Key Takeaways

- TenantEvaluation ranks #1 for Florida HOAs with HOA-specific features like QuickApprove board dashboards and custom bylaw integration, outperforming TransUnion SmartMove and RentPrep.

- Automated screening cuts processing from 5–10 days to minutes, saving 50 staff hours daily while maintaining FCRA compliance and Florida statute adherence.

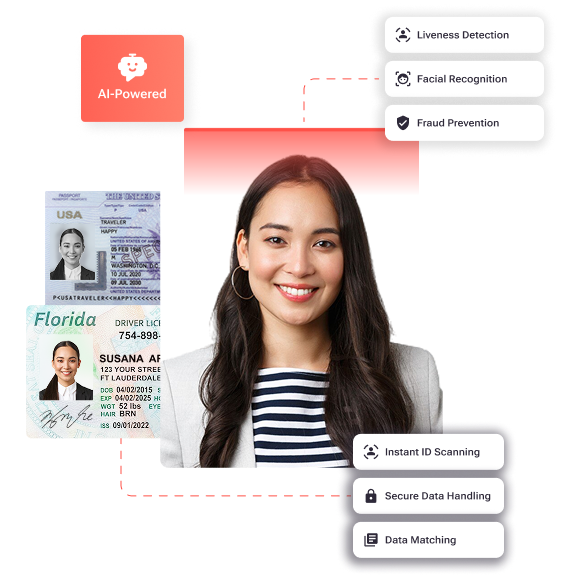

- Comprehensive checks cover credit, criminal history, evictions, income verification, and ID validation with automatic sensitive data redaction.

- The applicant-paid revenue model has generated $150M for communities, turning screening into a profit center unlike subscription-based competitors.

- Streamline your HOA tenant screening with Tenant Evaluation’s all-in-one platform, and schedule a demo to boost efficiency and revenue.

Why Florida HOAs Need Specialized Tenant Screening in 2026

Florida community associations face unique screening and compliance challenges that generic landlord tools cannot handle. Manual document processing creates security vulnerabilities and compliance gaps. New 2026 regulations require condominium associations to maintain DBPR online accounts. Flood disclosure requirements under Florida Statute §83.512 add further complexity to the screening process.

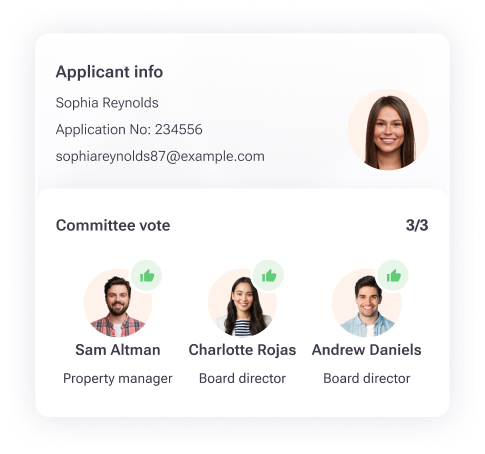

Effective HOA tenant screening rests on five critical criteria that work together. First, FCRA compliance requires direct credit bureau relationships and automated adverse action workflows. Second, HOA-specific features such as board dashboards and custom bylaw integration keep decisions consistent and transparent. Third, automation must reduce processing time by about 70 percent and free as much as 50 hours of daily staff time. Fourth, revenue generation through applicant-paid models with fee sharing turns screening into a profit center. Fifth, enterprise-grade security with PCI Level 1 compliance and automatic redaction of sensitive information protects both applicants and associations.

Condo associations typically require comprehensive screening, including criminal searches, credit reports, social verification, eviction history, and employment verification. Common red flags include eviction records and poor credit scores below community thresholds. Associations also watch for criminal history, identity discrepancies, and unverified employment or rental references.

Top 5 Tenant Background Check Providers for HOA Managers in 2026

#1 TenantEvaluation: TenantEvaluation is the only all-in-one platform built specifically for Florida HOAs since 2007. Core features include the QuickApprove board dashboard for real-time voting and transparency and IDVerify for automated document verification. SafeCheck+ delivers FCRA-compliant screening, and IncomeEv handles employment verification. The platform also provides automatic redaction of sensitive data, 24/7 AI support in 11 languages, and revenue sharing that has generated $150 million for communities. TenantEvaluation partners with RealManage, Castle Group, and other enterprise management companies and holds a 4.8/5 Google rating.

#2 TransUnion SmartMove: TransUnion SmartMove offers ResidentScore and applicant-paid screening for straightforward use cases. The platform lacks HOA-specific board dashboards and custom bylaw integration. HOA managers with complex workflows often need additional tools to cover full association processes.

#3 RentPrep: RentPrep provides FCRA-compliant reports with manual verification processes that suit many landlords. The platform focuses on individual landlords and does not include specialized HOA features or board voting capabilities. HOA boards that require structured approvals may find these gaps significant.

#4 Verify Screening Solutions: Verify Screening Solutions uses the TazWorks platform for background checks and basic reporting. The service does not deliver end-to-end automation or applicant interaction features that HOA workflows often require. Managers may still rely on email and spreadsheets to move applications forward.

#5 AppFolio/DoorLoop: AppFolio and DoorLoop offer comprehensive property management solutions with built-in screening capabilities. Their subscription-heavy pricing models can increase costs for associations that only need screening and onboarding. These platforms also focus less on HOA-specific needs and board governance workflows.

TenantEvaluation vs. Competitors in Key HOA Screening Features

|

Feature |

TenantEvaluation |

TransUnion SmartMove |

RentPrep |

Verify Solutions |

|

FCRA Compliance |

Direct TransUnion/Equifax reseller |

Yes |

Yes |

Yes |

|

HOA Board Dashboard |

QuickApprove with voting |

No |

No |

No |

|

End-to-End Automation |

Full (70% time savings) |

Screening only |

Partial |

Basic |

|

Florida HOA Compliance |

Custom bylaws integration |

Generic |

Generic |

Generic |

|

Revenue Model |

Applicant-paid with sharing |

Applicant-paid |

Package-based fees |

Package-based fees |

|

Processing Time |

Minutes (50 hrs/day saved) |

Moderate |

Manual (days) |

Moderate |

TenantEvaluation holds a clear competitive advantage through HOA-specific workflow automation that replaces multiple third-party providers. Competitors focus on individual screening components and leave gaps in onboarding and board coordination. TenantEvaluation covers the full journey from application intake through board approval and record retention. The platform’s automatic redaction capabilities and board voting features directly address compliance requirements that generic solutions cannot match.

How TenantEvaluation Serves Small HOAs and Enterprise CAMs

Small self-managed HOAs gain immediate value from TenantEvaluation’s intuitive setup and removal of manual processes that dominate board meetings. A 50-unit condo association used the platform to cut approval times and move applicants through the process faster. Quicker approvals supported faster unit turnovers and stronger cash flow for the community.

Enterprise Community Association Managers that process more than 100,000 applications annually benefit from TenantEvaluation’s scalability and analytics features. Advanced reporting delivers demographic insights that support decisions about EV charging stations, amenity planning, or pet policy changes. The revenue-sharing model has helped management companies create meaningful new income streams while maintaining strict compliance standards. Schedule a demo today to see how your organization can achieve similar results.

FAQ

What do condo associations look for in background checks?

Condo associations look for a complete picture of each applicant’s financial and legal history. Typical screening includes credit reports to assess financial reliability, criminal background checks with multistate searches and sex offender registry verification, eviction history searches, employment and income verification, and social security validation. TenantEvaluation customizes screening criteria to match each community’s specific bylaws and requirements. This approach keeps standards consistent while maintaining FCRA compliance.

What are FCRA requirements for Florida HOAs?

Florida HOAs must follow several FCRA requirements when they screen applicants. Associations must obtain written consent from applicants before conducting background checks and provide clear disclosure of screening criteria and fees. Boards must issue adverse action notices when they deny applications based on screening reports. They also need to maintain audit trails of all screening decisions and apply criteria consistently to avoid discrimination. TenantEvaluation’s platform automates these compliance steps with built-in workflows and documentation.

What are the best alternatives to SmartMove for HOAs?

TenantEvaluation serves as the leading alternative to TransUnion SmartMove for HOAs that need specialized workflows. The platform offers board dashboards, custom bylaw integration, and comprehensive automation that SmartMove does not provide. SmartMove covers basic screening needs, while TenantEvaluation delivers end-to-end onboarding designed specifically for community association workflows and Florida compliance requirements.

How much do HOA tenant screening services cost?

Most HOA screening services follow applicant-paid models that range from $25 to $75 per application. TenantEvaluation uses a revenue-sharing approach that allows associations to earn income from the screening process instead of paying upfront subscription fees. This structure turns screening into a profit center and has generated $150M for communities.

How long does HOA tenant screening take?

Traditional manual screening often takes 5 to 10 days because of document collection, verification, and board review cycles. TenantEvaluation’s automated platform reduces screening time to minutes for standard approvals. Most applications finish within 24 hours, including board review and voting through the QuickApprove dashboard.

Conclusion: TenantEvaluation as the #1 Choice for Florida HOAs

TenantEvaluation’s focus on Florida HOA compliance, comprehensive automation, and revenue generation makes it a clear leader for community association resident screening and onboarding in 2026. The platform combines FCRA compliance, board transparency, and operational efficiency to address the specific challenges HOA managers face. At the same time, it opens new revenue opportunities for both associations and management companies. Schedule a demo today to transform your screening process and join the 5,000+ communities already benefiting from TenantEvaluation’s proven platform.