guidance. Florida permits broad access to adult criminal history, but fair housing compliance depends on consistent, documented standards.

Written consent is required before running background, credit, or criminal reports, and current data from reputable reporting agencies should be used for all decisions.

Common Screening Challenges For Florida HOAs & Condos

Heavy Administrative Work

Paper forms, email attachments, and manual follow-ups consume staff time and create delays. Disconnected systems make it harder to track status, respond to applicants, or present clear information to boards.

Compliance And Legal Risk

Fair Housing rules apply to every stage of tenant screening. Unclear criteria, inconsistent exceptions, or misuse of criminal and eviction data increase the risk of discrimination claims and regulatory scrutiny, especially when new laws like reusable reports are involved.

Data Security Concerns

Handling Social Security numbers, bank statements, and IDs by email or paper raises exposure to breaches and identity theft. Lack of PCI-compliant systems and encryption can create liability and reputational damage if information is lost or accessed improperly.

Delays And Limited Transparency

Slow approvals can cause applicants to choose other properties and can frustrate listing agents and owners. Poor visibility into status leads to repeated calls to management and confusion among board members.

Best Practices And Emerging Standards For 2026

Use All-In-One Digital Platforms

Centralized platforms for applications, document uploads, background checks, and communication shorten processing times and reduce errors. Dynamic forms, automated reminders, and document review help ensure files are complete before board review.

Reinforce Compliance And Data Security

Boards and CAMs benefit from systems with built-in FCRA workflows, templates for adverse action notices, and audit logs tailored to Florida communities. PCI Level 1 security and end-to-end encryption help protect applicant data and reduce exposure if a device or account is compromised.

Improve Transparency And Board Involvement

Dedicated board dashboards give decision-makers real-time access to application files, status updates, and voting tools. Individualized review of criminal records that focuses on recent, relevant convictions aligns with HUD guidance and emerging best practices.

Support A Diverse Applicant Base

Multilingual portals, clear instructions, and mobile-friendly applications reduce barriers for qualified applicants and demonstrate a commitment to fair housing principles. Clear communication also reduces errors and resubmissions.

Florida Case Example: Tenant Evaluation Results

A Florida management company using Tenant Evaluation reported annual savings of about $240,000, a 50 percent reduction in processing time, and a shift away from manual handling of sensitive documents. Staff could focus more on owner and resident support while maintaining consistent screening standards.

Manual Vs. Automated Rental History Verification Systems

|

Feature |

Manual or Traditional Process |

Automated System (such as Tenant Evaluation) |

|

Compliance |

Higher risk of errors and inconsistent application of rules |

Structured FCRA and Fair Housing workflows with automatic redaction of sensitive data |

|

Efficiency |

Paper-heavy, slow, and dependent on staff availability |

Automated reminders and checks that can cut processing time by more than half |

|

Transparency |

Limited status visibility for boards and CAMs |

Real-time dashboards and clear tracking for all stakeholders |

|

Security |

Greater exposure to loss or misuse of documents |

PCI Level 1 security, encryption, and controlled access to files |

Key Questions About Florida Rental History Verification

How does Florida’s reusable tenant screening report law affect HOA and condo screening?

The law allows applicants to reuse a single comprehensive report for 30 days, and housing providers must accept it without charging another screening fee. Associations need to adjust fee structures, update policies, and ensure that platforms can import or review reusable reports while keeping criteria consistent.

What are the main legal requirements for background and credit checks in Florida communities?

Written consent is required before any credit or background check. When credit information contributes to a denial, communities must provide adverse action notices, access to the report, and an opportunity to dispute inaccuracies. Criminal history checks may use Florida’s broad access to adult records, but fair housing principles favor individualized review based on relevance and recency rather than blanket bans.

What should a complete rental history verification include for Florida HOAs and condos?

Effective verification confirms at least 12 months of rental history, payment patterns, lease compliance, outstanding balances, and any eviction actions. Direct contact with previous landlords helps clarify property care, behavior, and rule compliance that may not appear in credit data.

Conclusion: Position Your Florida Community For A More Secure 2026

Rental history verification now plays a central role in risk management for Florida HOAs and condos. Regulatory changes that began in 2025, combined with rising expectations for speed and transparency, make manual, paper-based processes less practical and more risky.

Communities that adopt structured, technology-enabled screening can reduce administrative workload, improve compliance, and provide a better experience for applicants and owners. Those practices also prepare boards and CAMs for future legal and market changes.