Last updated: January 27, 2026

Key Takeaways for Florida HOA Screening

- Sophisticated AI fraud attacks surged 180% globally in 2025, so digital document authentication now plays a central role for Florida HOA managers who need to block fake IDs and deepfakes.

- Direct credit bureau access from TransUnion and Equifax delivers over 99% accuracy and outperforms aggregated services and manual reviews that suffer from mixed files and human error.

- Advanced tools such as 3D liveness detection and multi-bureau verification prevent common screening problems like identity confusion and fraudulent income documents.

- TenantEvaluation focuses on Florida-specific FCRA compliance, 5 to 10 minute processing, and a revenue-sharing model, and it processes more than 100,000 applications each year.

- Upgrading your HOA screening with Tenant Evaluation helps you keep reports accurate, compliant, and protected against fraud.

Core Factors That Drive Accurate Tenant Evaluation

Accurate tenant evaluation rests on three pillars: reliable data sources, strong authentication methods, and a solid compliance framework. Direct credit bureau resellers such as TransUnion and Equifax provide over 99.9% background check accuracy at the state level. This performance significantly exceeds aggregated services that filter and sometimes dilute bureau data.

The gap between direct bureau access and aggregator services creates clear accuracy differences. Direct pulls from both Equifax and TransUnion reveal discrepancies in 72% of cases with different scores, 5% showing no score on one bureau, and 63% differences in collections. These variations show how single-bureau or aggregated data can miss critical details that affect screening decisions.

FCRA rules require maximum possible accuracy in background reporting, so direct bureau relationships matter for every Florida HOA. TenantEvaluation maintains direct reseller status with major credit bureaus. This approach gives community associations unfiltered, comprehensive data that supports confident board decisions.

|

Authentication Method |

Accuracy Rate |

Primary Risk |

|

Direct Bureau API |

99%+ |

Minimal false positives |

|

Aggregated Data |

90-95% |

Filtered or incomplete records |

|

Manual Review |

85-90% |

Human error, delays |

Modern Digital Document Authentication Tools That Stop Fraud

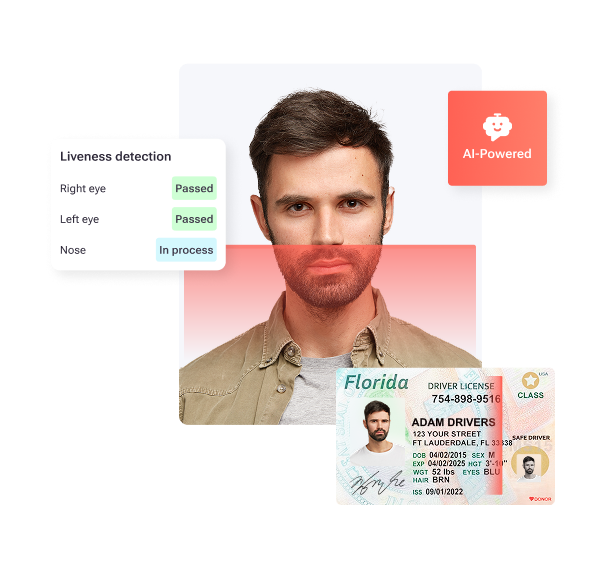

Modern digital document authentication layers several checks together to stop sophisticated fraud attempts. AI models trained on millions of real and fake videos detect deepfakes with over 95% accuracy in identity verification. These models use behavioral pattern analysis, audio and visual mismatch detection, and source verification protocols.

Advanced authentication now includes 3D face mapping, liveness detection, multi-modal biometrics, and real-time fraud scoring. These technologies respond to the growing threat of AI-generated documents, as 2025-2026 sees AI fraud agents generating hyper-realistic deepfakes, IDs with accurate holograms, and synthetic identities that target tenant screening documents.

TenantEvaluation’s IDVerify solution builds ID verification into its smart application form and document review. The system automatically checks for valid IDs and required documents, redacts sensitive personal information, and maintains audit trails that support security and compliance. Hybrid AI approaches deliver 90-99% accuracy for comprehensive fraud detection, combining supervised and unsupervised methods that flag document inconsistencies and behavioral anomalies.

Accuracy in AI-generated document detection keeps improving as machine learning models review document security features, metadata patterns, and submission behaviors. This layered approach gives Florida HOAs strong protection against evolving fraud while keeping application processing fast and predictable.

Fixing Mixed Files and Other Tenant Screening Accuracy Problems

Mixed files create one of the most serious accuracy problems in tenant screening. These errors occur when criminal records belonging to someone with the same or a similar name end up on your report. Mixed files increase liability for HOAs and can cause wrongful denials or approvals of risky tenants.

Common causes include identity confusion among people with similar names, close birthdates, or Social Security numbers that differ by a single digit. Individuals with common names face a higher risk for mixed identity files where records from multiple people merge. Risk grows further when applicants share the same city or zip code.

TenantEvaluation’s SafeCheck+ solution tackles mixed file prevention with multi-bureau verification, full SSN and date-of-birth cross-checks, and 360-degree reference verification. The platform automatically contacts previous landlords and confirms rental history through direct communication instead of relying only on database records. This process gives a clear answer to the common concern about previous landlord calls, because the system handles that verification automatically and consistently.

Effective prevention strategies rely on strict identity verification protocols, multiple data sources for cross-checking, and detailed audit trails. TenantEvaluation’s IncomeEV solution adds direct employer verification instead of accepting self-reported income alone. This step reduces the risk of fraudulent financial information that often appears alongside mixed file issues.

Why TenantEvaluation Stands Out for Florida HOAs

TenantEvaluation’s focus on Florida community associations creates clear advantages over generic property management tools. Subscription-based competitors such as AppFolio and RealPage rely on monthly fees, while TenantEvaluation uses a revenue-sharing model that ties its success to community outcomes and has generated 150 million dollars for partner communities.

|

Feature |

TenantEvaluation |

Buildium/AppFolio |

Snappt/RentSpree |

|

Direct Bureau Reseller |

Yes (TransUnion and Equifax) |

Third-party providers |

Limited bureau access |

|

Processing Time |

5-10 minutes |

1-5 days |

Hours to days |

|

Board Dashboard |

QuickApprove included |

Not available |

Not available |

|

Florida Compliance |

Florida-specific built-in |

Generic compliance |

Basic compliance |

The platform processes more than 100,000 applications each year and holds a 4.8 out of 5 Google rating, which shows consistent performance at scale. TenantEvaluation’s all-in-one design removes the need to juggle several third-party providers. This approach reduces integration headaches and data gaps that often appear when competitors depend on external services.

Schedule a demo today and see the difference between generic property management tools and a screening platform built specifically for HOAs.

How Florida Communities Use TenantEvaluation in Real Life

Small self-managed HOAs gain immediate value from TenantEvaluation’s automated workflows because these tools remove the need for dedicated staff to handle screening. The platform’s 24/7 multilingual support and intelligent form logic keep applications consistent and complete for communities of any size.

Enterprise-level Community Association Managers use TenantEvaluation’s analytics to guide long-term policy decisions. Demographic insights help boards decide on EV charging stations or pet policies based on real resident data instead of guesswork. This data-driven approach supports a “3-3-3 rule” style planning cycle, where communities review three years of resident patterns and then design three-year strategic plans.

The platform’s risk reduction and automation can free as many as 50 staff hours per day for property management teams. Those hours shift from manual document review and verification calls to higher-value work such as resident communication and community projects.

Checklist for Choosing a Florida HOA Screening Provider

HOA boards can use a simple checklist when they compare screening providers. Direct credit bureau reseller status supports data accuracy and FCRA compliance. Board access through a dedicated dashboard keeps decisions transparent. Florida-specific customization addresses state rules and community association needs. Revenue-sharing models align provider incentives with community outcomes. TenantEvaluation meets each of these criteria and offers a comprehensive screening solution for Florida HOAs.

Schedule a demo today to confirm how TenantEvaluation fits your community’s screening requirements.

Frequently Asked Questions

What background check do most landlords use?

Most professional landlords and HOAs rely on FCRA-compliant background checks that pull data directly from major credit bureaus such as TransUnion and Equifax. These direct bureau relationships deliver 99.9% accuracy at the state level and include criminal screening from more than 180 million records plus analysis of 35 million tenant credit records each year. TenantEvaluation keeps direct reseller status with both TransUnion and Equifax so community associations receive unfiltered, comprehensive data for board review.

How do I know if my rental history is good?

Strong rental history shows on-time payments, no eviction records, positive references from previous landlords, and consistent compliance with lease terms. TenantEvaluation’s SafeCheck+ solution supports this review with 360-degree reference verification that includes automated previous landlord contact, eviction history checks, and personal reference confirmation. The system cross-references several databases to improve accuracy and reduce mixed file errors that could misrepresent an applicant’s true rental record.

Do landlords call previous landlords?

Professional property managers and HOAs typically verify rental history through direct contact with previous landlords, and many now use automated systems to save time. TenantEvaluation automates this step through SafeCheck+, which contacts previous landlords, verifies rental payment history, and confirms lease compliance. This automated process keeps verification consistent and removes the manual calls that often slow down applications.

What are FCRA-compliant background check accuracy rates?

FCRA-compliant background checks that use direct credit bureau data usually reach accuracy rates between 95% and 99%, which clearly beats aggregated services. Direct TransUnion and Equifax resellers achieve the highest accuracy because they work with unfiltered bureau data under strict permissible purpose rules. TenantEvaluation’s direct bureau relationships support maximum accuracy and include automated adverse action workflows and clear audit trails for full FCRA compliance.

How does direct-source income verification compare to manual review?

Direct-source income verification through real-time APIs reaches about 99.8% accuracy, while manual review depends on documents that can be forged. TenantEvaluation’s IncomeEV solution connects directly with employers and financial institutions to confirm income, employment status, and payment history without relying on applicant-provided pay stubs or bank statements. This direct connection blocks common fraud patterns such as fake pay stubs with round numbers and irregular deposit activity.

Conclusion: Protect Your Florida HOA With Accurate Screening

Digital document authentication and accurate tenant evaluation reports give Florida HOAs a strong defense against fraud, compliance risk, and wasted staff time. Manual processes remain vulnerable to AI-generated fraud, while direct-source digital verification can reach accuracy levels above 99%, which shows why specialized screening solutions matter.

TenantEvaluation’s FCRA-first design, direct credit bureau relationships, and Florida-specific compliance features position community associations for success in a complex screening landscape. The platform’s record of processing more than 100,000 applications annually and generating 150 million dollars for partner communities confirms its performance at scale.

As Florida adopts new transparency rules and fraud tactics grow more advanced, community associations benefit from screening tools built for their specific needs instead of generic rental platforms. TenantEvaluation delivers the specialized capabilities, compliance structure, and operational efficiency that Florida HOAs need to protect their communities and streamline resident onboarding.

Schedule a demo today and see how TenantEvaluation’s digital document authentication and accurate screening reports can modernize your community’s resident evaluation process.