Key Takeaways for Florida Associations

- Florida HOAs must follow strict FCRA rules, including written consent and timely adverse action notices, or risk costly settlements.

- Generic tools like RentSpree and TurboTenant lack HOA-specific features, custom rules, and Florida regulations, which creates manual work and compliance gaps.

- TenantEvaluation stands out with direct TransUnion and Equifax reseller status, HOA board dashboards, 70% time savings, and revenue sharing that has generated over $150 million for communities.

- Specialized platforms automate end-to-end screening, maintain PCI Level 1 security, and provide audit trails that remove administrative burdens and liability risks.

- Switching to Tenant Evaluation gives Florida HOAs FCRA-compliant screening that saves time, reduces risk, and creates new revenue. Schedule your demo today.

How We Compare HOA Tenant Screening Alternatives

Florida HOAs and condos need screening tools that handle compliance, governance, and daily workflows without extra manual work. The criteria below focus on what matters most to community associations.

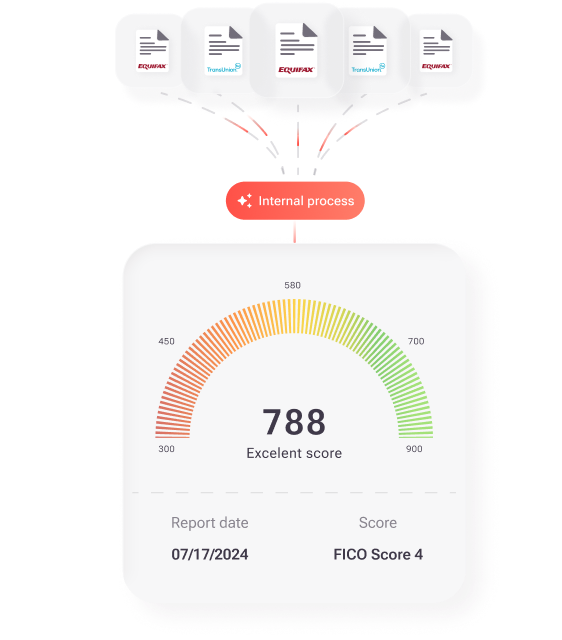

- FCRA Compliance: Direct credit bureau reseller status with TransUnion or Equifax, automated adverse action workflows, and built-in audit trails.

- HOA Specialization: Board dashboards, custom community rules, Florida-specific regulations, and multi-party approval workflows.

- Automation Level: End-to-end processing from application intake through final decision, instead of screening-only tools that require manual follow-up.

- Time Savings: Faster processing that cuts timelines from days to hours and removes repetitive administrative tasks.

- Revenue Model: Revenue-sharing options that support association budgets instead of subscription fees that drain resources.

- Security & Compliance: PCI Level 1 compliance, automatic redaction of sensitive data, and secure handling of resident information.

Explicit written authorization on separate disclosure documents and proper adverse action procedures ensure FCRA compliance. Generic tools often miss these steps. Specialized platforms build each requirement into the workflow so every action aligns with federal standards. Florida HOAs benefit most from solutions that understand community association governance instead of generic rental workflows built for individual landlords.

TenantEvaluation vs Generic Tenant Screening Tools

|

Feature |

TenantEvaluation |

Generic Tools (RentSpree, TurboTenant, etc.) |

|

FCRA Direct Reseller |

Yes (TransUnion/Equifax) |

Partial (third-party scraping risks) |

|

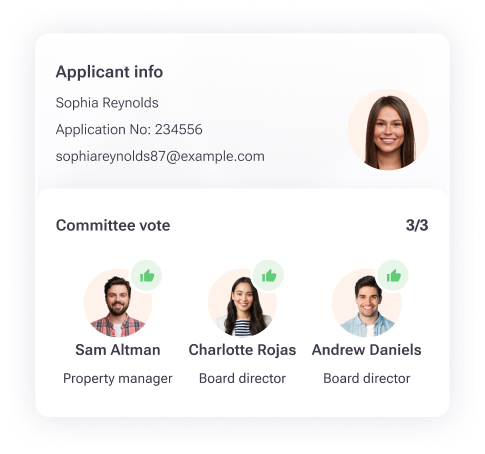

HOA Board Dashboard |

Yes (QuickApprove) |

No |

|

Time Savings |

70% faster, 50 hrs/day saved |

Days of manual work |

|

Revenue Model |

Sharing ($150M generated) |

Subscriptions/fees |

|

Florida HOA-Specific |

Yes (custom rules/compliance) |

No (generic rentals) |

This comparison shows clear gaps between specialized HOA platforms and generic screening tools. TenantEvaluation’s direct credit bureau relationships provide legitimate data access under strict FCRA controls. Many competitors rely on third-party data scraping, which increases liability exposure for associations.

The QuickApprove board dashboard gives real-time visibility and voting features that generic tools do not offer. Boards see every application, track status, and record decisions in one place.

TenantEvaluation’s revenue-sharing model has generated over $150 million for communities. Screening becomes a profit generator instead of a pure cost. Generic platforms rely on subscription fees and offer little HOA-specific value in return.

Why Generic Screening Platforms Fall Short for Florida HOAs

Limits of RentSpree, TurboTenant, and RentPrep for HOAs

Generic screening platforms struggle with the real needs of Florida HOAs. Reddit users highlight TurboTenant’s poor integration with HOA management software and lack of multi-party approval support. These tools do not support board voting workflows, Florida-specific bylaws, or community association governance rules.

RentSpree and similar platforms also lack customizable fields for HOA criteria such as pet restrictions, parking verification, and rental caps. Florida users report that these tools ignore state laws on service animal verifications and short-term rental bans, which expose HOAs to regulatory fines.

Where AppFolio Falls Short for Community Associations

AppFolio offers broad property management features, but does not go deep enough for HOA and condo governance. Its subscription model increases operating costs for associations and does not include revenue-sharing benefits.

The platform focuses on generic rentals and cannot fully support the layered approval structures, document requirements, and compliance rules that Florida HOAs and condos must follow.

How TenantEvaluation Solves HOA Screening Pain Points

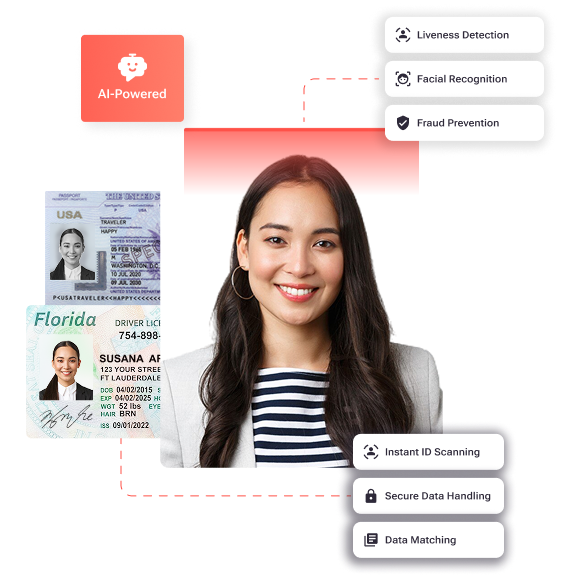

TenantEvaluation addresses these gaps with HOA-specific tools. The IDVerify solution validates identification documents automatically. SafeCheck+ delivers comprehensive background screening with FCRA compliance built into each step. IncomeEv verifies employment directly with employers instead of relying on self-reported data.

The platform uses intelligent form logic that adapts to each applicant type. It adjusts questions for tenants, purchasers, additional residents, or adult children so boards receive accurate and complete information. Automatic redaction of sensitive data supports PCI Level 1 compliance and reduces data breach risk for associations.

Real communities see these benefits in daily operations. CAMs remove administrative overload through automation. Boards gain transparency with dedicated dashboards. Applicants complete mobile-friendly applications and receive faster decisions.

Schedule a demo today and see how specialized HOA screening can streamline operations while maintaining strong FCRA compliance.

Real-World Results and Risk Reduction for Florida HOAs

Florida management companies report major gains after moving to TenantEvaluation. One client saved $240,000 per year by reclaiming 50 hours of staff time each day. Teams shifted from manual screening tasks to higher-value work. Processing times dropped by 50%, which created savings of about $10 per hour across their portfolio.

Risk reduction adds another layer of value. TenantEvaluation removes liability from manual handling of sensitive resident information through bank-level encryption and automatic redaction. Built-in audit trails document every step for FCRA compliance and help protect associations from violations and legal disputes.

Leading property management firms such as RealManage, FirstService Residential, and Associa use TenantEvaluation for their HOA portfolios. These partnerships show the platform’s enterprise-grade strength and industry trust. Community analytics then provide insights for better decisions, including demographic trends and amenity planning, so communities can scale without adding headcount.

Frequently Asked Questions for Florida HOAs

What makes screening FCRA compliant for Florida HOAs?

FCRA-compliant screening for Florida HOAs requires explicit written authorization before any report is run. Associations must follow proper adverse action procedures when they deny applications and keep complete audit trails for every decision. The screening provider must act as a direct credit bureau reseller and enforce permissible purpose controls.

Boards also need consistent criteria for all applicants and must send denied applicants clear notices that explain dispute rights. TenantEvaluation builds each of these steps into the workflow so associations avoid compliance gaps.

How does TenantEvaluation compare to RentSpree for HOA applications?

RentSpree focuses on generic rental properties and does not include the specialized features Florida HOAs need. It cannot support board voting workflows, custom community rules, or Florida-specific regulations. RentSpree also lacks direct credit bureau relationships, which can create FCRA compliance risks.

TenantEvaluation offers dedicated board dashboards, automated compliance workflows, and revenue-sharing options that generic platforms do not provide.

How can HOAs avoid FCRA violations in 2026?

HOAs can reduce FCRA risk by using screening providers with direct credit bureau relationships and automated adverse action workflows. Associations should avoid generic tools that rely on third-party data scraping or weak authorization processes.

Boards need consistent screening criteria for every applicant and complete audit trails for each decision. Partnering with specialized platforms like TenantEvaluation helps because these tools reflect community association governance in every feature.

What are the biggest risks of using generic screening tools for Florida condos?

Generic screening tools create FCRA risk through poor authorization procedures, inconsistent criteria, and weak adverse action processes. These tools rarely support Florida-specific regulations, such as HB 793 rental restrictions or detailed community association rules.

The absence of board-focused dashboards also reduces transparency. Subscription pricing then adds another problem by draining association budgets without offering revenue opportunities.

How does revenue sharing work with specialized HOA screening platforms?

Revenue-sharing platforms like TenantEvaluation collect application fees from applicants, deduct a service fee, and return the remaining amount to the association or management company. This structure often creates a cost-neutral or revenue-positive program.

TenantEvaluation has generated more than $150 million for communities through this model. Unlike subscription-based generic tools, revenue sharing aligns the platform’s success with the association’s financial goals while maintaining FCRA compliance.

Conclusion: Choose an HOA-Focused Screening Partner

The choice between generic screening tools and HOA-focused platforms shapes your association’s compliance risk, efficiency, and revenue. Generic tools such as RentSpree and TurboTenant may work for individual landlords but fall short for Florida community associations with complex rules.

TenantEvaluation’s specialized design addresses these pain points, supports revenue generation, and maintains strong FCRA compliance. Community association managers who want efficiency should look for end-to-end automation and direct credit bureau connections. Board members who need visibility and control benefit from dedicated dashboards with voting features. Associations that want stronger finances gain more from revenue-sharing models than from flat subscription fees.

TenantEvaluation focuses solely on community associations and treats FCRA compliance as a core requirement, not a side feature. With more than 5,000 communities served and over $150 million generated, the platform proves its value through measurable results. Schedule a demo today and turn your HOA’s screening process from a compliance risk into a strategic advantage.