Last updated: January 27, 2026

Key Takeaways for Florida HOA Screening

- Automated tenant screening delivers higher accuracy than manual review through AI verification, direct credit bureau access, and fraud detection for Florida HOAs.

- FCRA dispute resolution uses a structured six-step process with adverse action notices, 30 to 45-day investigations, and updated reports.

- TenantEvaluation offers HOA-specific tools, QuickApprove dashboards, revenue sharing, and a documented $150 million ROI for more than 5,000 communities.

- Manual screening exposes HOAs to fraud, heavy daily admin workloads, compliance risk, and slower revenue collection compared with automated systems.

- Florida HOAs can streamline screening and reduce disputes by getting started with Tenant Evaluation today.

Automated Screening Accuracy vs Manual Errors in Florida HOAs

Accurate tenant screening depends on multiple verified data points such as identity, income, credit history, and background checks. Florida screening standards often require income of at least three times monthly rent, credit scores of 600 or higher, and full background verification to support reliable tenant placement.

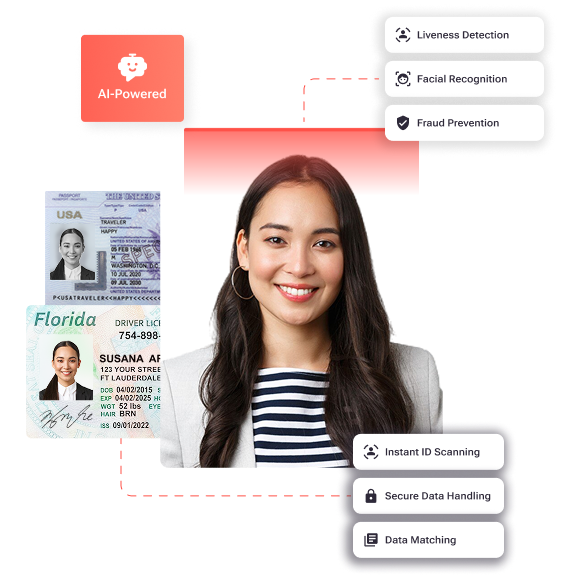

Automated screening platforms improve accuracy through advanced verification tools. IDverify technology uses AI-based identity checks to flag fraudulent documents and confirm that applicants are who they claim to be. IncomeEV tools contact employers directly instead of relying on self-reported income, and SafeCheck+ background screening taps into broad criminal databases through direct credit bureau relationships rather than scraped third-party data.

Manual screening introduces serious accuracy gaps for Florida HOAs. Privacy and fair housing laws restrict how much information property managers can share with owners, so professional screening workflows are necessary for compliance. Manual document review rarely catches sophisticated fraud, income checks often depend on easily altered documents, and background searches can miss key records when databases are incomplete.

Accuracy differences grow in complex or high-volume situations. Automated systems perform best when they draw from fresh, comprehensive data sources. Manual workflows struggle with human error, inconsistent criteria, and limited ability to cross-check multiple databases at the same time.

FCRA Screening Report Dispute Steps for Florida HOAs

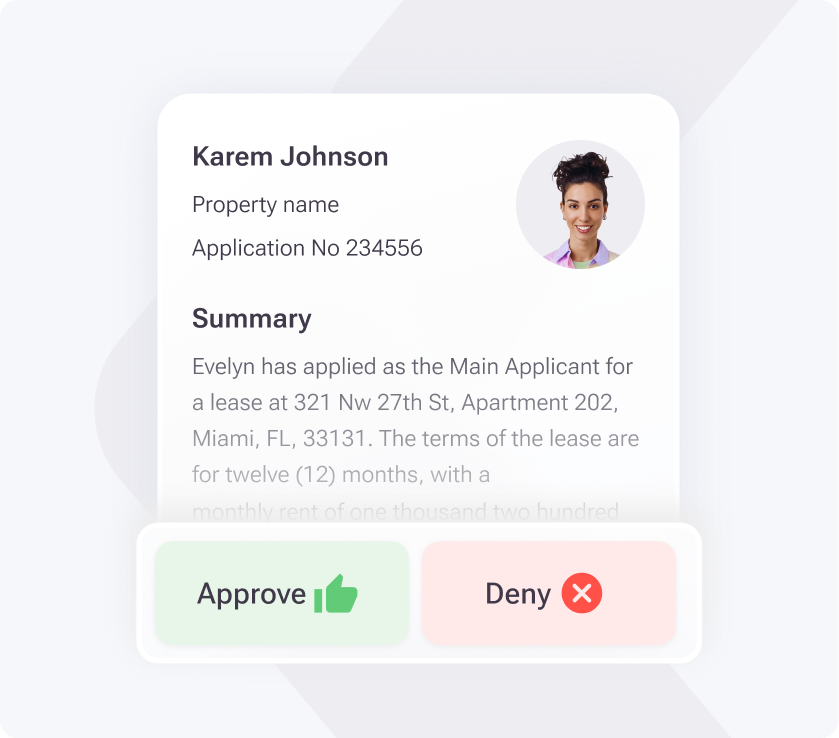

The Fair Credit Reporting Act (FCRA) sets clear rules for handling screening report disputes that Florida HOAs must follow. When HOAs or landlords deny an application based on a screening report, they must send an adverse action notice with the reporting company’s contact details, the applicant’s right to a free report within 60 days, and instructions for disputes.

The formal dispute process follows a predictable sequence. First, the applicant requests a copy of the screening report from the Consumer Reporting Agency within 60 days of the adverse action. Second, the applicant reviews the report for errors such as mixed files, outdated items, or missing records. Third, the applicant submits a dispute directly to the screening company and includes proof such as pay stubs, letters, or court documents.

Fourth, the Consumer Reporting Agency investigates the dispute within 30 days, or 45 days in some situations, while some states require even faster timelines. Fifth, the agency informs all parties of the results and corrects any confirmed inaccuracies. Finally, the HOA receives an updated report and must reconsider the application using the corrected information.

Automated screening platforms simplify these steps with built-in adverse action templates, automated dispute tracking, and direct credit bureau integrations that speed up investigations. Manual processes often run past legal deadlines because of slow communication, missing paperwork, and weak follow-up systems.

TenantEvaluation vs Manual Screening and Other Platforms

|

Feature |

Manual Processes |

Competitors (RentSpree/TurboTenant/AppFolio) |

TenantEvaluation |

|

Florida HOA Specialization |

None, generic workflows |

General rental and property management tools with limited HOA options |

Built for Florida HOAs with tailored compliance |

|

Report Accuracy |

Frequent errors, high fraud exposure |

Basic checks, no AI redaction |

Higher accuracy using IDverify, IncomeEV, and SafeCheck+ |

|

Dispute Resolution Speed |

30 to 45 days or more with manual handling |

Automated workflows with uneven HOA support |

FCRA-focused adverse action workflows |

|

Board Transparency |

Scattered emails, no central tracking |

No dedicated board portals |

QuickApprove dashboard with real-time voting |

|

Compliance & ROI |

High risk and lost efficiency |

Fixed monthly subscription fees |

Revenue sharing model, FCRA-first design, $150M generated |

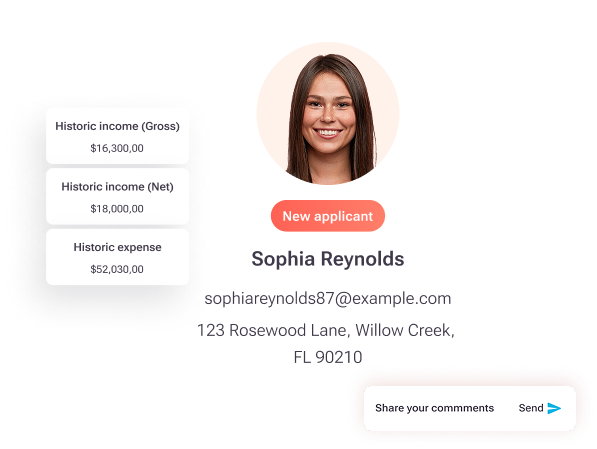

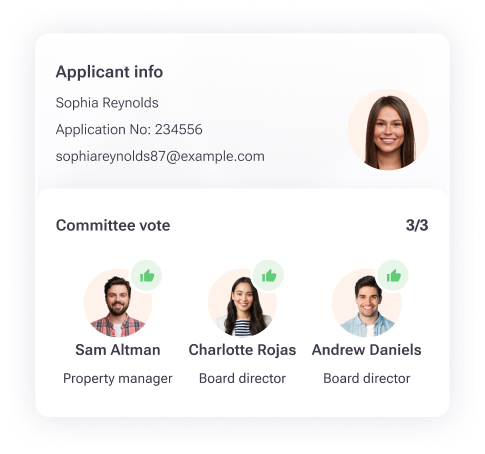

TenantEvaluation delivers more than basic tenant checks for Florida associations. The platform handles more than 100,000 applications per year across over 5,000 communities and maintains a 4.8 out of 5 Google rating through its HOA-focused design. QuickApprove gives board members direct access to application details, voting tools, and complete audit trails that many general rental platforms do not offer.

The revenue model also stands out. Instead of a flat subscription, TenantEvaluation charges per application and shares revenue with communities, which ties platform growth to HOA financial performance. This structure has produced more than $150 million for partner communities while maintaining PCI Level 1 security and full encryption from end to end.

See TenantEvaluation in action by scheduling a demo today and experience how HOA-specific screening improves daily operations.

How TenantEvaluation Eases CAM, Board, and Applicant Workloads

Community Association Managers reduce heavy administrative work when they move from manual screening to TenantEvaluation. One Florida management company cut costs by $240,000 per year after switching platforms and reclaimed 50 staff hours each day for higher-value tasks. Intelligent forms reject incomplete applications automatically, and automated document review confirms signed leases and valid IDs without manual checking.

Board visibility improves through QuickApprove, which shows real-time application status, AI summaries, and simple voting tools in one place. Board members review complete applicant files without long email threads or scattered attachments and keep clear audit trails that support compliance and recordkeeping.

Applicants gain faster approvals and a smoother experience. They use mobile-friendly forms, receive 24/7 multilingual support, and benefit from automated workflows that cut processing times from days to hours. Realtors also benefit from quicker decisions. Florida’s Miya’s Law requirements for employee background checks highlight the state’s focus on thorough screening, which automated platforms handle more consistently than manual methods.

Frequently Asked Questions

How accurate are automated tenant screening reports?

Automated tenant screening reports usually outperform manual checks because they connect directly to credit bureaus, use AI to verify documents, and search broad databases. TenantEvaluation improves accuracy with IDverify identity checks, IncomeEV employment verification, and SafeCheck+ background screening that queries nationwide criminal records. Manual workflows face higher error rates due to human mistakes, limited data access, and weak protection against advanced document fraud.

How do you dispute an inaccurate HOA evaluation report?

Disputing an inaccurate HOA evaluation report follows FCRA rules. Request your screening report within 60 days of the adverse action, review it carefully, and list each error. Send a written dispute with supporting documents to the Consumer Reporting Agency and keep copies for your records. The agency generally has 30 days to investigate. Automated platforms such as TenantEvaluation support this process with built-in adverse action steps and clear audit logs.

What is the Florida HOA 5-year rule for background checks?

The “Florida HOA 5-year rule” usually refers to community policies that focus on recent criminal history, often within the past five to seven years. Many Florida HOAs adopt this window to balance safety with fair housing compliance and FCRA reporting limits. This approach helps associations reduce discrimination risk while still screening for meaningful safety concerns. Automated platforms can configure lookback periods to match each community’s written policies.

What is a Level 2 background check in Florida HOAs?

A Level 2 background check in Florida is a detailed screening that includes FBI fingerprint checks, statewide criminal records, and databases for sexual offenders and serious violent crimes. Employers use Level 2 checks for positions that involve vulnerable populations, and some HOAs adopt them for higher security standards. Automated platforms can standardize Level 2 checks through direct law enforcement and state database access, while manual methods may overlook records because of patchy coverage.

Why TenantEvaluation Is a Strong Choice for Florida HOAs

Automated screening clearly outperforms manual processes for Florida HOAs that need accurate, compliant, and efficient tenant evaluation. TenantEvaluation addresses the daily challenges of Community Association Managers and board members with precise dispute handling and reliable screening accuracy that general platforms rarely match.

With more than 5,000 communities served, over 100,000 applications processed each year, and $150 million in partner revenue, TenantEvaluation shows consistent results in the Florida HOA market. The platform’s FCRA-first design, direct credit bureau links, and automated compliance workflows create a strong foundation for lawful, dependable screening that protects associations and speeds operations.

Schedule a demo today to improve accuracy and reduce disputes while upgrading your community’s resident onboarding experience.