Key Takeaways

- Florida HOAs need clear authority in their governing documents and legally reviewed policies before screening tenants.

- Effective background checks combine identity, credit, criminal, eviction, and income verification while following Fair Housing and FCRA rules.

- Digital applications, secure document collection, and structured board workflows reduce delays and support consistent decisions.

- Well managed screening programs protect sensitive data and can create stable revenue that offsets association costs.

- Tenant Evaluation offers a centralized platform for Florida HOAs to manage applications, background checks, and approvals, improving compliance and efficiency, get started with Tenant Evaluation.

The Challenge: Why Strategic HOA Tenant Screening Matters

Florida Community Association Managers and HOA Board Members face pressure to protect residents, follow complex regulations, and handle heavy workloads. Weak screening can result in late payments, property damage, disputes, and lower property values.

Manual processes increase the risk of Fair Housing Act violations, data exposure, and long approval times. Inconsistent criteria and unsecured email exchanges also raise the chance of discrimination claims and penalties. A structured, technology supported process gives Florida HOAs clearer control over risk, compliance, and resident experience.

1. Know Florida Regulations and Your HOA Governing Documents

Compliance starts with understanding what your HOA is allowed to do. Florida HOAs operate under state landlord tenant laws, federal Fair Housing rules, and their own CC&Rs, bylaws, and rules. Associations face Fair Housing liability if policies or decisions discriminate against protected classes such as race, religion, or disability.

Boards need written authority for tenant screening in their governing documents, including whether owners must use approved screening services. Some states restrict direct tenant screening by HOAs, so legal review is essential before enforcing rules. Florida associations benefit from periodic policy reviews with HOA counsel to remove unclear or biased language and to align screening standards with current law.

2. Build a Comprehensive Background Check Package

Stronger decisions come from looking at the full applicant profile, not a single data point. Core screening components typically include:

- Identity verification and government ID matching

- Credit report details such as score, payment history, and bankruptcies

- Criminal records, including felonies, misdemeanors, and sex offender status

- Eviction history and rental related court judgments

- Income and employment verification to support rent obligations

Boards should review payment patterns and debt levels instead of focusing only on a single credit score. Criminal checks work best when boards evaluate directly related convictions, considering the type of offense, severity, and time since the event. Eviction history and income stability help predict whether residents are likely to pay on time and follow community rules.

3. Protect Your HOA With FCRA and Fair Housing Compliance

Fair Credit Reporting Act and Fair Housing compliance gives structure to a defensible screening program. Associations that use consumer reports must obtain written consent and share required notices if they deny an application. Policies can still violate the Fair Housing Act if they have a discriminatory impact, even without intent.

Boards benefit from standardized procedures that include:

- Clear written consent forms before running any reports

- Documented, objective approval criteria that apply to every applicant

- Adverse action notices that explain denials and list the reporting agency

- Training for staff and board members on protected classes and prohibited topics

Screeners should not ask about race, ethnicity, religion, disability, family status, national origin, public assistance, sexual orientation, or gender identity. A consistent checklist for every application supports both fairness and legal defense.

4. Streamline Applications and Document Collection

Digital applications reduce incomplete files, missing signatures, and long email chains. Manual handling often slows approvals for weeks and frustrates both owners and applicants.

Modern online systems guide each applicant type through the correct forms and document list. The platform can require a fully executed lease, legible ID, and supporting income documents before submission, which prevents repeated follow ups.

Secure uploads and e-signatures shorten processing times and give managers a clear view of file status. Many communities cut administrative time by dozens of hours per month when they replace paper and email with a single online portal.

5. Guard Applicant Data and Privacy

Tenant screening involves Social Security numbers, banking details, and government IDs. Unsecured spreadsheets, email attachments, and paper files expose HOAs to privacy complaints and costly breaches.

Specialized screening platforms strengthen protection with automatic redaction of sensitive fields, encrypted storage and transmission, and strict role based access. PCI Level 1 payment standards also support secure fee collection.

Clear policies on data retention and deletion, combined with technology that limits human handling, lower the chance that a misfiled or shared document will create legal or reputational damage for the association.

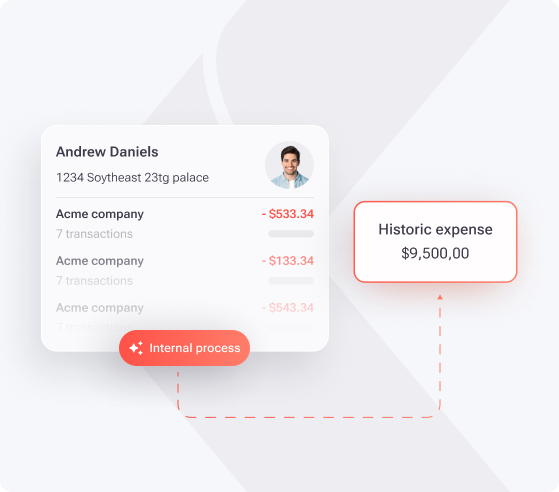

6. Use Board Dashboards to Speed Approvals

Board review often becomes the slowest step in the approval process. Email threads, scattered PDFs, and physical folders make it hard to track status or show how a decision was reached.

Board dashboards centralize key details in one place, including applicant summaries, screening results, and voting tools. Members can review credit and background highlights, cast votes, and add notes within the same system. Automatic time stamps and activity logs create a clear audit trail that supports both transparency and compliance, while faster responses help avoid unnecessary vacancy days.

7. Add Financial Transparency and Revenue Controls

Screening fees, if managed well, can offset administrative work or even produce net income for the community. Manual collection and tracking, however, often leave money on the table and create extra work for staff.

Automated platforms collect fees online, route funds correctly, and record every transaction. Some providers offer revenue sharing models that rebate a portion of each application fee back to the HOA. Communities using this structure can fund better screening tools without raising dues, and some generate meaningful annual revenue. Tenant Evaluation has helped associations capture more than $150 million in total screening related revenue.

|

Feature/Aspect |

Manual Screening Process |

Automated Platform such as Tenant Evaluation |

Impact |

|

Efficiency and speed |

Heavy paperwork and email, approvals can take weeks |

Online forms and workflows, approvals often completed in days |

Shorter vacancy periods |

|

Compliance |

Inconsistent steps, higher risk of FCRA and Fair Housing issues |

Built in checklists, templates, and audit logs |

Lower legal exposure |

|

Data security |

Paper files and unencrypted email create breach risk |

Encryption, access controls, and automatic redaction |

Stronger privacy protection |

|

Board review |

Scattered documents, limited visibility |

Central dashboard with status, notes, and votes |

Faster, better documented decisions |

Frequently Asked Questions (FAQ)

Can HOAs ban short term rentals in Florida communities?

Many Florida HOAs can restrict or ban short term rentals if their governing documents clearly limit use to longer term residential occupancy. Rules often define minimum lease terms and prohibited rental activity. New restrictions usually cannot apply retroactively to owners who bought before the change, so boards should work with HOA counsel when drafting and adopting rental limits.

What constitutes a legal violation by an HOA regarding tenant screening?

Violations often involve ignoring governing documents, breaking state or federal law, or treating applicants inconsistently. Examples include applying different standards to similar applicants, asking about protected characteristics, or denying an application without following FCRA notice rules. Boards reduce risk by using the same written criteria for every file and keeping clear records that tie each decision to business needs and community safety.

What should an HOA consider when evaluating criminal background checks for tenants?

Boards should focus on convictions that have a direct connection to housing risk. Key factors include the type and seriousness of the offense, how long ago it occurred, the applicant’s age at the time, rental history, and any evidence of rehabilitation. A dated, nonviolent offense may carry less weight than a recent conviction involving violence or property damage that could affect neighbors’ safety.

How can HOAs minimize liability when conducting tenant background checks?

Some associations lower direct risk by requiring owners to perform background checks through approved providers and lease addendums, while the HOA sets minimum standards. This structure keeps screening consistent but reduces the association’s role in case by case decisions. Regular legal review of criteria, forms, and notices helps keep the program aligned with current law.

What documentation should HOAs maintain for tenant screening compliance?

Strong records typically include signed consent forms, copies or summaries of screening reports, written decision notes, adverse action notices, and time stamped board votes. Digital systems that store these items automatically make it easier to respond to questions from residents, auditors, or regulators. Good documentation also helps boards refine their criteria over time based on actual outcomes.

Conclusion: Create a Repeatable, Compliant Screening Process

Florida HOAs that treat tenant background checks as a structured process, rather than a one time task, gain better control over risk, consistency, and resident experience. Clear authority in governing documents, defined criteria, secure technology, and disciplined documentation all work together to protect the community.

Purpose built screening platforms give Community Association Managers and boards a single place to manage applications, fees, background checks, and approvals. This approach supports faster decisions, better compliance, and more predictable financial outcomes for the association.