Key Takeaways

- Florida condo associations in 2026 face higher regulatory pressure and resident expectations, so manual, paper-based screening now creates avoidable risk and delays.

- Clear, written screening criteria that follow fair housing rules help boards make consistent, defensible decisions and reduce exposure to discrimination claims.

- Comprehensive background and income verification, combined with secure record-keeping, support both community safety and long-term financial stability.

- Digital screening platforms with automation, strong data security, and board dashboards cut administrative workload and speed up approvals.

- Tenant Evaluation offers a Florida-focused, fully online screening solution that simplifies compliance and board decisions; get started with Tenant Evaluation to modernize your process.

The Rising Need for Modern Condo Association Screening in 2026

Florida condo operations now run under closer scrutiny. Manual processes strain under new requirements and expectations, including the Florida Building Safety Act’s milestone inspections and Structural Integrity Reserve Studies, which took full effect in 2025. These rules highlight the importance of accurate records, financial strength, and predictable cash flow, all of which depend on selecting reliable residents.

Paper-based systems lead to incomplete applications, slow communication among applicants, realtors, and boards, and missed details. Property managers often spend several times longer chasing documents than reviewing them, which pulls time away from maintenance, owner communication, and long-term planning.

Effective screening now has a broader scope. Boards need a consistent way to assess criminal history, income stability, rental history, and overall fit with community standards. A uniform process protects current residents, supports fair housing compliance, and sets clear expectations for anyone moving in.

1. Protect Your Association With Fair Housing Compliance

Compliance with fair housing rules forms the foundation of any screening program. Condo associations qualify as housing providers and must follow the Fair Housing Act (FHA) and Florida Statutes § 760.23(1), which prohibit discrimination based on protected characteristics such as race, religion, sex, familial status, or disability.

To reduce risk, screening should rely on objective criteria and a uniform process. Helpful steps include:

- Creating written policies that define acceptable credit score ranges, income-to-assessment or income-to-rent ratios, and disqualifying criminal offenses

- Providing these criteria to applicants in advance so expectations are clear

- Documenting reasons for adverse decisions in consistent, factual language

- Training board members and managers regularly on FHA standards and updates

This structure helps boards defend decisions, avoid inconsistent treatment, and build trust with applicants and residents.

2. Strengthen Safety With Comprehensive Background and Financial Vetting

Thorough background and financial checks give boards a clearer picture of each applicant. A well-rounded review can include:

- Criminal background checks and sex offender registry searches

- Credit reports that show payment patterns, not only a score

- Income verification through pay stubs, bank data, or employer confirmation

- Eviction and landlord history, including payment and conduct issues

Many communities require an income-to-rent or income-to-assessment ratio of at least 3:1, along with minimum credit score thresholds. These standards should appear in governing documents and apply to every applicant.

Consistent financial vetting reduces delinquencies, protects reserve funding, and helps avoid conflicts over nonpayment or property damage.

3. Reduce Workload by Digitizing and Automating Applications

Online screening platforms now replace clipboards, faxed forms, and scattered email chains. A digital system lets applicants submit forms, upload documents, and authorize checks at any time, from any device. Florida management teams that shifted to automated workflows report saving dozens of staff hours each week through fewer follow-ups and faster approvals.

Effective systems use smart form logic and automation to:

- Route applicants down different paths for tenants, purchasers, or subleases

- Flag missing documents, such as leases or IDs, before submission

- Trigger background and credit checks automatically after payment

- Notify managers and boards when files are ready for review

This approach shortens approval timelines, creates a better applicant experience, and frees staff to focus on resident services instead of paperwork.

Schedule a demo to see how Tenant Evaluation supports fully online applications for condos and HOAs.

4. Safeguard Applicant Data With Strong Security Protocols

Screening relies on highly sensitive personal information. Boards need tools and policies that reduce the chances of a data breach and meet privacy and reporting obligations. Secure platforms typically include:

- End-to-end encryption for data in transit and at rest

- PCI Level 1 compliance for handling payment information

- Automatic redaction of Social Security numbers and bank details in reports

- Role-based access controls and detailed audit logs

The Florida Building Safety Act’s long record-retention requirements for inspection and reserve reports illustrate how long associations may need to maintain sensitive information. Aligning screening records with Fair Credit Reporting Act (FCRA) rules and documented retention schedules helps boards prove due diligence in any audit or dispute.

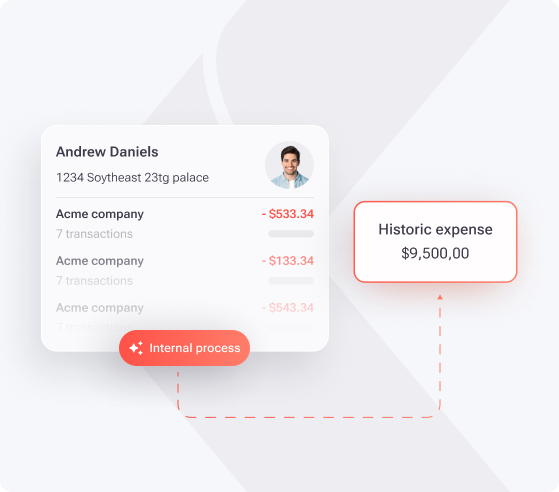

5. Give Boards Clear Dashboards and Faster Decision Tools

Board members make important choices about who joins the community, often while balancing full-time jobs. Modern screening solutions can streamline this work with a central board dashboard that shows:

- Real-time application status for each unit

- Concise summaries of background, credit, and income findings

- Centralized comments and questions from board members

- Built-in voting tools to record approvals, denials, or conditions

These features reduce email chains and paper packets and help boards reach timely decisions while keeping a clear record of the review process.

6. Align Screening With Florida-Specific Rules and Governing Documents

Florida associations operate under detailed state laws as well as their own declarations, bylaws, and rules. Screening tools work best when they match these requirements rather than relying on generic templates.

Helpful customizations include:

- Configuring minimum credit scores, income ratios, and required documents to mirror your governing documents

- Embedding references to lease terms, rental caps, and pet policies in the application flow

- Confirming authority to screen under the documents and state law, such as verifying screening authority in governing documents under Fla. Stat. § 718.104(5) and updating bylaws where needed

Tailored setups help ensure the process is enforceable, clear to applicants, and ready for legal review if challenged.

7. Turn Screening From a Cost Center Into a Revenue Support Tool

Well-designed screening programs can offset their own costs and contribute to the association budget. Online systems collect application fees automatically and route funds to the correct accounts with less staff involvement.

Some platforms also share a portion of application fees with the association, which can help pay for technology, insurance, or common-area projects. Faster approvals can shorten vacancy periods, supporting more stable assessment income.

Improved screening does not only protect the community, it can also support long-term financial planning when paired with clear fee structures and transparent communication.

Tenant Evaluation vs. Traditional Condo Screening Methods

|

Feature / Aspect |

Tenant Evaluation |

Traditional Manual Process |

|

Application Process |

Online, web and mobile, smart logic, 24/7 access |

Paper forms, physical submissions, limited access |

|

Document Review |

Automated verification, ID verification, intelligent checks for completeness |

Manual review, higher risk of errors, slower verification |

|

Data Security |

PCI Level 1, encryption, auto-redaction of PII, audit trails |

Greater risk of data exposure, often unsecured storage |

|

Board Involvement |

QuickApprove-style dashboard, real-time access, AI summaries, voting tools |

Paper packets, email chains, slower decisions |

Frequently Asked Questions About Condo Screening in Florida

How do Florida’s newer condo laws affect tenant screening?

Recent laws, including SB 4-D (2022), SB 154 (2023), and HB 913, concentrate on structural safety, reserve funding, and financial disclosures. These rules raise the stakes for financial stability. Associations now benefit from stronger financial vetting of applicants, because reliable assessment income supports reserves and required repairs. The focus on better record-keeping also extends to screening files, which should be complete, secure, and easy to audit.

Can a condo association deny an applicant based on credit or criminal history?

Boards may deny applicants based on credit or criminal history when they use objective, written criteria, apply those standards consistently, and avoid discrimination against protected classes under the FHA and Florida Statutes § 760.23(1). Policies often set a specific credit score threshold and define which types of offenses affect eligibility. Considering the nature of the offense, its age, and its relevance to safety or property damage further reduces fair housing risk.

What screening records should condo associations maintain?

Associations should keep a complete file for each application. Typical contents include the application form, lease or purchase contract, IDs, income and employment documentation, credit and background reports, communication logs, and board decision records. HB 913 expands the definition of official records and, together with long retention periods for milestone inspections and SIRS, signals that detailed and secure record retention is important for all key association documents, including screening.

How can an association update its documents to authorize tenant screening?

Some older documents do not clearly permit screening. In those cases, the association should confirm its authority to screen under Fla. Stat. § 718.104(5) and then follow the amendment process in its declaration and bylaws. This process usually involves notice to owners and a vote that meets a defined approval percentage. Boards often work with a community association attorney to ensure that new screening language is enforceable and consistent with fair housing and state law.

What data security measures should associations prioritize during screening?

Associations should use platforms that provide encryption, PCI Level 1 compliance for payments, and automatic redaction of sensitive data in reports. Documented policies for who can access information, how long it is kept, and how it is disposed of help align with FCRA and state law. Systems with audit logs and timestamped actions make it easier to demonstrate that the board handled applicant information responsibly.

Conclusion: Strengthen Your Community With Smarter Screening

Florida condo associations in 2026 benefit from screening programs that combine fair housing compliance, thorough background and financial checks, digital workflows, strong data security, and Florida-specific customization. When screening also supports revenue and reduces manual work, boards gain more time to focus on long-term planning and resident experience.

Schedule a demo with Tenant Evaluation to see how a modern, Florida-focused screening platform can support your association’s safety, compliance, and financial goals.